Completable Massachusetts State Income Tax Forms 2022

What is the Completable Massachusetts State Income Tax Forms

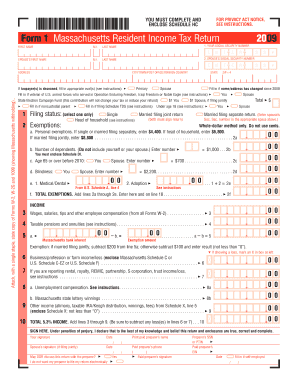

The Completable Massachusetts State Income Tax Forms are official documents required for residents and businesses in Massachusetts to report their income and calculate their state tax obligations. These forms are essential for ensuring compliance with state tax laws and are used to determine the amount of tax owed or any potential refund. The forms vary depending on the taxpayer's situation, including individual income, business income, and other specific circumstances.

How to use the Completable Massachusetts State Income Tax Forms

Using the Completable Massachusetts State Income Tax Forms involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts. Next, individuals can access the forms online and fill them out electronically. It is crucial to review all entries for accuracy before submission. Once completed, the forms can be printed for mailing or submitted electronically, depending on the chosen method.

Steps to complete the Completable Massachusetts State Income Tax Forms

Completing the Completable Massachusetts State Income Tax Forms requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income statements and deductions.

- Select the appropriate tax form based on your filing status and income type.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, following the instructions provided.

Legal use of the Completable Massachusetts State Income Tax Forms

The legal use of the Completable Massachusetts State Income Tax Forms is governed by state tax regulations. These forms must be filled out accurately and submitted by the designated deadlines to avoid penalties. Electronic submissions are considered legally binding, provided they comply with the relevant eSignature laws. It is essential to ensure that all information is truthful and complete to maintain compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Completable Massachusetts State Income Tax Forms are critical for taxpayers to observe. Typically, the deadline for individual income tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific deadlines related to extensions or estimated tax payments to ensure timely compliance.

Required Documents

To complete the Completable Massachusetts State Income Tax Forms, several documents are required. These typically include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income sources, such as freelance work.

- Receipts for deductible expenses, such as medical costs or educational expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the Completable Massachusetts State Income Tax Forms. These methods include:

- Online submission through the Massachusetts Department of Revenue website, which is often the fastest option.

- Mailing a printed copy of the completed form to the appropriate state address.

- In-person submission at designated state tax offices, which may be useful for those seeking assistance.

Quick guide on how to complete completable massachusetts state income tax forms

Complete Completable Massachusetts State Income Tax Forms effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Completable Massachusetts State Income Tax Forms on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Completable Massachusetts State Income Tax Forms without hassle

- Locate Completable Massachusetts State Income Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form: via email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Completable Massachusetts State Income Tax Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct completable massachusetts state income tax forms

Create this form in 5 minutes!

How to create an eSignature for the completable massachusetts state income tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Completable Massachusetts State Income Tax Forms?

Completable Massachusetts State Income Tax Forms are the official documents required for filing state income taxes in Massachusetts. They can be filled out electronically, making the tax preparation process more efficient and accessible. Using airSlate SignNow ensures you can eSign these forms securely and conveniently.

-

How does airSlate SignNow help with Completable Massachusetts State Income Tax Forms?

airSlate SignNow simplifies the process of completing and eSigning Completable Massachusetts State Income Tax Forms. Our platform allows users to upload forms, fill them out electronically, and send them directly to recipients. This reduces the time spent on paperwork and ensures compliance with state regulations.

-

Is airSlate SignNow cost-effective for processing income tax forms?

Yes, airSlate SignNow offers a cost-effective solution for processing Completable Massachusetts State Income Tax Forms. With our competitive pricing plans, businesses can save money on traditional signing methods while enjoying the same level of security and convenience. Flexible subscription options cater to individual freelancers as well as businesses of all sizes.

-

What features does airSlate SignNow offer for income tax form processing?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure eSignature options for Completable Massachusetts State Income Tax Forms. These tools enhance productivity by reducing manual tasks and ensuring that documents are handled promptly. Users can also track the status of their forms in real-time.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow easily integrates with various accounting and tax preparation software, allowing you to streamline your workflow. By integrating your favorite tools with our platform, you can effortlessly manage and eSign Completable Massachusetts State Income Tax Forms while keeping all your financial data in sync.

-

How secure is airSlate SignNow for handling tax documents?

Security is a top priority at airSlate SignNow. Our platform uses bank-level encryption and complies with regulations to ensure that your Completable Massachusetts State Income Tax Forms are protected. You can eSign documents with confidence, knowing that sensitive information is safeguarded against unauthorized access.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for Completable Massachusetts State Income Tax Forms offers numerous benefits, including increased efficiency and reduced turnaround time. You can eSign documents anytime, anywhere, and streamline your tax preparation process. Additionally, our customer support team is available to assist you with any queries you may have.

Get more for Completable Massachusetts State Income Tax Forms

Find out other Completable Massachusetts State Income Tax Forms

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval