Form 1 Massachusetts Resident Income Tax Return Mass Gov 2023-2026

Understanding the Form 1 Massachusetts Resident Income Tax Return

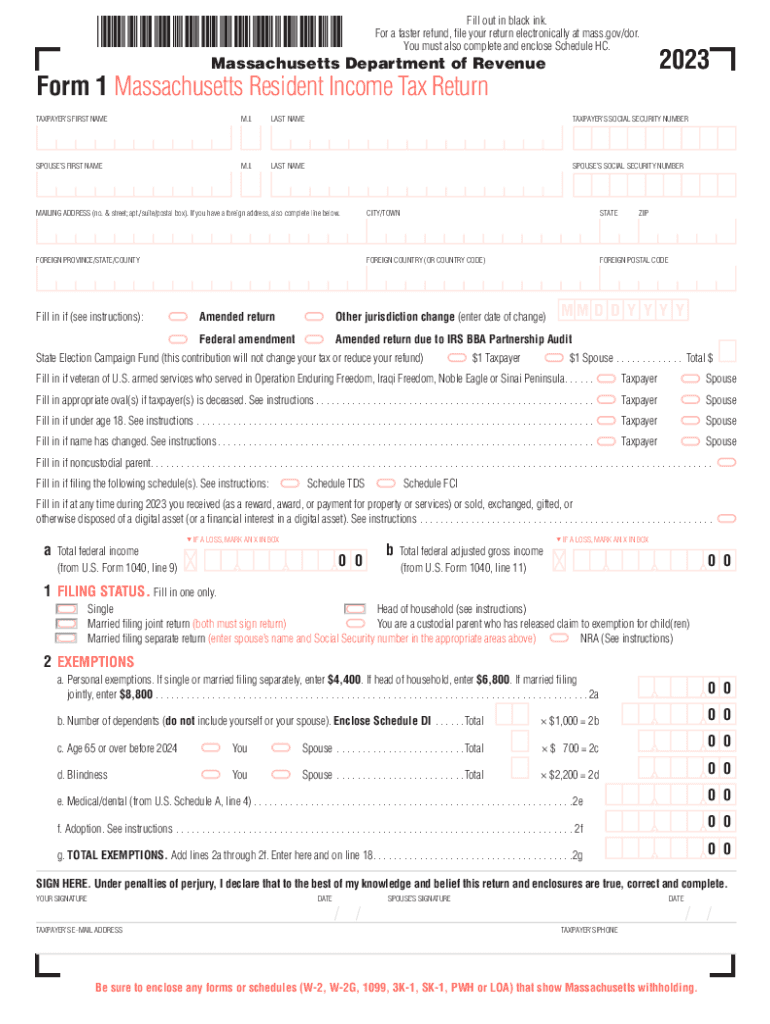

The Form 1 Massachusetts Resident Income Tax Return is a crucial document for residents of Massachusetts who need to report their income and calculate their state tax obligations. This form is specifically designed for individuals who earn income while residing in the state. It allows taxpayers to detail their income, claim deductions, and determine their tax liability. Completing this form accurately is essential to ensure compliance with Massachusetts tax laws.

Steps to Complete the Form 1 Massachusetts Resident Income Tax Return

Filling out the Form 1 requires careful attention to detail. Here are the steps to guide you through the process:

- Gather Required Information: Collect all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill in Personal Information: Start by entering your name, address, and Social Security number at the top of the form.

- Report Income: Accurately list all sources of income, including wages and interest. Ensure that the total matches your documentation.

- Claim Deductions: Review available deductions and credits to reduce your taxable income. Include any relevant information regarding dependents.

- Calculate Tax Liability: Use the tax tables provided by the Massachusetts Department of Revenue to determine your tax due based on your taxable income.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

How to Obtain the Form 1 Massachusetts Resident Income Tax Return

The Form 1 can be easily obtained through several methods. Taxpayers can access the form online via the Massachusetts Department of Revenue website, where it is available for download in PDF format. Additionally, physical copies of the form can be requested at local tax offices or public libraries throughout the state. It is advisable to ensure you are using the correct version for the tax year you are filing.

Filing Deadlines for the Form 1 Massachusetts Resident Income Tax Return

Timely filing of the Form 1 is essential to avoid penalties. For most taxpayers, the deadline to file the Form 1 is typically April fifteenth of the year following the tax year. If April fifteenth falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers who need additional time can file for an extension, but it is important to pay any owed taxes by the original deadline to prevent interest and penalties.

Required Documents for Filing the Form 1

To successfully complete the Form 1, taxpayers need to gather several key documents:

- W-2 Forms: These forms report wages and taxes withheld from employers.

- 1099 Forms: These are necessary for reporting various types of income, including freelance work or interest income.

- Proof of Deductions: Documentation for any deductions claimed, such as receipts for charitable contributions or medical expenses.

- Previous Year’s Tax Return: Having last year’s return can help ensure consistency and accuracy in reporting.

Legal Use of the Form 1 Massachusetts Resident Income Tax Return

The Form 1 is legally mandated for residents of Massachusetts who meet certain income thresholds. Filing this form is necessary to comply with state tax laws and to avoid potential penalties for non-compliance. It is important to ensure that all information reported is accurate and truthful, as discrepancies can lead to audits or legal consequences.

Quick guide on how to complete form 1 massachusetts resident income tax return mass gov

Effortlessly prepare Form 1 Massachusetts Resident Income Tax Return Mass gov on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 1 Massachusetts Resident Income Tax Return Mass gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign Form 1 Massachusetts Resident Income Tax Return Mass gov with ease

- Find Form 1 Massachusetts Resident Income Tax Return Mass gov and click Get Form to begin.

- Take advantage of the tools we offer to finish your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1 Massachusetts Resident Income Tax Return Mass gov and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 massachusetts resident income tax return mass gov

Create this form in 5 minutes!

How to create an eSignature for the form 1 massachusetts resident income tax return mass gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are MA 2015 tax forms and why do I need them?

MA 2015 tax forms are the documents required by the Massachusetts Department of Revenue for filing your state taxes for the year 2015. Completing these forms accurately is crucial for compliance and to avoid penalties. Using airSlate SignNow simplifies the process, allowing you to eSign your tax forms securely and efficiently.

-

How does airSlate SignNow assist in filling out MA 2015 tax forms?

airSlate SignNow provides an intuitive platform that allows users to easily upload and fill out MA 2015 tax forms. You can add text, sign electronically, and share the documents with others right from the application. This seamless process ensures your forms are completed accurately and delivered on time.

-

What features does airSlate SignNow offer for managing MA 2015 tax forms?

With airSlate SignNow, you gain access to various features like document templates, team collaboration tools, and secure cloud storage. These features not only streamline the signing process for MA 2015 tax forms but also enhance the overall document management experience. The platform is designed to meet the needs of individuals and businesses alike.

-

Is there a cost associated with using airSlate SignNow for MA 2015 tax forms?

Yes, airSlate SignNow offers a range of pricing plans, allowing you to choose one that best fits your needs when managing MA 2015 tax forms. The pricing is competitive, especially considering the convenience and security provided. Each plan includes features that cater to different user requirements, ensuring that you find the right fit.

-

Can I integrate airSlate SignNow with other tools for managing MA 2015 tax forms?

Absolutely! airSlate SignNow offers integration with various popular tools like CRM systems, cloud storage services, and productivity software. This allows for a more streamlined process when managing MA 2015 tax forms, enabling you to work efficiently within your existing workflow. Integration enhances the overall experience and encourages productivity.

-

What benefits does airSlate SignNow offer for eSigning MA 2015 tax forms?

eSigning MA 2015 tax forms with airSlate SignNow eliminates the need for printing and mailing documents. This not only saves time but also reduces the risk of losing important paperwork. Additionally, the eSigning feature is legally binding, ensuring that your tax forms are valid and acceptable to the authorities.

-

How secure is airSlate SignNow when handling MA 2015 tax forms?

Security is a top priority for airSlate SignNow when managing MA 2015 tax forms. The platform uses advanced encryption technology to protect your documents and information. Furthermore, airSlate SignNow complies with industry-standard security protocols, giving you peace of mind as you handle sensitive tax information.

Get more for Form 1 Massachusetts Resident Income Tax Return Mass gov

- 1612 marion st form

- Relationship is greater than that of the previous owner form

- Pay period is five 5 days form

- This note is made in the city of state of south carolina and the form

- Fillable online dol dol esa forms owcp 1500 dol fax

- South carolina known as form

- Date of injury or illness doc templatepdffiller form

- 15s south carolina workers compensation commission form

Find out other Form 1 Massachusetts Resident Income Tax Return Mass gov

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF