Form 1 NRPY Massachusetts NonresidentPart Year Tax 2022

What is the Form 1 NRPY Massachusetts Nonresident Part Year Tax?

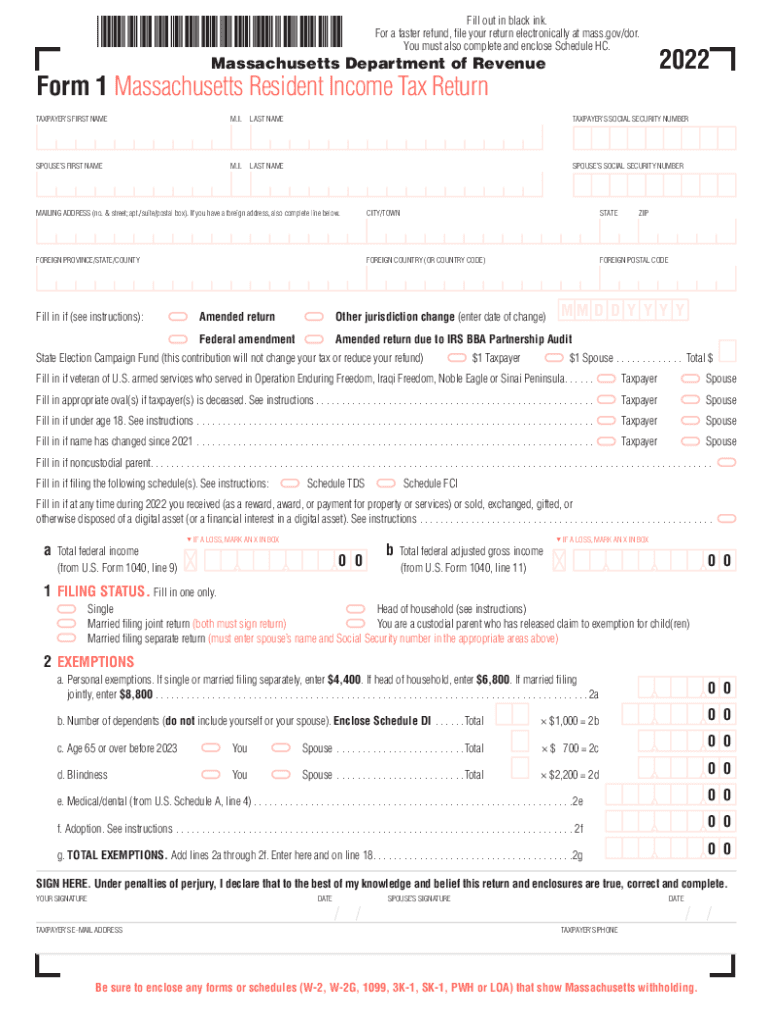

The Form 1 NRPY is designed for individuals who are nonresidents or part-year residents of Massachusetts and need to report their income earned within the state. This form is essential for ensuring compliance with Massachusetts tax laws and accurately calculating the tax owed based on the income earned while residing in the state. It allows taxpayers to detail their income sources, deductions, and credits applicable to their situation.

Steps to Complete the Form 1 NRPY Massachusetts Nonresident Part Year Tax

Completing the Form 1 NRPY involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned while a resident of Massachusetts, as well as any income sourced from the state while a nonresident.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and ensure that all figures are accurate.

- Sign and date the form before submission.

How to Obtain the Form 1 NRPY Massachusetts Nonresident Part Year Tax

The Form 1 NRPY can be obtained through the Massachusetts Department of Revenue website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be available at local tax offices and public libraries for those who prefer a physical copy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1 NRPY. Typically, the deadline for submitting the form aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific dates for the current tax year to avoid penalties.

Legal Use of the Form 1 NRPY Massachusetts Nonresident Part Year Tax

The Form 1 NRPY is legally binding when completed accurately and submitted on time. To ensure its legal standing, it must be signed by the taxpayer, affirming that the information provided is true and complete to the best of their knowledge. The form must also comply with Massachusetts tax regulations, which govern the reporting of income and payment of taxes.

Penalties for Non-Compliance

Failure to file the Form 1 NRPY or inaccuracies in reporting can lead to significant penalties. The Massachusetts Department of Revenue may impose fines, interest on unpaid taxes, and potential legal action for non-compliance. It is essential for taxpayers to ensure that they meet all filing requirements to avoid these consequences.

Quick guide on how to complete form 1 nrpy massachusetts nonresidentpart year tax

Complete Form 1 NRPY Massachusetts NonresidentPart Year Tax effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Form 1 NRPY Massachusetts NonresidentPart Year Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 1 NRPY Massachusetts NonresidentPart Year Tax effortlessly

- Locate Form 1 NRPY Massachusetts NonresidentPart Year Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or the need to print new document copies due to errors. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Modify and eSign Form 1 NRPY Massachusetts NonresidentPart Year Tax to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1 nrpy massachusetts nonresidentpart year tax

Create this form in 5 minutes!

How to create an eSignature for the form 1 nrpy massachusetts nonresidentpart year tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Massachusetts State?

airSlate SignNow is a powerful tool that enables businesses in Massachusetts State to send and eSign documents quickly and securely. With its user-friendly interface, organizations in the state can streamline their document workflows, ensuring efficiency and compliance. This makes it an ideal solution for businesses looking to optimize their operations within Massachusetts.

-

What are the pricing options for airSlate SignNow for businesses in Massachusetts State?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Massachusetts State. The plans range from basic features to more advanced options, ensuring that every organization finds a suitable solution that fits its budget. Comparatively, airSlate SignNow provides signNow cost savings compared to other eSignature solutions.

-

What features does airSlate SignNow offer for users in Massachusetts State?

Users in Massachusetts State can benefit from a comprehensive suite of features provided by airSlate SignNow, including document templates, team collaboration tools, and automated workflows. These features not only enhance productivity but also ensure compliance with local laws and regulations unique to Massachusetts. The platform is designed to adapt to various business needs.

-

How does airSlate SignNow improve document security for Massachusetts State businesses?

airSlate SignNow prioritizes document security, making it an excellent choice for businesses within Massachusetts State. The platform employs advanced encryption methods and complies with industry standards to protect sensitive information. This ensures that users can confidently manage their documents without fearing data bsignNowes.

-

Can airSlate SignNow integrate with other software used by businesses in Massachusetts State?

Yes, airSlate SignNow seamlessly integrates with various applications that businesses in Massachusetts State commonly use, including CRM systems, cloud storage services, and productivity tools. This integration capability enhances overall workflow efficiency and allows for easy access to necessary tools within the existing software ecosystem. It's designed to fit smoothly into your technology stack.

-

What are the benefits of using airSlate SignNow for companies in Massachusetts State?

Using airSlate SignNow provides numerous benefits to companies in Massachusetts State, such as faster document turnaround times and improved customer satisfaction. The platform reduces reliance on paper documents, contributing to sustainability efforts. Moreover, businesses can customize their workflows, making it easier to meet specific operational requirements.

-

How can I get started with airSlate SignNow in Massachusetts State?

Getting started with airSlate SignNow in Massachusetts State is simple and straightforward. Prospective users can sign up for a free trial to explore the platform's features and see how it fits their needs. Once you decide to proceed, selecting a pricing plan that aligns with your business size and document needs is easy.

Get more for Form 1 NRPY Massachusetts NonresidentPart Year Tax

Find out other Form 1 NRPY Massachusetts NonresidentPart Year Tax

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure