Form 1 Massachusetts Resident Income Tax Return 2019

What is the Form 1 Massachusetts Resident Income Tax Return

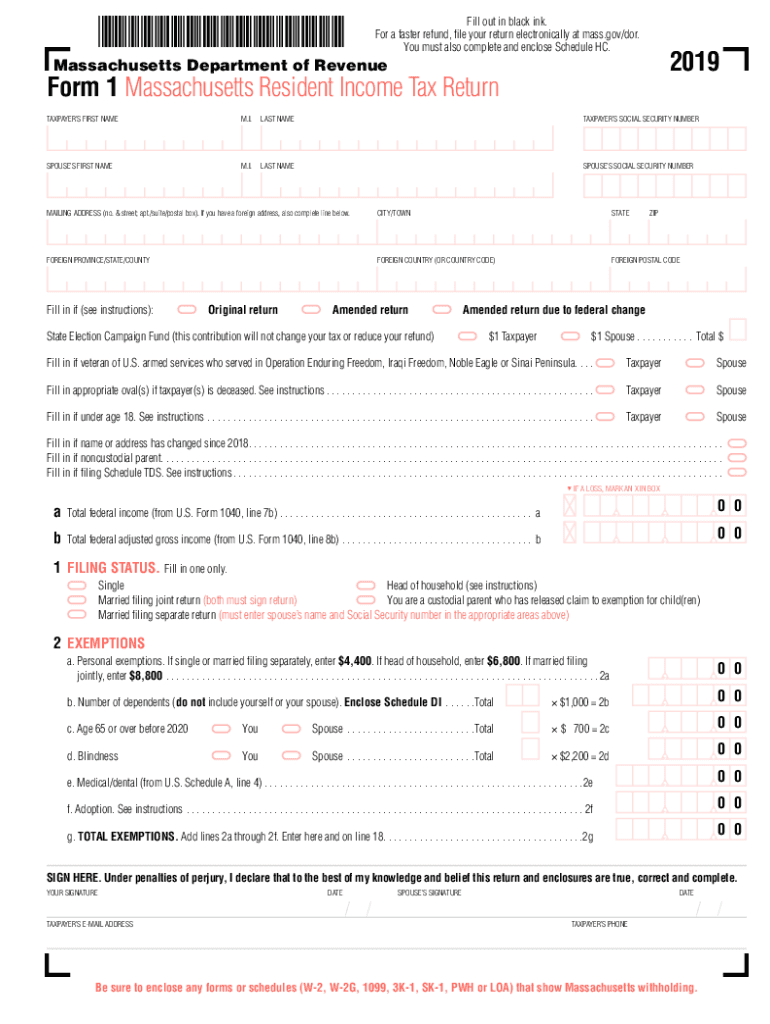

The Form 1 Massachusetts Resident Income Tax Return is a crucial document for individuals residing in Massachusetts who need to report their income and calculate their state tax obligations. This form is used by residents to declare their income, claim deductions, and determine their tax liability for the year. It is essential for ensuring compliance with state tax laws and for facilitating the accurate assessment of taxes owed.

How to use the Form 1 Massachusetts Resident Income Tax Return

Using the Form 1 Massachusetts Resident Income Tax Return involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any relevant deduction information. Next, individuals can fill out the form either electronically or using a paper version. It is important to follow the instructions provided with the form carefully to ensure all required information is included. Once completed, the form can be submitted online, by mail, or in person, depending on the chosen method of filing.

Steps to complete the Form 1 Massachusetts Resident Income Tax Return

Completing the Form 1 Massachusetts Resident Income Tax Return involves a systematic approach:

- Gather all necessary income documents, such as W-2s and 1099s.

- Identify and document any deductions or credits you may qualify for.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the form through your chosen method: online, by mail, or in person.

Legal use of the Form 1 Massachusetts Resident Income Tax Return

The legal use of the Form 1 Massachusetts Resident Income Tax Return is governed by state tax regulations. To be considered valid, the form must be filled out truthfully and accurately. Any fraudulent information can lead to penalties or legal consequences. Additionally, the form must be submitted by the appropriate deadlines to avoid late fees or interest charges on any taxes owed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1 Massachusetts Resident Income Tax Return are generally aligned with federal tax deadlines. Typically, the deadline for filing is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any specific dates for extensions or estimated tax payments to ensure compliance and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 1 Massachusetts Resident Income Tax Return. The form can be filed online through the Massachusetts Department of Revenue's website, which is often the fastest method. Alternatively, individuals may choose to print the form and mail it to the appropriate address. For those who prefer a more personal approach, in-person submission at designated tax offices is also available. Each method has its own processing times and requirements, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete 2019 form 1 massachusetts resident income tax return

Conveniently Prepare Form 1 Massachusetts Resident Income Tax Return on Any Device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without any delays. Manage Form 1 Massachusetts Resident Income Tax Return from any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Form 1 Massachusetts Resident Income Tax Return Effortlessly

- Find Form 1 Massachusetts Resident Income Tax Return and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Form 1 Massachusetts Resident Income Tax Return and maintain excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 1 massachusetts resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1 massachusetts resident income tax return

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What are Massachusetts tax forms and why are they important?

Massachusetts tax forms are official documents required for reporting personal and business income to the state of Massachusetts. They are crucial for ensuring compliance with state tax laws and help businesses and individuals claim eligible deductions and credits. Properly completing Massachusetts tax forms can signNowly affect your tax liabilities.

-

How can airSlate SignNow help with filling out Massachusetts tax forms?

airSlate SignNow provides a user-friendly platform that simplifies the process of filling out Massachusetts tax forms. With our eSignature feature, you can quickly gather signatures and complete forms digitally, reducing the hassle of paperwork. This can signNowly speed up your tax preparation process.

-

What features does airSlate SignNow offer for managing Massachusetts tax forms?

airSlate SignNow offers various features tailored for managing Massachusetts tax forms, including custom templates, document sharing, and secure storage. The platform allows users to easily collaborate with team members and clients, ensuring that everyone has access to necessary documentation. Additionally, advanced analytics help track the status of your forms.

-

What is the pricing structure for using airSlate SignNow for Massachusetts tax forms?

airSlate SignNow offers competitive pricing plans that cater to different business needs, whether you’re a small firm or a large enterprise. By opting for our service, you can save on the costs of paper, ink, and postage while improving efficiency. Detailed pricing information can be found on our website.

-

Are there any integrations available for using airSlate SignNow with Massachusetts tax forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software and applications that assist with Massachusetts tax forms. This includes popular platforms like QuickBooks and Xero, allowing for a smoother workflow. Enhancing your existing tools with these integrations can help streamline your tax preparation processes.

-

Can I store my Massachusetts tax forms securely using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your Massachusetts tax forms and related documents. Our platform ensures that your data is encrypted and compliant with industry standards, giving you peace of mind regarding the safety of your sensitive information.

-

Is electronic signature valid for Massachusetts tax forms?

Yes, electronic signatures are legally recognized and valid for Massachusetts tax forms, provided they meet specific criteria under federal and state laws. airSlate SignNow enables users to collect eSignatures in compliance with these regulations. This feature ensures that your submissions are not only efficient but also legally binding.

Get more for Form 1 Massachusetts Resident Income Tax Return

Find out other Form 1 Massachusetts Resident Income Tax Return

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation