Hawaii N 15 Rev Form

What is the Hawaii N 15 Rev

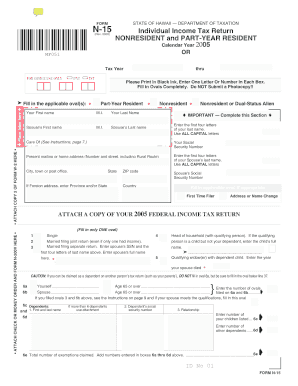

The Hawaii N 15 Rev form is a state-specific tax document used by individuals and businesses to report income earned in Hawaii. This form is essential for ensuring compliance with the state's tax laws. It is a revision of the original N 15 form, designed to accommodate changes in tax regulations and reporting requirements. Taxpayers must accurately complete this form to avoid penalties and ensure that their tax obligations are met.

How to use the Hawaii N 15 Rev

To use the Hawaii N 15 Rev form, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Once the information is collected, the taxpayer can fill out the form, ensuring that all income is reported accurately. It is important to follow the instructions provided with the form to guarantee proper completion. After filling out the form, taxpayers can submit it online, by mail, or in person, depending on their preference.

Steps to complete the Hawaii N 15 Rev

Completing the Hawaii N 15 Rev form involves several key steps:

- Gather all necessary income documentation, including W-2s and 1099s.

- Download the Hawaii N 15 Rev form from the official state tax website.

- Fill out the form with accurate income information and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline through your chosen method: online, by mail, or in person.

Legal use of the Hawaii N 15 Rev

The Hawaii N 15 Rev form is legally recognized for tax reporting purposes in Hawaii. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Hawaii Department of Taxation. This includes correctly reporting all income and ensuring that the form is submitted by the appropriate deadlines. Failure to comply with these regulations may result in penalties or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii N 15 Rev form are typically aligned with federal tax deadlines. Taxpayers should be aware that the form is usually due on April fifteenth for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to mark their calendars and ensure timely submission to avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Hawaii N 15 Rev form. The form can be submitted online through the Hawaii Department of Taxation's e-filing system, which offers a convenient and efficient way to file. Alternatively, taxpayers can choose to mail the completed form to the appropriate tax office or deliver it in person. Each method has its own advantages, and taxpayers should select the one that best fits their needs.

Quick guide on how to complete hawaii n 15 rev

Effortlessly prepare Hawaii N 15 Rev on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Hawaii N 15 Rev on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and eSign Hawaii N 15 Rev with ease

- Find Hawaii N 15 Rev and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure private information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Hawaii N 15 Rev and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii n 15 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of Hawaii N 15 Rev 2005?

Hawaii N 15 Rev 2005 refers to the specific regulations for electronic signatures and documents in the state of Hawaii. Understanding these regulations is crucial for businesses operating within the state who wish to remain compliant while utilizing electronic signature solutions like airSlate SignNow.

-

How does airSlate SignNow comply with Hawaii N 15 Rev 2005?

airSlate SignNow is designed to meet legal standards, including those outlined in Hawaii N 15 Rev 2005. Our platform incorporates strong security measures and audit trails, ensuring that your electronic signatures are secure and compliant with state laws.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing tiers to accommodate various business needs. While specific prices may vary, our plans are designed to provide cost-effective solutions that align with the requirements outlined in Hawaii N 15 Rev 2005, ensuring you get the best value for electronic signing.

-

What features does airSlate SignNow include?

airSlate SignNow includes features such as document templates, bulk sending, and real-time tracking, all of which are compliant with Hawaii N 15 Rev 2005. These tools enhance the user experience, streamline your signing process, and ensure legal compliance.

-

How can airSlate SignNow benefit my business?

Using airSlate SignNow can greatly benefit your business by saving time and reducing costs associated with traditional signing methods. The platform not only streamlines workflows but also ensures compliance with regulations like Hawaii N 15 Rev 2005, allowing for easy document management in a digital world.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with numerous applications, improving productivity. With integrations available for popular CRMs and project management tools, businesses can ensure that all workflows remain compliant with Hawaii N 15 Rev 2005 while enhancing operational efficiency.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for new users to understand and navigate. This ease of use is vital for businesses looking to comply with Hawaii N 15 Rev 2005 without extensive training for employees.

Get more for Hawaii N 15 Rev

Find out other Hawaii N 15 Rev

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form