Form 8300 Letter to Customer

What is the Form 8300 Letter To Customer

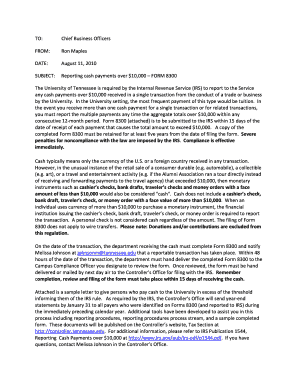

The Form 8300 letter to customer is a notification required by the Internal Revenue Service (IRS) for businesses that receive cash payments exceeding $10,000 in a single transaction or in related transactions. This letter serves to inform customers that the business is obligated to report the transaction to the IRS. The purpose of this requirement is to combat money laundering and other financial crimes by ensuring that large cash transactions are documented and reported appropriately.

How to use the Form 8300 Letter To Customer

Using the Form 8300 letter to customer involves a few straightforward steps. First, businesses must accurately complete the IRS Form 8300, detailing the transaction and the customer’s information. Once the form is filled out, the business must provide a copy of the notification letter to the customer. This letter should include information about the transaction, the amount received, and a reminder that the transaction has been reported to the IRS. It is essential to deliver this letter promptly, ideally within a few days of the transaction, to ensure compliance with IRS regulations.

Steps to complete the Form 8300 Letter To Customer

Completing the Form 8300 letter to customer requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the customer’s name, address, and the amount of cash received.

- Fill out the IRS Form 8300 accurately, ensuring all required fields are completed.

- Draft the notification letter, including details of the transaction and a statement about IRS reporting.

- Provide the customer with a copy of the letter, either in person or via mail.

- Keep a copy of the letter for your records, along with the completed Form 8300.

Legal use of the Form 8300 Letter To Customer

The legal use of the Form 8300 letter to customer is critical for compliance with federal regulations. Businesses must ensure that they report any cash transactions exceeding $10,000 to the IRS, as failure to do so can result in significant penalties. The letter serves as a formal notification to the customer that their transaction has been reported, which is a legal requirement. It is important for businesses to understand the implications of this form and to use it correctly to avoid legal issues.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 8300 letter to customer. According to IRS regulations, businesses must file Form 8300 within 15 days of the transaction. Additionally, the notification letter must be provided to the customer within the same timeframe. The IRS also outlines the necessary information that must be included in both the form and the letter, ensuring that all parties are aware of their responsibilities. Adhering to these guidelines is essential for maintaining compliance and avoiding penalties.

Penalties for Non-Compliance

Non-compliance with the requirements surrounding the Form 8300 letter to customer can lead to severe penalties. Businesses that fail to report cash transactions as required may face fines and other legal repercussions. The IRS can impose penalties for late filings, inaccuracies, or failure to provide the notification letter to customers. Understanding these potential penalties highlights the importance of adhering to IRS regulations and ensuring that all necessary documentation is completed accurately and on time.

Quick guide on how to complete form 8300 letter to customer

Complete Form 8300 Letter To Customer seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents rapidly without delays. Manage Form 8300 Letter To Customer on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest method to modify and eSign Form 8300 Letter To Customer with ease

- Obtain Form 8300 Letter To Customer and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your files or obscure confidential details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 8300 Letter To Customer and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8300 letter to customer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8300 notification letter?

A form 8300 notification letter is a document that is sent to inform eligible recipients that a business has reported cash transactions exceeding $10,000 to the IRS. This letter serves as a compliance measure and helps ensure that businesses adhere to federal regulations. Understanding the importance of a form 8300 notification letter can help you maintain proper documentation and avoid potential fines.

-

How can airSlate SignNow help with the form 8300 notification letter process?

airSlate SignNow simplifies the process of generating and sending form 8300 notification letters. Our platform allows you to create customized letters quickly, ensuring compliance with IRS regulations. With user-friendly features, you can easily manage your documents and track their progress, streamlining the notification letter process.

-

Is there a cost associated with sending a form 8300 notification letter through airSlate SignNow?

Yes, airSlate SignNow operates on a subscription model that varies depending on the features you require. However, the cost is generally cost-effective compared to traditional methods of sending form 8300 notification letters. The price includes access to our eSignature capabilities, document management tools, and customer support.

-

What features does airSlate SignNow offer for form 8300 notification letters?

Our platform provides various features such as customizable templates for form 8300 notification letters, built-in eSignature capabilities, and real-time tracking. You can easily edit and personalize your letters while ensuring they meet compliance standards. Additionally, our cloud storage allows for secure document management.

-

Can I integrate airSlate SignNow with other software for managing form 8300 notification letters?

Yes, airSlate SignNow offers seamless integrations with multiple software platforms like CRMs, accounting software, and email services. This allows for a more efficient workflow when handling form 8300 notification letters and other documents. By integrating our solution into your existing systems, you can enhance productivity and reduce manual errors.

-

How does airSlate SignNow enhance compliance when sending form 8300 notification letters?

airSlate SignNow enhances compliance by providing templates that adhere to the IRS guidelines for form 8300 notification letters. The platform ensures that all necessary fields are completed, reducing the likelihood of errors. Additionally, our secure eSignature process ensures that documents are properly authenticated and legally binding.

-

What are the benefits of using airSlate SignNow for form 8300 notification letters?

Using airSlate SignNow for form 8300 notification letters provides businesses with speed, efficiency, and compliance. The platform allows you to send notifications electronically, reducing paper waste and time spent on manual processes. Moreover, enhanced security features protect sensitive information, giving you peace of mind.

Get more for Form 8300 Letter To Customer

Find out other Form 8300 Letter To Customer

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document