About Schedule C Form 1040 or 1040 SR, Profit or Loss from 2020

What is the Schedule C Form 1040 or 1040 SR?

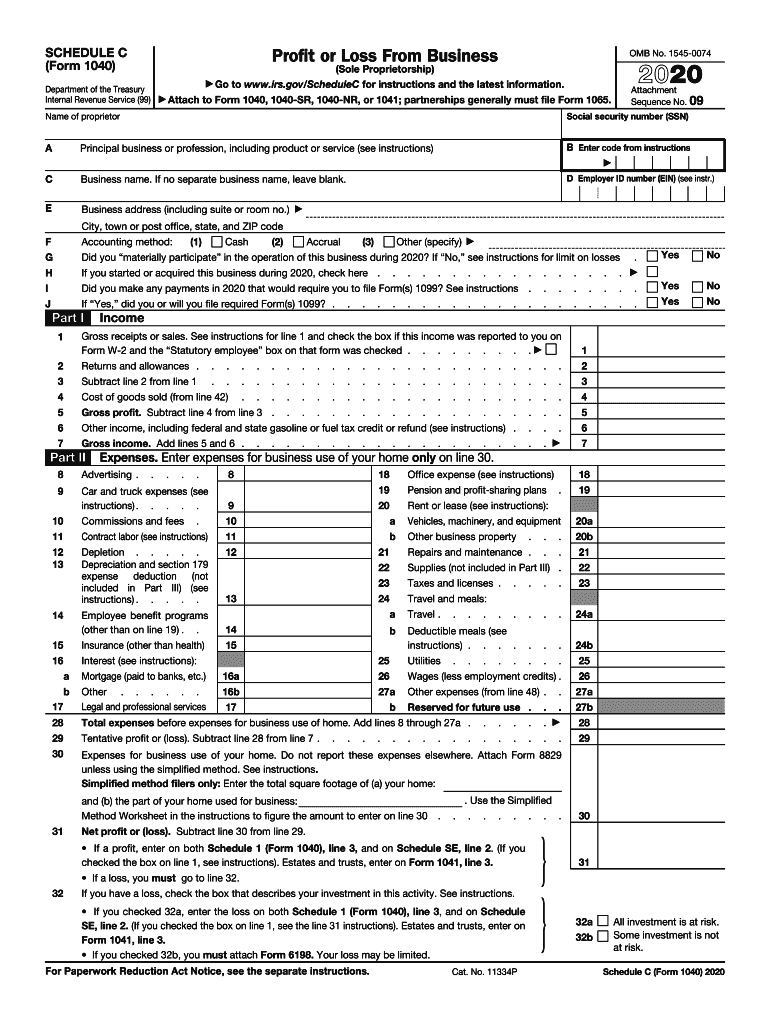

The Schedule C form, officially known as Form 1040, is used by self-employed individuals to report income or loss from their business. This form is essential for sole proprietors and single-member LLCs, allowing them to detail their earnings and expenses. The information reported on Schedule C is then transferred to the individual’s Form 1040 or 1040 SR, which is the standard income tax return for U.S. taxpayers. Understanding the purpose of this form is crucial for accurate tax reporting and compliance.

Steps to Complete the Schedule C Form 1040 or 1040 SR

Completing the Schedule C form involves several key steps:

- Gather necessary documents: Collect all relevant financial records, including income statements, receipts for expenses, and any previous tax returns.

- Fill out the basic information: Enter your name, Social Security number, and business name at the top of the form.

- Report income: List all sources of income from your business. This includes sales, services, and any other revenue streams.

- Detail expenses: Categorize and list all business expenses, such as advertising, utilities, and supplies. Be sure to keep accurate records to substantiate these claims.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss. This figure will be critical for your overall tax liability.

- Review and sign: Double-check all entries for accuracy, then sign and date the form before submission.

IRS Guidelines for Schedule C Form 1040 or 1040 SR

The IRS provides specific guidelines for completing the Schedule C form. It is essential to adhere to these requirements to ensure compliance and avoid penalties. Key guidelines include:

- Ensure all income is reported accurately, including cash and non-cash transactions.

- Keep thorough records of all business expenses, as the IRS may require documentation in case of an audit.

- Be aware of the deadlines for filing your tax return, as late submissions may incur penalties.

- Consult the IRS instructions for Schedule C for any updates or changes to the form.

Filing Deadlines for Schedule C Form 1040 or 1040 SR

Filing deadlines for the Schedule C form align with the standard tax return deadlines. Typically, individual tax returns are due on April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers can also file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents for Completing Schedule C Form 1040 or 1040 SR

To accurately complete the Schedule C form, you will need several documents, including:

- Income records, such as invoices and bank statements.

- Expense receipts, including bills for utilities, supplies, and other business-related costs.

- Previous tax returns for reference.

- Any relevant business licenses or permits.

Examples of Using Schedule C Form 1040 or 1040 SR

Examples of when to use Schedule C include:

- A freelance graphic designer reporting income from various clients.

- A consultant who provides services and incurs expenses for travel and materials.

- A small business owner selling products online or at local markets.

Quick guide on how to complete about schedule c form 1040 or 1040 sr profit or loss from

Complete About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From effortlessly on any device

Managing documents online has become increasingly popular among both businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed files, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

The easiest way to modify and electronically sign About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From with ease

- Find About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From to ensure effective communication at every phase of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule c form 1040 or 1040 sr profit or loss from

Create this form in 5 minutes!

How to create an eSignature for the about schedule c form 1040 or 1040 sr profit or loss from

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the purpose of the 2020 schedule c form?

The 2020 schedule c form is used to report income or loss from a business you operated as a sole proprietor. It provides you with a way to outline your business income, expenses, and ultimately, your net profit or loss. Accurately completing the 2020 schedule c is essential for tax purposes.

-

How can airSlate SignNow help me with my 2020 schedule c?

airSlate SignNow streamlines the process of sending and eSigning your 2020 schedule c forms. Our platform allows you to create, edit, and securely share documents with ease, ensuring that you can focus on your business while we handle the paperwork efficiently.

-

Is airSlate SignNow compatible with popular accounting software for tax forms, including the 2020 schedule c?

Yes, airSlate SignNow integrates seamlessly with several popular accounting software solutions. This integration allows you to manage your 2020 schedule c forms directly from your accounting software, ensuring a smooth workflow and reducing the chance of errors.

-

What pricing options are available for using airSlate SignNow with my 2020 schedule c documentation?

airSlate SignNow offers flexible pricing plans that are budget-friendly and tailored to meet your needs, whether you're an individual or a business. Our pricing allows you to efficiently manage your 2020 schedule c documents without breaking the bank.

-

Can I securely store my 2020 schedule c documents in airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your important documents, including your 2020 schedule c forms. This means you can access them anytime, anywhere, while knowing they are protected with advanced security measures.

-

What features of airSlate SignNow enhance the eSigning process for the 2020 schedule c?

Our platform offers various features such as custom workflows, reminders, and real-time notifications that enhance the eSigning process for your 2020 schedule c. These tools simplify the signing experience, making it quick and efficient for both you and your signers.

-

How user-friendly is airSlate SignNow for completing the 2020 schedule c?

airSlate SignNow boasts an intuitive interface designed for users of all skill levels. Completing your 2020 schedule c forms is straightforward, allowing you to fill out, review, and eSign documents with minimal hassle.

Get more for About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From

- Fillable online department of justice bureau of alcohol form

- United kingdom dental confidential form

- How to file a motion in the special civil part form

- Wwwlacourtorg forms pdfcivil case cover sheet addendum and statement of location

- Order appointing court approved reporter as official reporter pro form

- Cbp form 3229

- Application form for renew driver license

- Bank clearance certificate format pdf

Find out other About Schedule C Form 1040 Or 1040 SR, Profit Or Loss From

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors