Form 1040 U S Individual Income Tax Return 2020

What is the Form 1040 U S Individual Income Tax Return

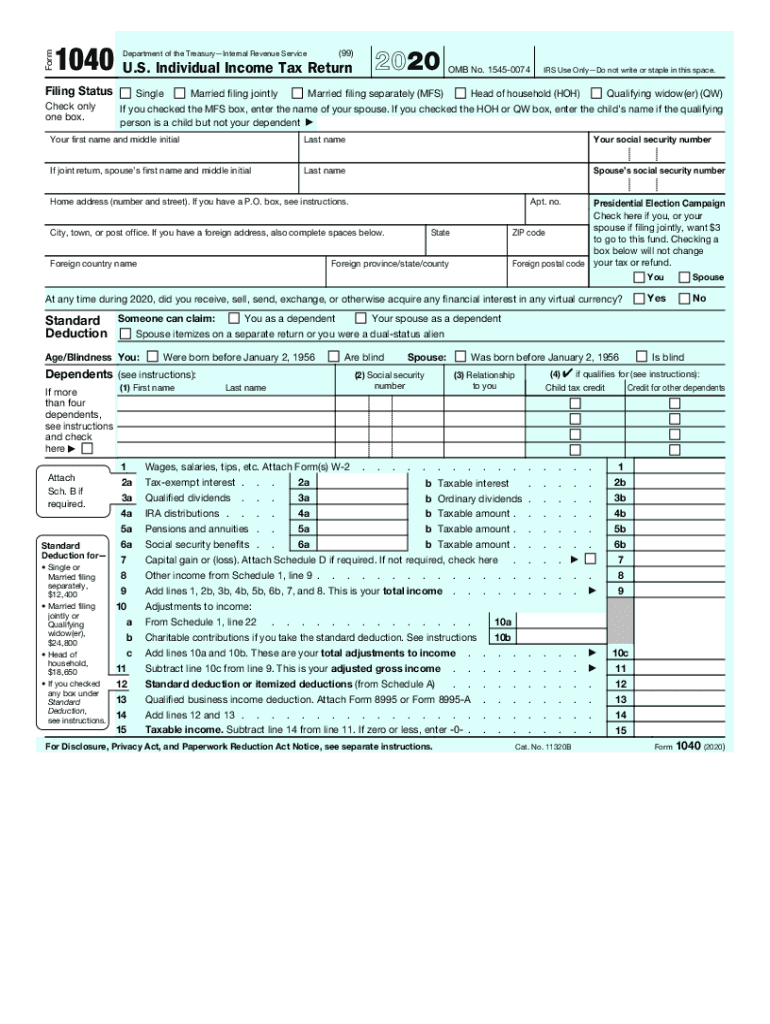

The 2 tax form, officially known as the U S Individual Income Tax Return, is a crucial document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to calculate their tax liability, claim deductions, and report any tax credits. It serves as the primary means for individuals to fulfill their tax obligations and is essential for ensuring compliance with federal tax laws.

How to use the Form 1040 U S Individual Income Tax Return

Using the 2017 federal tax form 1040 involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, follow the instructions provided with the form to accurately fill in your income, deductions, and credits. It is important to ensure that all information is complete and correct to avoid issues with the IRS. After completing the form, you can file it electronically or by mail, depending on your preference.

Steps to complete the Form 1040 U S Individual Income Tax Return

Completing the 2017 tax form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, report your income from various sources, such as wages, dividends, and interest. After calculating your total income, you will need to determine your adjusted gross income (AGI) by subtracting any adjustments. Following this, apply any deductions you qualify for, such as the standard deduction or itemized deductions. Finally, calculate your tax liability and any credits before determining whether you owe taxes or are due a refund.

Required Documents

To accurately complete the 2017 IRS form 1040, you will need several documents. Key documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as mortgage interest and medical expenses

- Proof of any tax credits you intend to claim

- Social Security numbers for yourself and any dependents

Filing Deadlines / Important Dates

For the 2017 tax year, the deadline to file your 1040 form was April 17, 2018. If you filed for an extension, the extended deadline would have been October 15, 2018. It is important to adhere to these deadlines to avoid penalties and interest on any taxes owed. Keeping track of these dates helps ensure timely compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the 2 tax form on time can result in significant penalties. The IRS typically imposes a failure-to-file penalty, which is a percentage of the taxes owed for each month the return is late. Additionally, if you owe taxes and do not pay them, you may incur a failure-to-pay penalty. Understanding these penalties can motivate timely and accurate filing, ensuring compliance with tax regulations.

Quick guide on how to complete 2020 form 1040 us individual income tax return

Complete Form 1040 U S Individual Income Tax Return effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Form 1040 U S Individual Income Tax Return on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 1040 U S Individual Income Tax Return with ease

- Locate Form 1040 U S Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about losing or misplacing documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1040 U S Individual Income Tax Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1040 us individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1040 us individual income tax return

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the 2017 1040 tax form and who needs to file it?

The 2017 1040 tax form is a standard IRS form used by U.S. taxpayers to report their annual income and calculate their tax liability. Individuals who earn income from various sources, including wages, self-employment, or investments, typically need to file this form to determine their tax obligations.

-

How can airSlate SignNow help with filling out the 2017 1040 tax form?

airSlate SignNow provides easy-to-use templates and document management features that streamline the process of filling out the 2017 1040 tax form. Users can securely send, sign, and store their completed tax documents, ensuring they are organized and accessible when needed.

-

Is there a cost associated with using airSlate SignNow for the 2017 1040 tax form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, making it a cost-effective solution for managing documents, including the 2017 1040 tax form. A free trial is also available to let users explore its features before committing to a subscription.

-

Can I integrate airSlate SignNow with other software while preparing my 2017 1040 tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and file management software, helping you to manage the 2017 1040 tax form alongside your other financial documents. This ensures a smooth workflow and accurate record-keeping across applications.

-

What features does airSlate SignNow offer for the 2017 1040 tax form?

airSlate SignNow offers features such as electronic signatures, document tracking, and custom templates, which simplify the process of preparing the 2017 1040 tax form. These features empower users to complete and manage their tax documents efficiently and securely.

-

How secure is my information when using airSlate SignNow for my 2017 1040 tax form?

Your information is highly secure when using airSlate SignNow for your 2017 1040 tax form. The platform utilizes industry-standard encryption protocols to protect your data, ensuring your sensitive tax information is safe and confidential at all times.

-

What support options are available for users preparing the 2017 1040 tax form with airSlate SignNow?

airSlate SignNow offers comprehensive support options, including live chat, email, and phone support to assist users with preparing the 2017 1040 tax form. The knowledge base and user guides are also available to help navigate any questions or issues during the process.

Get more for Form 1040 U S Individual Income Tax Return

- Form i 360 petition for amerasian widower or special immigrant

- I 590 form

- Wwwsignnowcomfill and sign pdf form1073713186a3 186a form fill out and sign printable pdf templatesignnow

- Form i 698 application to adjust status from temporary to permanent resident under section 245a of the ina application to

- Form g 1041 genealogy index search request g 1041pdf

- Carolina tax form

- Form 2519 request for receipt of title or registrationform 2519 request for receipt of title or registrationform 2519 request

- Form i 102 application for replacementinitial nonimmigrant arrival departure document

Find out other Form 1040 U S Individual Income Tax Return

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent