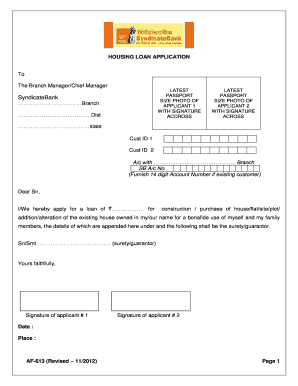

Syndicate Bank Home Loan Form

What is the Syndicate Bank Home Loan

The Syndicate Bank home loan is a financial product designed to assist individuals in purchasing or constructing residential properties. This loan typically offers competitive interest rates and flexible repayment options, making it an attractive choice for homebuyers. Borrowers can use the funds not only for buying a new home but also for renovating or extending an existing property. Understanding the specifics of this loan type is essential for potential homeowners to make informed financial decisions.

How to Obtain the Syndicate Bank Home Loan

To obtain a Syndicate Bank home loan, prospective borrowers should follow a straightforward process. Initially, it is advisable to check eligibility criteria, which may include factors such as income, credit score, and employment status. Once eligibility is confirmed, the next step involves gathering necessary documentation, including proof of identity, income statements, and property details. After preparing these documents, applicants can approach the bank to fill out the loan application form, either online or in person. The bank will then assess the application, verify the information, and communicate the loan approval status.

Steps to Complete the Syndicate Bank Home Loan

Completing the Syndicate Bank home loan process involves several key steps. First, applicants should ensure they meet the eligibility requirements. Next, they need to compile the required documents, which typically include:

- Proof of identity (e.g., passport, driver's license)

- Income proof (e.g., salary slips, tax returns)

- Property documents (e.g., sale agreement, title deed)

After gathering these documents, the applicant submits the home loan application form. The bank will review the application, conduct a property valuation, and perform a credit assessment. Once approved, the borrower will receive a sanction letter outlining the loan amount, interest rate, and repayment terms. Finally, the loan agreement must be signed, and funds will be disbursed accordingly.

Legal Use of the Syndicate Bank Home Loan

The legal use of a Syndicate Bank home loan is governed by specific regulations and guidelines. Borrowers must ensure that the funds are utilized for legitimate purposes, such as purchasing a home or financing home improvements. Misuse of loan funds can lead to legal repercussions, including penalties or loan default. Additionally, it is crucial for borrowers to comply with all terms outlined in the loan agreement to maintain legal standing and avoid disputes with the bank.

Eligibility Criteria

Eligibility criteria for the Syndicate Bank home loan typically include several factors that potential borrowers must meet. These may involve:

- Minimum age requirement, usually between eighteen and sixty-five years

- Stable income source, which can be from employment, business, or other means

- A satisfactory credit score, reflecting the borrower's creditworthiness

- Property ownership or intent to purchase a residential property

Meeting these criteria is essential for a successful loan application, as they help the bank assess the risk associated with lending.

Required Documents

When applying for a Syndicate Bank home loan, borrowers must prepare a set of required documents to support their application. Commonly required documents include:

- Proof of identity, such as a government-issued ID

- Proof of income, including recent salary slips and tax returns

- Bank statements for the last six months

- Property documents, including the sale agreement and title deed

- Passport-sized photographs

Having these documents ready can streamline the application process and improve the chances of timely approval.

Quick guide on how to complete syndicate bank home loan

Prepare Syndicate Bank Home Loan effortlessly on any device

Online document management has gained traction among enterprises and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Syndicate Bank Home Loan on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Syndicate Bank Home Loan without hassle

- Find Syndicate Bank Home Loan and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Syndicate Bank Home Loan and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the syndicate bank home loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Syndicate Bank home loan?

A Syndicate Bank home loan is a financial product offered by Syndicate Bank to help individuals purchase or construct their homes. These loans come with competitive interest rates and flexible repayment options, making it easier for borrowers to achieve their homeownership dreams.

-

What are the eligibility criteria for a Syndicate Bank home loan?

To qualify for a Syndicate Bank home loan, applicants typically need to be salaried or self-employed individuals with a stable income. Additionally, borrowers should have a good credit score, a proper identity proof, and property documents in order to apply successfully.

-

What are the interest rates for Syndicate Bank home loans?

Syndicate Bank offers attractive interest rates on home loans, which may vary based on the loan amount, tenure, and other factors. It is advisable to check the latest rates on the bank's official website or consult with a bank representative to get updated information.

-

How can I apply for a Syndicate Bank home loan?

You can apply for a Syndicate Bank home loan online through the bank's website or by visiting a local branch. The application process is straightforward, requiring you to fill out forms and submit necessary documents for processing your loan application.

-

What is the maximum loan amount for a Syndicate Bank home loan?

The maximum loan amount for a Syndicate Bank home loan depends on various factors, including your income, repayment capacity, and property value. Generally, the bank offers loans that can cover a signNow portion of your home's cost to ensure you can meet your housing needs.

-

Are there any processing fees associated with a Syndicate Bank home loan?

Yes, Syndicate Bank may charge processing fees for home loan applications. These fees typically vary based on the loan amount and specific terms, so it's essential to inquire about the applicable charges before proceeding with your application.

-

What are the benefits of choosing a Syndicate Bank home loan?

Choosing a Syndicate Bank home loan offers benefits such as competitive interest rates, flexible repayment options, and personalized banking services. Additionally, the bank provides a hassle-free documentation process, which simplifies your journey to homeownership.

Get more for Syndicate Bank Home Loan

Find out other Syndicate Bank Home Loan

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer