State of Utah Statement of Functional Expenses Form

What is the State Of Utah Statement Of Functional Expenses Form

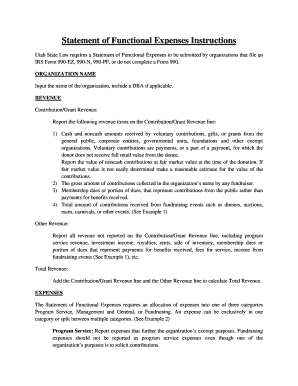

The State Of Utah Statement Of Functional Expenses Form is a crucial document used by organizations to report their functional expenses. This form helps in categorizing expenditures by function, such as program services, management, and general expenses. It is essential for non-profits and governmental entities to maintain transparency and accountability in their financial reporting. By accurately completing this form, organizations can provide stakeholders with a clear view of how funds are allocated and spent.

How to use the State Of Utah Statement Of Functional Expenses Form

Using the State Of Utah Statement Of Functional Expenses Form involves several key steps. First, gather all relevant financial data, including receipts, invoices, and previous financial statements. Next, categorize expenses according to the required sections of the form. It is important to ensure that all entries are accurate and reflect the actual expenses incurred. Once completed, the form should be reviewed for accuracy before submission to the appropriate state agency or governing body.

Steps to complete the State Of Utah Statement Of Functional Expenses Form

Completing the State Of Utah Statement Of Functional Expenses Form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all necessary financial documents related to expenses.

- Identify and categorize each expense according to the form's sections.

- Enter the data into the form, ensuring accuracy in amounts and descriptions.

- Review the completed form for any errors or omissions.

- Submit the form to the designated state agency by the required deadline.

Legal use of the State Of Utah Statement Of Functional Expenses Form

The legal use of the State Of Utah Statement Of Functional Expenses Form is governed by state regulations that require accurate and truthful reporting of financial activities. Organizations must ensure compliance with all applicable laws to avoid penalties. The form serves as an official record that may be subject to audits or reviews by state authorities, making it essential for organizations to maintain integrity in their reporting.

Key elements of the State Of Utah Statement Of Functional Expenses Form

Key elements of the State Of Utah Statement Of Functional Expenses Form include:

- Identification of the organization, including name and address.

- Detailed categorization of expenses by function.

- Total expenses reported for the fiscal year.

- Signatures of authorized representatives to validate the form.

Form Submission Methods

The State Of Utah Statement Of Functional Expenses Form can be submitted through various methods. Organizations may choose to file the form online, which is often the most efficient option. Alternatively, the form can be mailed to the appropriate state agency or submitted in person at designated offices. It is important to check for any specific submission requirements or deadlines to ensure timely processing.

Quick guide on how to complete state of utah statement of functional expenses form

Complete State Of Utah Statement Of Functional Expenses Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle State Of Utah Statement Of Functional Expenses Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign State Of Utah Statement Of Functional Expenses Form effortlessly

- Obtain State Of Utah Statement Of Functional Expenses Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Edit and eSign State Of Utah Statement Of Functional Expenses Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of utah statement of functional expenses form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the State Of Utah Statement Of Functional Expenses Form?

The State Of Utah Statement Of Functional Expenses Form is a document used by organizations to report their expenses in a functional manner. It provides transparency and clarity in how funds are allocated across various programs and services. By utilizing this form, businesses can ensure compliance with state requirements.

-

How can airSlate SignNow assist with the State Of Utah Statement Of Functional Expenses Form?

airSlate SignNow offers an efficient platform to create, send, and eSign the State Of Utah Statement Of Functional Expenses Form. Our user-friendly interface allows for seamless document management, ensuring that you can focus on meeting compliance requirements without the hassle of cumbersome paperwork.

-

Is there a cost associated with using airSlate SignNow for the State Of Utah Statement Of Functional Expenses Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our solutions are cost-effective, allowing organizations to manage their documentation, including the State Of Utah Statement Of Functional Expenses Form, without breaking the bank. You can check our pricing page for detailed information.

-

What features does airSlate SignNow provide for the State Of Utah Statement Of Functional Expenses Form?

airSlate SignNow provides features such as customizable templates, multiple eSignature options, and real-time tracking for the State Of Utah Statement Of Functional Expenses Form. These features simplify the signing process, make document management easier, and help maintain accurate records.

-

Can I integrate airSlate SignNow with other tools for the State Of Utah Statement Of Functional Expenses Form?

Absolutely! airSlate SignNow supports integrations with various popular applications, ensuring a smooth workflow when preparing the State Of Utah Statement Of Functional Expenses Form. This connectivity allows for streamlined processing and better data management across platforms.

-

What benefits do I gain from using airSlate SignNow for the State Of Utah Statement Of Functional Expenses Form?

Using airSlate SignNow for the State Of Utah Statement Of Functional Expenses Form enhances efficiency and accuracy in document management. You benefit from faster turnaround times, improved organization, and the ability to track document status, resulting in a more productive workflow.

-

How secure is airSlate SignNow when handling the State Of Utah Statement Of Functional Expenses Form?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security measures to protect your documents, including the State Of Utah Statement Of Functional Expenses Form. You can confidently handle sensitive information knowing it is safeguarded against unauthorized access.

Get more for State Of Utah Statement Of Functional Expenses Form

Find out other State Of Utah Statement Of Functional Expenses Form

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form