1099 R Fillable Form

What is the 1099 R Fillable Form

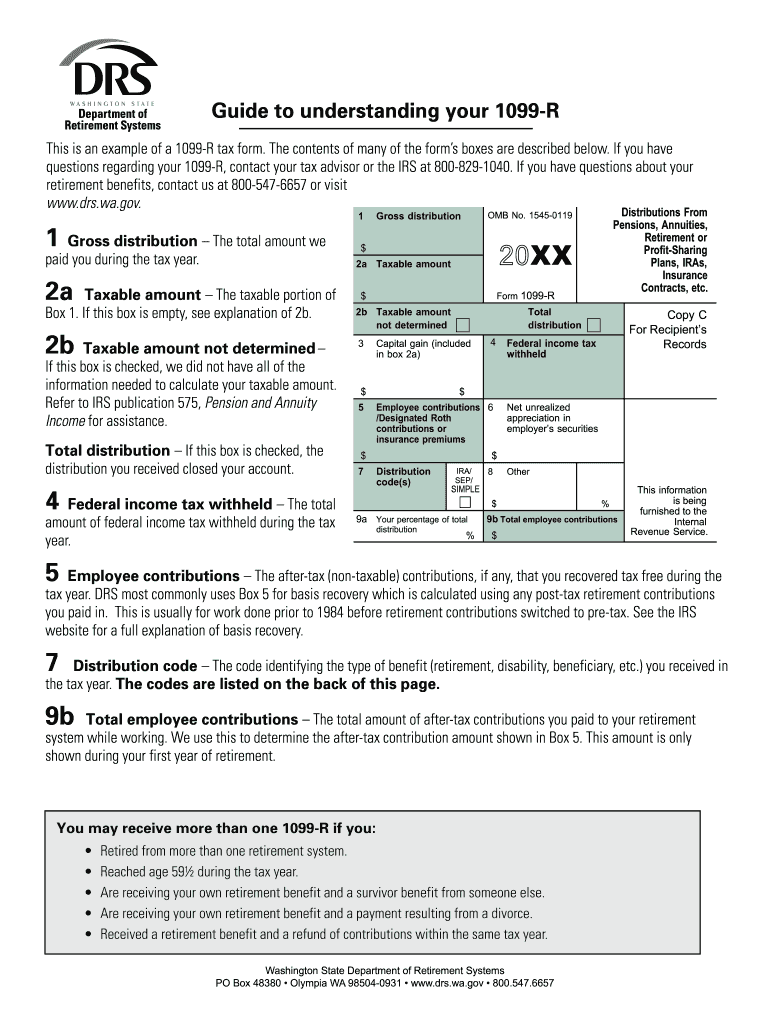

The 1099 R printable form is a tax document used in the United States to report distributions from retirement accounts, pensions, annuities, and other sources of income. This form is essential for both the payer and the recipient, as it provides information necessary for accurate tax reporting. Recipients of the 1099 R form typically include retirees, beneficiaries of deceased individuals, and individuals who have taken early withdrawals from their retirement accounts. Understanding this form is crucial for ensuring compliance with IRS regulations.

How to Obtain the 1099 R Fillable Form

To obtain the 1099 R printable form, individuals can visit the official IRS website, where they can download the form directly. Additionally, many financial institutions and retirement plan administrators provide this form to their clients at the end of the tax year. It is important to ensure that you have the correct version of the form for the specific tax year, as there may be updates or changes in the form's requirements.

Steps to Complete the 1099 R Fillable Form

Completing the 1099 R printable form involves several key steps:

- Gather all necessary information, including your personal details, the payer's information, and the amount distributed.

- Fill in the form accurately, ensuring that all fields are completed, including the distribution code that indicates the type of distribution.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS and provide a copy to the recipient by the required deadline.

Legal Use of the 1099 R Fillable Form

The 1099 R printable form serves as an official record of income received from retirement accounts and is legally binding for tax reporting purposes. It is essential for recipients to report the income accurately on their tax returns to avoid penalties. The form must be completed in compliance with IRS guidelines, and both the payer and recipient have responsibilities regarding its accuracy and timeliness.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 R printable form are crucial to ensure compliance with IRS regulations. Generally, the form must be provided to recipients by January thirty-first of the year following the tax year in which the distribution occurred. Additionally, the form must be submitted to the IRS by the end of February if filing by paper or by March thirty-first if filing electronically. It is important to adhere to these deadlines to avoid potential penalties.

Who Issues the Form

The 1099 R printable form is typically issued by financial institutions, retirement plan administrators, and employers who manage pension plans. These entities are responsible for reporting distributions made to individuals during the tax year. It is essential for recipients to keep track of these forms, as they will be needed for accurate tax filing.

Quick guide on how to complete 1099 r fillable form 2013

Complete 1099 R Fillable Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents efficiently without delays. Handle 1099 R Fillable Form on any device through airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to edit and eSign 1099 R Fillable Form effortlessly

- Find 1099 R Fillable Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from whichever device you prefer. Edit and eSign 1099 R Fillable Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 r fillable form 2013

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is an IT 1099 R printable form?

An IT 1099 R printable form is a tax document used to report distributions from pensions, annuities, retirement plans, and other types of income. This form is essential for individuals who receive retirement income and must report it to the IRS. With airSlate SignNow, you can easily create, fill out, and eSign your IT 1099 R printable form.

-

How can I obtain an IT 1099 R printable form?

You can obtain an IT 1099 R printable form directly through the IRS website or by using airSlate SignNow's document templates. Our platform allows users to generate this form effortlessly and customize it according to their needs. Plus, you can save it as a printable version for submission.

-

Can I eSign my IT 1099 R printable form?

Yes, you can eSign your IT 1099 R printable form using airSlate SignNow. Our platform offers a secure and legally binding eSignature feature that allows you to sign your tax documents from anywhere. This makes it convenient to finalize your tax forms without the need for printing and scanning.

-

Is there a cost associated with using airSlate SignNow for the IT 1099 R printable form?

airSlate SignNow offers various pricing plans to suit different business needs. While some basic features are available for free, accessing advanced options for your IT 1099 R printable form may require a subscription. We provide value through our easy-to-use platform backed by excellent customer support.

-

What features does airSlate SignNow offer for handling IT 1099 R printable forms?

airSlate SignNow provides features such as customizable templates, secure eSignatures, document tracking, and collaboration tools specifically for IT 1099 R printable forms. These tools simplify the process of completing and filing your tax documents, ensuring all necessary data is accurately captured.

-

Can airSlate SignNow integrate with other software for tax filing?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software. This integration capability allows you to import and export your IT 1099 R printable form data easily, saving you time and reducing the risk of errors during tax filing.

-

What are the benefits of using airSlate SignNow for my IT 1099 R printable form?

Using airSlate SignNow for your IT 1099 R printable form provides speed, convenience, and accuracy. You can electronically sign and share your forms securely, access them from anywhere, and track the status of your documents in real-time. This simplification enhances your overall tax filing experience.

Get more for 1099 R Fillable Form

Find out other 1099 R Fillable Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney