SALES TAX FORM ST 3

What is the SALES TAX FORM ST 3

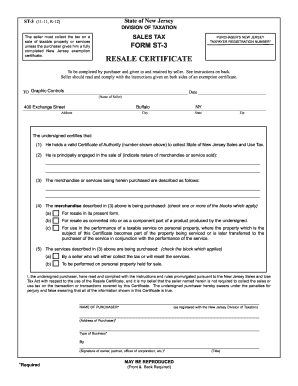

The SALES TAX FORM ST 3 is a crucial document used in the United States for sales tax exemption purposes. This form allows certain businesses and organizations to make tax-exempt purchases of goods and services. Typically, it is utilized by entities that qualify under specific tax-exempt categories, such as non-profit organizations, government agencies, and certain educational institutions. By presenting this form to vendors, eligible purchasers can avoid paying sales tax on qualifying transactions, which can significantly reduce operational costs.

How to use the SALES TAX FORM ST 3

Using the SALES TAX FORM ST 3 involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, accurately fill out the form, providing all required information, such as the purchaser's name, address, and the specific reason for the exemption. Once completed, present the form to the vendor at the time of purchase. It is essential to keep a copy of the form for your records, as it may be required for future reference or audits.

Steps to complete the SALES TAX FORM ST 3

Completing the SALES TAX FORM ST 3 requires attention to detail. Follow these steps:

- Gather necessary information, including your organization’s name, address, and tax identification number.

- Indicate the specific items or services for which the exemption is claimed.

- Clearly state the reason for the tax exemption, ensuring it aligns with the categories recognized by the state.

- Review the form for accuracy before signing and dating it.

- Provide the completed form to the vendor during the transaction.

Legal use of the SALES TAX FORM ST 3

The SALES TAX FORM ST 3 is legally binding when filled out correctly and used in compliance with state regulations. It is essential to ensure that the form is completed with accurate information and that the purchaser qualifies for the sales tax exemption. Misuse of this form can lead to penalties, including fines or back taxes owed. Therefore, understanding the legal implications and maintaining proper documentation is vital for organizations utilizing this form.

Key elements of the SALES TAX FORM ST 3

Several key elements must be included in the SALES TAX FORM ST 3 to ensure its validity:

- Purchaser Information: Name, address, and tax identification number of the entity claiming exemption.

- Vendor Information: Name and address of the seller to whom the form is presented.

- Reason for Exemption: A clear statement outlining the basis for the tax exemption.

- Signature and Date: The form must be signed and dated by an authorized representative of the purchaser.

Filing Deadlines / Important Dates

While the SALES TAX FORM ST 3 is not typically filed with a tax authority, it is essential to be aware of any deadlines related to sales tax reporting and payments. Each state may have different requirements for when sales tax returns are due, which can affect how and when the form should be used. Staying informed about these deadlines helps ensure compliance and avoids potential penalties.

Quick guide on how to complete sales tax form st 3

Effortlessly Prepare SALES TAX FORM ST 3 on Any Device

Digital document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents efficiently without delays. Manage SALES TAX FORM ST 3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign SALES TAX FORM ST 3 with ease

- Obtain SALES TAX FORM ST 3 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign SALES TAX FORM ST 3 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax form st 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SALES TAX FORM ST 3 and why is it important?

The SALES TAX FORM ST 3 is a document used in certain states for purchasing goods exempt from sales tax. It's important for businesses to utilize this form correctly to avoid unnecessary tax charges and ensure compliance with tax regulations.

-

How can airSlate SignNow help me manage the SALES TAX FORM ST 3?

airSlate SignNow allows you to easily create, send, and eSign the SALES TAX FORM ST 3 digitally. This streamlines the process, reduces paperwork, and ensures that you have signed copies readily available for record-keeping and compliance.

-

What features does airSlate SignNow offer for completing the SALES TAX FORM ST 3?

With airSlate SignNow, you can fill out the SALES TAX FORM ST 3 electronically, add signatures, and track document status in real-time. Additionally, our platform allows for secure sharing and document storage, making it a comprehensive solution.

-

Is there a cost associated with using airSlate SignNow for the SALES TAX FORM ST 3?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides robust features that simplify the process of managing the SALES TAX FORM ST 3 and other important documents.

-

Can I integrate airSlate SignNow with other applications for managing the SALES TAX FORM ST 3?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to streamline workflows involving the SALES TAX FORM ST 3. This integration enhances efficiency by connecting your eSigning process with other business tools.

-

What benefits does using airSlate SignNow provide for the SALES TAX FORM ST 3?

Using airSlate SignNow for the SALES TAX FORM ST 3 comes with numerous benefits such as faster processing times, reduced paperwork, and improved accuracy. Additionally, the platform's security features ensure that your documents are protected at all times.

-

How can airSlate SignNow ensure compliance with regulations related to the SALES TAX FORM ST 3?

airSlate SignNow helps ensure compliance with regulations related to the SALES TAX FORM ST 3 by providing a legally binding eSign process, with audit trails that verify each step in the signing process. This minimizes the risk of errors and ensures adherence to tax requirements.

Get more for SALES TAX FORM ST 3

Find out other SALES TAX FORM ST 3

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT