California Form 3588Fill Out and Use This PDF FormsPal 2022

Understanding the California Form 3588

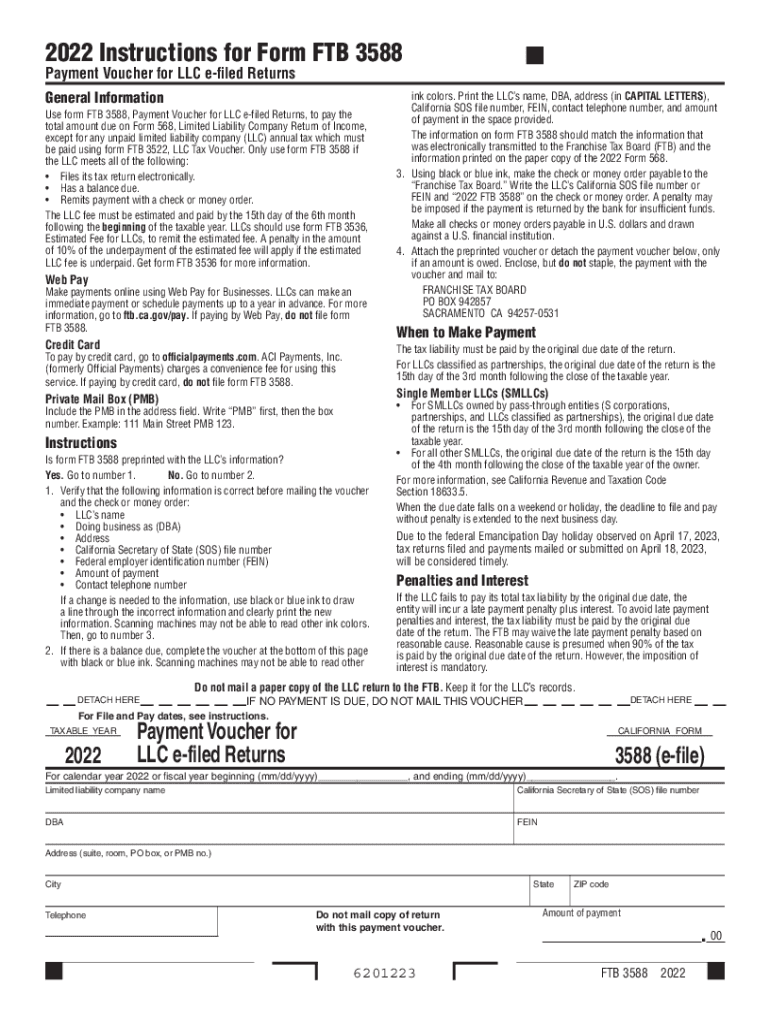

The California Form 3588, also known as the 2022 FTB 3588, is a payment voucher used by businesses to submit estimated tax payments for limited liability companies (LLCs). This form is essential for LLCs operating in California, as it helps ensure compliance with state tax obligations. By using Form 3588, LLCs can accurately report their estimated tax liabilities and make timely payments to the California Franchise Tax Board (FTB).

Steps to Complete the California Form 3588

Completing the California Form 3588 involves several straightforward steps:

- Gather necessary information, including your LLC's name, address, and taxpayer identification number.

- Determine the estimated tax amount based on your LLC's expected income for the year.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Choose your payment method, either by mail or electronically, and follow the instructions provided on the form.

Filing Deadlines for Form 3588

It is crucial to be aware of the filing deadlines associated with the California Form 3588. Typically, the form is due on the 15th day of the fourth month of the taxable year. For most LLCs, this means the deadline falls on April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Ensuring timely submission helps avoid penalties and interest charges.

Submission Methods for the California Form 3588

LLCs have several options for submitting the California Form 3588. The form can be submitted:

- By mail: Send the completed form along with your payment to the address specified by the California FTB.

- Electronically: Use the FTB's online services to submit the form and make your payment directly through their secure portal.

Choosing the electronic submission method can expedite processing and provide immediate confirmation of your payment.

Key Elements of the California Form 3588

When filling out the California Form 3588, it is important to include key elements such as:

- Your LLC's legal name and address.

- The taxpayer identification number (TIN) or Social Security number (SSN).

- The estimated tax amount due for the current year.

- Payment method selected for remitting the tax.

Accurate completion of these elements ensures that your payment is processed correctly and avoids delays.

Legal Use of the California Form 3588

The California Form 3588 is legally required for LLCs to report and pay estimated taxes. Failure to use this form correctly can result in penalties and interest on unpaid taxes. It is essential for LLCs to understand their obligations under California tax law and to use Form 3588 as a means of fulfilling these legal requirements. Proper use of this form helps maintain compliance and supports the financial health of the business.

Quick guide on how to complete california form 3588fill out and use this pdf formspal

Finish California Form 3588Fill Out And Use This PDF FormsPal effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without interruptions. Manage California Form 3588Fill Out And Use This PDF FormsPal on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign California Form 3588Fill Out And Use This PDF FormsPal with ease

- Obtain California Form 3588Fill Out And Use This PDF FormsPal and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional signed document.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign California Form 3588Fill Out And Use This PDF FormsPal to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3588fill out and use this pdf formspal

Create this form in 5 minutes!

How to create an eSignature for the california form 3588fill out and use this pdf formspal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2022 ftb 3588 form and why is it important?

The 2022 ftb 3588 form is a crucial document for California taxpayers, specifically for those claiming the California Earned Income Tax Credit. Understanding this form can help you maximize your tax benefits and ensure compliance with state regulations.

-

How can airSlate SignNow help with the 2022 ftb 3588 form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 2022 ftb 3588 form. This streamlines the process, making it easier for users to manage their tax documents securely and quickly.

-

What are the pricing options for using airSlate SignNow for the 2022 ftb 3588?

airSlate SignNow offers various pricing plans that cater to different business needs, starting from a free trial to premium subscriptions. These plans provide access to features that simplify the handling of documents like the 2022 ftb 3588.

-

What features does airSlate SignNow offer for managing the 2022 ftb 3588?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking. These tools enhance the management of the 2022 ftb 3588 form, ensuring that users can complete their tax filings efficiently.

-

Are there any integrations available for airSlate SignNow when handling the 2022 ftb 3588?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This allows users to easily access and manage their 2022 ftb 3588 forms alongside other important documents.

-

What are the benefits of using airSlate SignNow for the 2022 ftb 3588?

Using airSlate SignNow for the 2022 ftb 3588 offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform's user-friendly interface makes it accessible for everyone, regardless of technical expertise.

-

Is airSlate SignNow compliant with regulations for the 2022 ftb 3588?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations, ensuring that your 2022 ftb 3588 form is handled in accordance with legal standards. This compliance helps protect your sensitive information during the eSigning process.

Get more for California Form 3588Fill Out And Use This PDF FormsPal

- Charitable solicitation complaint form vdacs virginia gov

- Vaccine information statementcurrent viss

- Articles of organization of a virginia limited liability company form

- Va form 40 1330m claim for government medallion to affix to a private marker

- Dmv form dl5fill out and use this pdf

- Federal registervol 76 no 91wednesday may 11 form

- Value added tax vat refunds for diy housebuilders claim form for new houses

- How to register for vat on efilingsouth african revenue servicevat registration online application formcheck vatregister for

Find out other California Form 3588Fill Out And Use This PDF FormsPal

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe