Instructions for Form FTB 3588 Payment Voucher for LLC E Filed Returns 2024-2026

Understanding the FTB 3588 Form Payment Voucher for LLC E-filed Returns

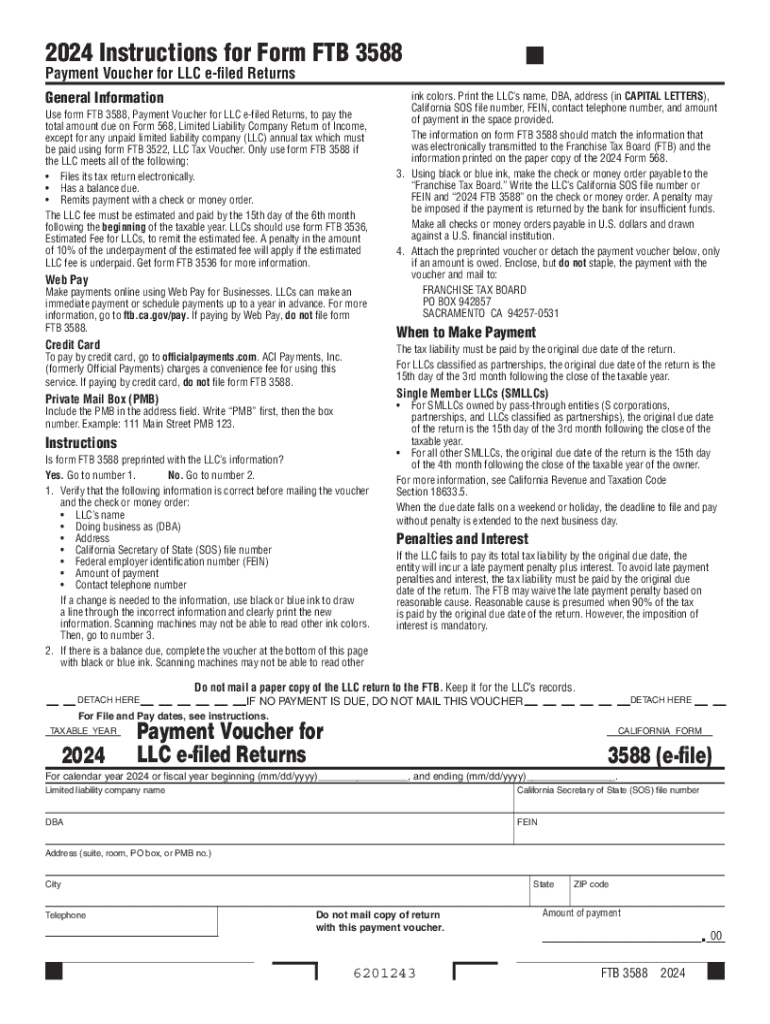

The FTB 3588 form, also known as the California LLC Payment Voucher, is essential for Limited Liability Companies (LLCs) that file their tax returns electronically. This form is used to submit the required tax payments to the California Franchise Tax Board (FTB) for the current tax year. It is particularly important for LLCs to ensure compliance with state tax obligations and to avoid penalties. The form outlines the payment amount due and provides a structured method for submitting payments electronically.

Steps to Complete the FTB 3588 Form

Filling out the FTB 3588 form involves several key steps:

- Gather necessary information, including your LLC's name, address, and tax identification number.

- Determine the payment amount based on your LLC's estimated tax liability for the year.

- Complete the form by entering the required details accurately.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the designated channels provided by the FTB.

Legal Use of the FTB 3588 Form

The FTB 3588 form is legally required for LLCs to report and pay their state taxes. Failing to submit this form can lead to penalties and interest on unpaid taxes. It is crucial for LLCs to understand the legal implications of this form and to ensure timely and accurate submissions to maintain compliance with California tax laws.

Filing Deadlines for the FTB 3588 Form

LLCs must be aware of specific filing deadlines associated with the FTB 3588 form. Generally, the payment voucher is due on the fifteenth day of the fourth month following the close of the tax year. For example, if your LLC operates on a calendar year, the payment would be due by April 15 of the following year. Missing this deadline can result in penalties, so it is essential to stay informed about these important dates.

Required Documents for the FTB 3588 Form

When preparing to complete the FTB 3588 form, LLCs should have the following documents ready:

- Previous year’s tax return for reference.

- Current year’s estimated income and expenses to calculate tax liability.

- LLC's federal tax identification number.

- Any correspondence from the California Franchise Tax Board regarding previous filings.

Examples of Using the FTB 3588 Form

Consider a scenario where an LLC anticipates a tax liability of five thousand dollars for the upcoming tax year. The LLC would complete the FTB 3588 form with this amount and submit it electronically to the FTB by the due date. This process ensures that the LLC remains compliant and avoids any potential penalties. Another example could involve an LLC that has experienced fluctuations in income, requiring a revised estimated payment amount. In such cases, the FTB 3588 form allows for adjustments to be made accordingly.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3588 payment voucher for llc e filed returns

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3588 payment voucher for llc e filed returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3588 form?

The ftb 3588 form is a California tax form used for reporting certain tax credits and adjustments. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations. Understanding the ftb 3588 form can help you maximize your tax benefits.

-

How can airSlate SignNow help with the ftb 3588 form?

airSlate SignNow provides a seamless platform for electronically signing and sending the ftb 3588 form. With its user-friendly interface, you can easily fill out and eSign the form, ensuring that your submissions are timely and secure. This simplifies the process of managing your tax documents.

-

Is there a cost associated with using airSlate SignNow for the ftb 3588 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion and signing of documents like the ftb 3588 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the ftb 3588 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the ftb 3588 form. These features enhance efficiency and ensure that your documents are handled with care. You can also integrate with other tools to streamline your workflow.

-

Can I integrate airSlate SignNow with other applications for the ftb 3588 form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage the ftb 3588 form alongside your other business tools. This allows for a more cohesive workflow and helps you keep all your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for the ftb 3588 form?

Using airSlate SignNow for the ftb 3588 form offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform allows you to complete and sign documents quickly, reducing the risk of errors. Additionally, your data is protected with advanced security measures.

-

How secure is airSlate SignNow when handling the ftb 3588 form?

airSlate SignNow prioritizes security, employing encryption and secure storage for documents like the ftb 3588 form. This ensures that your sensitive information remains confidential and protected from unauthorized access. You can trust airSlate SignNow to handle your documents securely.

Get more for Instructions For Form FTB 3588 Payment Voucher For LLC E filed Returns

Find out other Instructions For Form FTB 3588 Payment Voucher For LLC E filed Returns

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors