Tax School Brochure PDF CALT Center for Agricultural Law Calt Iastate Form

Understanding the Tax School Brochure PDF from CALT

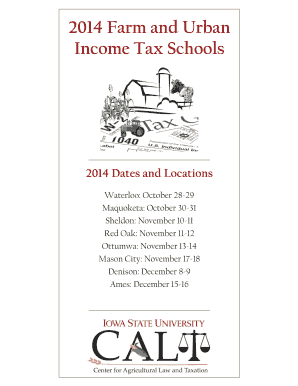

The Tax School Brochure PDF from the Center for Agricultural Law and Taxation (CALT) at Iowa State University serves as a comprehensive resource for individuals seeking information on agricultural law and tax issues. This document outlines various educational opportunities, including workshops and seminars designed to enhance understanding of tax regulations affecting agricultural producers. It provides essential details on the curriculum, instructors, and the benefits of participating in these educational programs.

Steps to Complete the Tax School Brochure PDF

Completing the Tax School Brochure PDF requires careful attention to detail to ensure all necessary information is provided. Start by reviewing the document thoroughly to understand the sections that need to be filled out. Gather relevant personal and business information, such as your tax identification number, contact details, and any specific tax-related queries you may have. Once you have completed the form, ensure it is signed and dated appropriately to validate your submission.

Legal Use of the Tax School Brochure PDF

The Tax School Brochure PDF is legally recognized as a valid document when completed and submitted according to the guidelines set forth by CALT. To ensure its legal standing, it must be filled out accurately and signed by the appropriate parties. The use of electronic signatures is permissible, provided that the signing process complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This ensures that the document holds up in legal contexts.

Key Elements of the Tax School Brochure PDF

Several key elements make up the Tax School Brochure PDF. These include:

- Program Overview: A summary of the educational offerings related to agricultural law and tax.

- Registration Information: Details on how to register for the programs, including deadlines and fees.

- Contact Information: Essential contacts for inquiries and support regarding the programs.

- Curriculum Details: An outline of topics covered, including tax planning, compliance, and legal considerations specific to agriculture.

Obtaining the Tax School Brochure PDF

To obtain the Tax School Brochure PDF, individuals can visit the CALT website or contact their office directly for a copy. The brochure is typically available for download in a PDF format, allowing for easy access and distribution. Ensure that you have the latest version to receive the most accurate and relevant information regarding upcoming programs and offerings.

Examples of Using the Tax School Brochure PDF

The Tax School Brochure PDF can be utilized in various scenarios, such as:

- Educational Institutions: Professors and educators can use the brochure as a resource for curriculum development in agricultural law courses.

- Tax Professionals: Accountants and tax advisors may refer to the brochure to stay informed about the latest tax regulations affecting agricultural clients.

- Farmers and Producers: Individuals in the agricultural sector can use the brochure to identify workshops that enhance their understanding of tax responsibilities and legal rights.

Quick guide on how to complete tax school brochure pdf calt center for agricultural law calt iastate

Effortlessly Prepare Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without hassle. Manage Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate effortlessly on any device with the airSlate SignNow applications for Android or iOS, and simplify your document-related tasks today.

How to Edit and eSign Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate Effortlessly

- Find Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to store your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax school brochure pdf calt center for agricultural law calt iastate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is calt tax school?

Calt tax school is an educational program designed to teach individuals about tax laws and regulations. It provides comprehensive training that covers various aspects of taxation, making it ideal for professionals seeking to enhance their skills in tax compliance and planning.

-

How can calt tax school benefit my business?

Calt tax school equips your team with essential tax knowledge that can lead to better tax management and compliance within your business. By understanding the intricacies of tax regulations, your organization can minimize liabilities and improve overall financial strategies.

-

What features does the calt tax school curriculum include?

The calt tax school curriculum includes modules on tax preparation, filing processes, and compliance updates. Additional features, such as hands-on workshops and expert-led sessions, ensure that participants gain practical experience alongside theoretical knowledge.

-

What is the pricing structure for calt tax school?

Calt tax school offers a variety of pricing options to accommodate different needs and budgets. Whether you choose a one-time course or a subscription model for ongoing learning, you can find a plan that aligns with your business's financial goals.

-

Are there any prerequisites for enrolling in calt tax school?

While there are no strict prerequisites for enrolling in calt tax school, having a basic understanding of tax principles can be beneficial. This ensures that all participants can maximize their learning experience and fully engage with the curriculum offered.

-

Can businesses integrate calt tax school training into their existing programs?

Yes, businesses can seamlessly integrate calt tax school training into their current employee development programs. This flexibility allows organizations to tailor learning experiences to meet their specific needs and enhance their team's competencies.

-

What support is available after completing calt tax school?

After completing calt tax school, participants have access to a network of professionals and resources for ongoing support. Alumni can benefit from continuous education opportunities and updates on changes in tax legislation, ensuring they stay informed.

Get more for Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate

Find out other Tax School Brochure pdf CALT Center For Agricultural Law Calt Iastate

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online