Prepayment Penalty Clause Form

What is the prepayment penalty clause

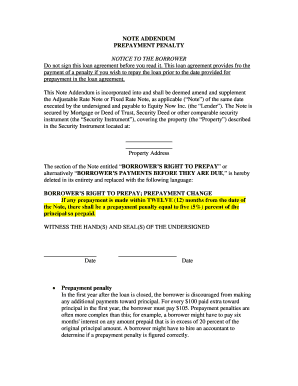

The prepayment penalty clause is a provision in a loan agreement that imposes a fee on borrowers who pay off their loans early. This clause is designed to protect lenders from the potential loss of interest income that results when a borrower pays off a loan before the scheduled maturity date. The penalty can vary based on the terms of the loan and may be a flat fee or a percentage of the remaining balance. Understanding this clause is crucial for borrowers, as it can significantly affect the overall cost of borrowing.

Key elements of the prepayment penalty clause

Several key elements define a prepayment penalty clause. These include:

- Duration: The time frame during which the penalty applies, often specified in years.

- Amount: The specific fee or percentage that will be charged if the borrower pays off the loan early.

- Conditions: Any conditions under which the penalty may be waived, such as refinancing or selling the property.

- Disclosure: Requirements for lenders to disclose the existence and terms of the penalty clause to borrowers before finalizing the loan agreement.

How to use the prepayment penalty clause

Using the prepayment penalty clause effectively involves understanding its implications before signing a loan agreement. Borrowers should:

- Review the terms carefully to know when and how the penalty applies.

- Consider their financial situation and potential for early repayment.

- Negotiate the terms if possible, especially if they anticipate making extra payments or paying off the loan early.

By being informed, borrowers can make better decisions regarding their loan agreements and avoid unexpected costs.

Steps to complete the prepayment penalty clause

Completing the prepayment penalty clause requires careful attention to detail. Here are the steps to follow:

- Read the loan agreement: Understand the full context of the clause within the agreement.

- Identify the penalty terms: Locate the specific terms related to the prepayment penalty.

- Consult with a financial advisor: Seek professional advice to understand the implications of the clause.

- Sign the agreement: Once you are comfortable with the terms, proceed to sign the document.

Legal use of the prepayment penalty clause

The legal use of a prepayment penalty clause is governed by state laws and regulations. In many jurisdictions, lenders are required to disclose the existence of such clauses clearly. Additionally, some states impose restrictions on the amount that can be charged as a penalty. It is essential for borrowers to familiarize themselves with their state's laws regarding prepayment penalties to ensure compliance and protect their rights.

Examples of using the prepayment penalty clause

Examples of how a prepayment penalty clause might be applied include:

- A borrower who pays off a mortgage loan three years before maturity may incur a penalty of two percent of the remaining balance.

- If a borrower refinances their loan within the penalty period, they may face a fee outlined in the original loan agreement.

These examples illustrate how the clause can impact financial decisions and the overall cost of borrowing.

Quick guide on how to complete prepayment penalty clause

Complete Prepayment Penalty Clause effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Prepayment Penalty Clause on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Prepayment Penalty Clause with ease

- Locate Prepayment Penalty Clause and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Annotate key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Prepayment Penalty Clause and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prepayment penalty clause

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a penalty clause example in a contract?

A penalty clause example refers to specific terms outlined in a contract that penalize a party for failing to meet agreed-upon conditions. This can include monetary fines or other punitive measures. Understanding a penalty clause example is crucial for businesses to ensure compliance and avoid unnecessary costs.

-

How can airSlate SignNow help with penalty clause examples?

airSlate SignNow simplifies the process of creating and managing documents that include penalty clauses. With our easy-to-use interface, you can quickly draft contracts with clear penalty clause examples, ensuring all parties understand their obligations. This reduces the risk of disputes and enhances compliance.

-

Is there a cost associated with using airSlate SignNow for penalty clause documents?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including the creation of documents with penalty clause examples. Each plan provides access to essential features, but the cost varies depending on the functionalities you require. Explore our pricing options to find the best plan for your business.

-

Can I customize penalty clause examples in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize penalty clause examples to suit your specific needs. You can edit clauses, add specific terms, and ensure that the language reflects the agreement accurately, providing greater flexibility in contract management.

-

What features of airSlate SignNow support penalty clause examples?

airSlate SignNow offers features such as customizable templates, easy eSigning, and secure document storage, which are essential for managing penalty clause examples. These features help streamline the contract process and ensure that your documents are compliant and readily accessible for future reference.

-

Does integrating airSlate SignNow enhance my use of penalty clause examples?

Integrating airSlate SignNow with your existing systems enhances how you manage penalty clause examples within contracts. It allows for seamless workflows, reduced manual entry, and efficient tracking of document statuses, making it easier to maintain compliance and reduce potential disputes.

-

What are the benefits of using penalty clause examples in business contracts?

Using penalty clause examples in business contracts ensures clarity and deters non-compliance, ultimately protecting your interests. These clauses clearly outline the consequences for failing to meet contractual obligations, helping to mitigate risks and maintain strong business relationships.

Get more for Prepayment Penalty Clause

- Enclosed herewith please find form

- Sample letter delivery lead time form

- I5 delivery address line postal explorer uspscom form

- In the county court of form

- Enclosed herewith please find the original complaint for claim and delivery which we form

- Enclosed herewith please find a copy of the order setting a hearing on the original form

- State of idaho idaho legislature form

- Enclosed herewith please find a letter which i received from the attorney representing form

Find out other Prepayment Penalty Clause

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple