Declaration under Section 197a1 Form

What is the Declaration Under Section 197a1

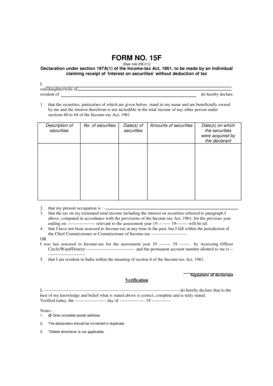

The declaration under section 197a1 is a formal document used primarily for tax purposes, allowing individuals or entities to claim exemption from withholding tax on certain types of income. This declaration is particularly relevant for non-resident taxpayers who receive income from sources within the United States. By submitting this form, taxpayers can assert their eligibility for reduced tax rates or exemptions as stipulated in applicable tax treaties.

Key Elements of the Declaration Under Section 197a1

Understanding the key elements of the declaration under section 197a1 is essential for proper completion. The form typically requires the following information:

- Taxpayer Identification: The name, address, and taxpayer identification number of the individual or entity submitting the declaration.

- Income Type: A clear description of the type of income for which the exemption is being claimed.

- Tax Treaty Reference: Identification of the relevant tax treaty provisions that justify the claim for exemption.

- Signature: The declaration must be signed by the taxpayer or an authorized representative to validate the claim.

Steps to Complete the Declaration Under Section 197a1

Completing the declaration under section 197a1 involves several straightforward steps:

- Gather necessary information, including personal identification and details about the income source.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy and completeness to avoid delays or rejections.

- Sign the declaration to confirm that all provided information is true and correct.

- Submit the completed form to the appropriate tax authority or entity requesting the declaration.

Legal Use of the Declaration Under Section 197a1

The legal use of the declaration under section 197a1 is governed by various tax laws and regulations. It is crucial to ensure that the form is used in compliance with the Internal Revenue Service (IRS) guidelines. The declaration serves as a formal assertion of the taxpayer's eligibility for tax exemptions, and improper use may lead to penalties or legal repercussions. Therefore, taxpayers should familiarize themselves with the relevant laws and ensure that all claims made in the declaration are substantiated by appropriate documentation.

Filing Deadlines / Important Dates

Filing deadlines for the declaration under section 197a1 can vary based on the type of income and the specific tax year. Generally, it is advisable to submit the declaration prior to the payment of income to ensure that withholding tax is not deducted. Taxpayers should be aware of any specific deadlines set by the IRS or other relevant tax authorities to avoid penalties. Keeping track of important dates can help ensure timely compliance with tax obligations.

Required Documents

When preparing to submit the declaration under section 197a1, certain documents may be required to support the claim. These documents can include:

- Taxpayer Identification: A copy of the taxpayer's identification, such as a Social Security number or Employer Identification Number.

- Income Documentation: Proof of the income source, such as contracts or payment agreements.

- Tax Treaty Documentation: Any relevant documents that outline the provisions of tax treaties applicable to the taxpayer.

Quick guide on how to complete declaration under section 197a1

Complete Declaration Under Section 197a1 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Declaration Under Section 197a1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and eSign Declaration Under Section 197a1 without hassle

- Find Declaration Under Section 197a1 and then click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Declaration Under Section 197a1 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the declaration under section 197a1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the declaration under section 197a1?

The declaration under section 197a1 is a formal statement that allows taxpayers to provide details required to claim certain tax benefits. It is especially crucial for ensuring proper tax treatment for applicable transactions. By understanding this declaration, businesses can optimize their tax filing strategy.

-

How can airSlate SignNow assist with creating a declaration under section 197a1?

airSlate SignNow simplifies the process of creating a declaration under section 197a1 by providing customizable templates and an intuitive signing interface. Users can easily fill out essential fields and capture electronic signatures in a secure environment. This streamlines the process and ensures compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, ensuring that access to tools for handling declarations under section 197a1 is affordable. Each plan provides essential features designed to enhance productivity and document management capabilities. For detailed pricing information, visit our website to explore your options.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes robust features for document management, such as automated workflows, customizable templates, and real-time tracking. These tools not only facilitate the creation of a declaration under section 197a1 but also enhance collaboration among teams. Users can ensure documents are processed quickly and efficiently.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, making it easier to manage the declaration under section 197a1 alongside other business processes. This seamless integration helps users maintain organization and consistency across different platforms, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like the declaration under section 197a1 provides numerous benefits, including improved accuracy and reduced processing time. The platform ensures secure storage and easy access to essential documents during tax season. This allows businesses to focus more on their core activities and less on paperwork.

-

Is airSlate SignNow compliant with legal and regulatory standards?

Yes, airSlate SignNow is designed to comply with relevant legal and regulatory standards, ensuring that documents, including the declaration under section 197a1, are managed securely. Our platform adheres to industry standards for electronic signatures, giving users confidence that their documents are both valid and secure. We prioritize data protection to safeguard your information.

Get more for Declaration Under Section 197a1

- 125 printable temporary guardianship agreement forms and

- This worksheet may be used to collect the information to be reported on the certificate of divorce or annulment or through the

- Motion for use and occupancy payments and objection form

- Jd ac 8 rev form

- Fw 003 gc order on court fee waiver judicial council forms

- Fillable online courts ca order on court fee waiver after form

- Personal data sheet new hampshire judicial branch fill form

- District court county fill and sign printable template form

Find out other Declaration Under Section 197a1

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document