Az Form 5013

What is the Az Form 5013

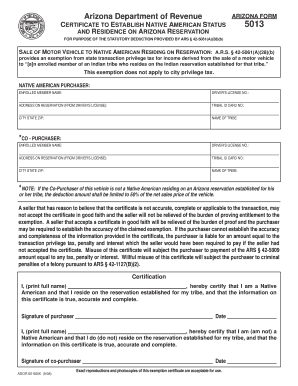

The Az Form 5013, also known as the native american tax exemption form, is a document used by eligible Native American individuals and tribes in Arizona to claim tax exemptions. This form allows qualified applicants to assert their status for tax purposes, ensuring they receive the benefits entitled to them under federal and state laws. Understanding the purpose and implications of this form is crucial for those who qualify, as it plays a significant role in tax compliance and financial planning.

How to use the Az Form 5013

Using the Az Form 5013 involves several key steps. First, ensure you meet the eligibility criteria, which typically includes being a member of a federally recognized tribe. Next, complete the form accurately, providing all necessary information, such as your tribal affiliation and personal identification details. Once completed, submit the form to the appropriate tax authority to process your exemption claim. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form securely.

Steps to complete the Az Form 5013

Completing the Az Form 5013 requires attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, including proof of tribal membership and identification.

- Access the form through your preferred method, whether online or via a physical copy.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Sign the form digitally or in ink, depending on your submission method.

- Submit the form to the relevant tax authority, keeping a copy for your records.

Legal use of the Az Form 5013

The Az Form 5013 is legally recognized when completed and submitted in accordance with applicable laws. It is essential to adhere to the guidelines set forth by the IRS and state tax authorities to ensure the form is valid. This includes providing accurate information and supporting documentation. Using reliable digital platforms can enhance the legal standing of your submission by ensuring compliance with eSignature laws and maintaining a secure record of your transaction.

Eligibility Criteria

To qualify for the Az Form 5013, applicants must meet specific eligibility criteria. Generally, this includes being a member of a federally recognized Native American tribe and providing proof of tribal affiliation. Additionally, applicants should be aware of any state-specific requirements that may apply. Understanding these criteria is vital for ensuring that your application is valid and that you receive the tax benefits for which you are eligible.

Form Submission Methods

The Az Form 5013 can be submitted through various methods, offering flexibility to applicants. Options typically include:

- Online submission through authorized platforms that support secure eSignatures.

- Mailing a physical copy to the appropriate tax authority.

- In-person submission at designated tax offices, if applicable.

Choosing the right submission method can impact the speed and efficiency of processing your exemption claim.

Quick guide on how to complete az form 5013

Complete Az Form 5013 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without obstacles. Manage Az Form 5013 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Az Form 5013 effortlessly

- Find Az Form 5013 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Az Form 5013 while ensuring clear communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az form 5013

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 5013 form?

The 5013 form is a crucial document used by nonprofit organizations to apply for tax-exempt status under the IRS guidelines. Understanding how to properly fill out the 5013 form is vital for ensuring compliance and eligibility for tax benefits. airSlate SignNow simplifies the process by allowing users to eSign and securely send the 5013 form.

-

How does airSlate SignNow help with the 5013 form?

airSlate SignNow provides an easy-to-use platform that allows businesses to create, send, and eSign the 5013 form digitally. With user-friendly templates and a streamlined process, airSlate SignNow helps organizations save time and reduce errors in their submissions. This ensures that your 5013 form is processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for the 5013 form?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Users can choose a plan that best fits their needs, whether they just need to eSign a 5013 form or require advanced features for document management. The cost-effective solution ensures that managing your 5013 form remains budget-friendly.

-

Can I integrate other tools with airSlate SignNow for the 5013 form?

Absolutely! airSlate SignNow integrates seamlessly with various business tools, allowing you to enhance your workflow when managing the 5013 form. Whether it’s CRM systems, document storage services, or project management apps, these integrations will help you streamline document handling and collaboration.

-

What are the benefits of using airSlate SignNow for the 5013 form?

Using airSlate SignNow for the 5013 form offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced security for sensitive information. The platform's ability to track document status and send reminders also ensures timely completion and submission of the 5013 form. This helps organizations focus more on their mission rather than paperwork.

-

Is it easy to eSign the 5013 form with airSlate SignNow?

Yes, eSigning the 5013 form with airSlate SignNow is incredibly straightforward. Users can electronically sign documents quickly and securely from any device, making it easier to manage signatures without the hassle of printing and scanning. This convenience ensures that your 5013 form is signed and submitted with minimal effort.

-

How secure is airSlate SignNow for handling my 5013 form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect your 5013 form and all related documentation, ensuring that sensitive information remains confidential. This commitment to security gives organizations peace of mind while handling important documents.

Get more for Az Form 5013

- Reviewed the petition to transfer guardianship from the state of delaware to the state of form

- And affidavit of proper use form

- Be it remembered that on this date form

- Form 520a

- Title 10 courts and judicial procedure form

- Basic divorce packet 1 forms

- Prenuptial agreement attorneysnewark delaware de form

- A proceeding involving the above captioned case having been previously filed in this form

Find out other Az Form 5013

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document