Ma Form 355 7004

What is the MA Form

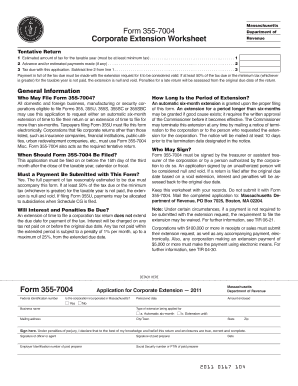

The MA Form is a tax-related document used by businesses in Massachusetts to request an automatic extension of time to file their corporate excise tax returns. This form is crucial for corporations that need additional time to gather necessary financial information or complete their tax filings accurately. By submitting Form, businesses can avoid late filing penalties while ensuring compliance with state tax regulations.

How to use the MA Form

Using the MA Form involves several straightforward steps. First, ensure that your business is eligible for an extension by reviewing the criteria set forth by the Massachusetts Department of Revenue. Next, accurately fill out the form, providing all required information, including your business name, address, and tax identification number. After completing the form, submit it by the due date to avoid penalties. It's important to retain a copy of the submitted form for your records.

Steps to complete the MA Form

Completing the MA Form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including your previous year’s tax return and current financial statements.

- Fill in your business information, including the name, address, and federal employer identification number (FEIN).

- Indicate the type of extension you are requesting and the tax year for which the extension applies.

- Sign and date the form to certify that the information provided is accurate.

- Submit the form electronically or via mail to the Massachusetts Department of Revenue by the deadline.

Legal use of the MA Form

The legal use of the MA Form ensures that businesses comply with Massachusetts tax laws. By submitting this form, corporations can receive an automatic extension for filing their tax returns without incurring penalties. However, it is essential to understand that while this form grants an extension for filing, it does not extend the time to pay any taxes owed. Businesses must still estimate and pay their tax liability by the original due date to avoid interest and penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the MA Form is crucial for compliance. The form must be submitted by the original due date of the corporate excise tax return, which is typically the fifteenth day of the third month following the end of the tax year. For corporations operating on a calendar year, this generally means the deadline is March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Required Documents

When preparing to file the MA Form, businesses should have several key documents ready. These include:

- Previous year’s corporate tax return for reference.

- Current financial statements, including balance sheets and income statements.

- Any relevant correspondence from the Massachusetts Department of Revenue.

- Records of estimated tax payments made during the year.

Quick guide on how to complete ma form 355 7004

Effortlessly prepare Ma Form 355 7004 on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Ma Form 355 7004 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Ma Form 355 7004 with ease

- Find Ma Form 355 7004 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal authority as a traditional handwritten signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Ma Form 355 7004 to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ma form 355 7004

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it utilize 355 7004?

airSlate SignNow is a comprehensive eSignature solution that empowers businesses to send, sign, and manage documents electronically. By integrating features like 355 7004, users can access a user-friendly interface and streamline their document workflow, improving efficiency and reducing turnaround time.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the subscription plan, but it offers cost-effective solutions tailored for different business needs. Customers can take advantage of the features offered along with the 355 7004 module to ensure a high return on investment.

-

What features are included in airSlate SignNow?

airSlate SignNow provides a range of features such as electronic signatures, document templates, and automated workflows. The integration of features like 355 7004 enhances document tracking and collaboration, making it easier for businesses to manage their agreements.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow allows businesses to save time and money by simplifying the document signing process. The inclusion of tools like 355 7004 ensures that users can easily manage their eSignature needs, leading to faster business transactions and increased productivity.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various third-party applications, which can be easily connected to enhance functionality. With features like 355 7004, users can synchronize with popular tools to create a seamless workflow that fits their business model.

-

Is airSlate SignNow secure?

Absolutely, airSlate SignNow prioritizes security with industry-standard encryption and compliance with regulations like HIPAA. This ensures that your documents are safely handled, providing peace of mind when using functionalities tied to 355 7004.

-

How can I try airSlate SignNow?

You can start with a free trial of airSlate SignNow to explore its capabilities and features. During the trial, you will get a firsthand experience of tools like 355 7004, helping you determine if it's the right solution for your business needs.

Get more for Ma Form 355 7004

- D r a f t district of north dakota united states courts form

- Letter of no objection request charlotte county form

- Order of name change north dakota supreme court form

- North dakota fixed rate note installment payments unsecured form

- Guide to financing the community supported farm new form

- North dakota fixed rate note installment payments secured by personal property form

- North dakota fixed rate note installment payments secured commercial property form

- Names of individuals making statement form

Find out other Ma Form 355 7004

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now