LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az Form

What is the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az?

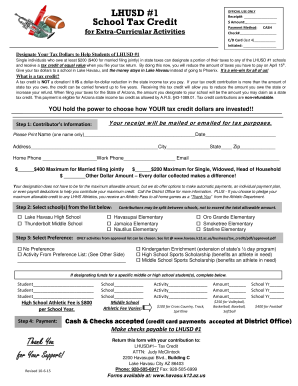

The LHUSD #1 School Tax Credit is a financial incentive designed to support the Lake Havasu Unified School District in Arizona. This tax credit allows taxpayers to contribute to extracurricular activities and programs within the district while receiving a dollar-for-dollar credit on their state income taxes. The credit is available to individuals and couples who file their taxes in Arizona, making it a beneficial option for those looking to support local education while reducing their tax liability.

How to obtain the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

To obtain the LHUSD #1 School Tax Credit, taxpayers must first ensure they meet the eligibility criteria set by the state of Arizona. This includes being a resident and filing a state income tax return. Once eligibility is confirmed, individuals can make contributions directly to the school district or its approved programs. It is essential to keep records of these contributions, as they will be needed when filing taxes to claim the credit.

Steps to complete the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

Completing the LHUSD #1 School Tax Credit involves several key steps:

- Verify eligibility by ensuring you are a resident of Arizona and file a state income tax return.

- Make a qualifying contribution to the Lake Havasu Unified School District or an approved extracurricular program.

- Collect documentation of your contribution, which may include receipts or acknowledgment letters from the school district.

- When filing your state income tax return, complete the appropriate forms to claim the tax credit, ensuring you include the amount contributed.

Key elements of the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

Key elements of the LHUSD #1 School Tax Credit include:

- The credit amount can reach up to $200 for individuals and $400 for couples filing jointly.

- Contributions must be made to extracurricular activities, which can include sports, arts, and other school programs.

- The credit is applicable only to state income taxes, not federal taxes.

- Taxpayers can carry forward unused credits to future tax years, subject to state regulations.

Eligibility Criteria for the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

Eligibility for the LHUSD #1 School Tax Credit requires that taxpayers meet specific criteria:

- Must be a resident of Arizona.

- Must file a state income tax return.

- Contributions must be made to an approved school or program within the Lake Havasu Unified School District.

Legal use of the LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

The legal use of the LHUSD #1 School Tax Credit is governed by Arizona state law. Taxpayers must adhere to the guidelines set forth by the Arizona Department of Revenue to ensure their contributions qualify for the credit. This includes making contributions to designated programs and maintaining proper documentation to support the claim on their tax returns. Non-compliance with these regulations may result in penalties or disqualification from claiming the credit.

Quick guide on how to complete lhusd 1 school tax credit lake havasu unified school district havasu k12 az

Effortlessly Prepare LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and physically signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Manage LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Edit and Electronically Sign LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az Seamlessly

- Obtain LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, such as email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lhusd 1 school tax credit lake havasu unified school district havasu k12 az

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the LHUSD #1 School Tax Credit for Lake Havasu Unified School District?

The LHUSD #1 School Tax Credit for Lake Havasu Unified School District helps support educational programs and activities by allowing Arizona taxpayers to contribute to local schools. This credit encourages community involvement and provides financial assistance to children in Havasu K12 Az.

-

How can I maximize my benefits using the LHUSD #1 School Tax Credit in Havasu K12 Az?

To maximize your benefits with the LHUSD #1 School Tax Credit, it’s advisable to donate up to the maximum allowable amount, which can directly reduce your state tax liability. Make sure to keep records of your donations to ensure compliance and maximize your benefits.

-

Who is eligible to donate towards the LHUSD #1 School Tax Credit in Lake Havasu?

Any Arizona taxpayer can donate towards the LHUSD #1 School Tax Credit for Lake Havasu Unified School District. This includes individuals and married couples who file taxes in Arizona, making it a great opportunity for community support.

-

What are the features of the airSlate SignNow solution in relation to handling school tax credits?

The airSlate SignNow solution offers an intuitive eSigning platform that allows easy submission and management of necessary documents related to the LHUSD #1 School Tax Credit. This streamlines processes and ensures compliance with state requirements for donations.

-

What benefits does the LHUSD #1 School Tax Credit provide to students in Havasu K12 Az?

The LHUSD #1 School Tax Credit directly benefits students by funding extracurricular activities, arts programs, and other essential school services. These enhancements contribute to a well-rounded educational experience for all children in Lake Havasu Unified School District.

-

Are there any fees associated with the LHUSD #1 School Tax Credit donations?

No, there are no additional fees associated with the LHUSD #1 School Tax Credit donations; the full amount of your contribution can be claimed on your tax return. This makes it a cost-effective way to support local education in Lake Havasu.

-

How can I integrate the airSlate SignNow platform for my school tax credit donations?

Integrating the airSlate SignNow platform for your LHUSD #1 School Tax Credit donations is simple. Our platform allows for smooth eSigning of forms and documents, ensuring that your contributions are processed swiftly and efficiently for Lake Havasu Unified School District.

Get more for LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

Find out other LHUSD #1 School Tax Credit Lake Havasu Unified School District Havasu K12 Az

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free