Attach to Form 1040, Form 1040NR, or Form 1040 T

What is the Attach To Form 1040, Form 1040NR, Or Form 1040 T

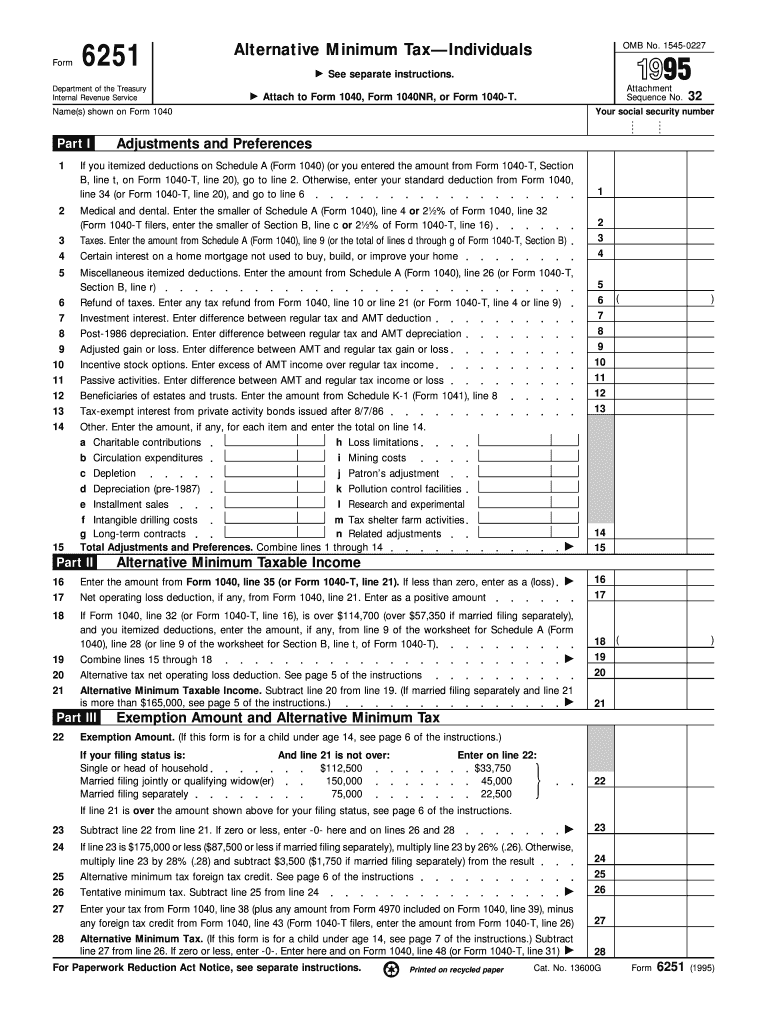

The Attach To Form 1040, Form 1040NR, or Form 1040 T is essential for taxpayers who need to report additional information alongside their primary tax return. This form allows for the inclusion of various schedules and attachments that provide a detailed account of income, deductions, and credits. Understanding the purpose of this form is crucial for ensuring accurate tax reporting and compliance with IRS regulations.

Steps to complete the Attach To Form 1040, Form 1040NR, Or Form 1040 T

Completing the Attach To Form 1040, Form 1040NR, or Form 1040 T involves several steps. First, gather all necessary documentation, including W-2s, 1099s, and any other relevant financial records. Next, fill out the primary tax return form accurately before moving on to the attachments. Ensure that each attachment is clearly labeled and corresponds to the correct section of the primary form. Finally, review all entries for accuracy and completeness before submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Attach To Form 1040, Form 1040NR, or Form 1040 T. Taxpayers must ensure that all forms are filled out in accordance with IRS instructions to avoid penalties. This includes adhering to deadlines for submission and ensuring that all required attachments are included. Familiarity with IRS guidelines can help taxpayers navigate the complexities of tax filing and ensure compliance.

Required Documents

To successfully complete the Attach To Form 1040, Form 1040NR, or Form 1040 T, certain documents are required. These typically include income statements such as W-2s and 1099s, documentation for deductions like mortgage interest statements, and any relevant receipts for credits. Having these documents organized and readily available can streamline the process and reduce the risk of errors in the tax return.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Attach To Form 1040, Form 1040NR, or Form 1040 T. Forms can be submitted online through the IRS e-file system, which is often the fastest method. Alternatively, taxpayers may choose to mail their forms to the appropriate IRS address based on their location and the type of form being submitted. In-person submission is also an option at designated IRS offices, although this may require an appointment.

Penalties for Non-Compliance

Failing to comply with the requirements for the Attach To Form 1040, Form 1040NR, or Form 1040 T can result in penalties. These may include fines for late submissions, interest on unpaid taxes, and potential audits. Understanding the implications of non-compliance emphasizes the importance of accurate and timely filing, ensuring that all necessary forms and attachments are included.

Quick guide on how to complete attach to form 1040 form 1040nr or form 1040 t

Complete Attach To Form 1040, Form 1040NR, Or Form 1040 T effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Attach To Form 1040, Form 1040NR, Or Form 1040 T on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Attach To Form 1040, Form 1040NR, Or Form 1040 T without any hassle

- Obtain Attach To Form 1040, Form 1040NR, Or Form 1040 T and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Attach To Form 1040, Form 1040NR, Or Form 1040 T and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I determine the tax form to be filed -1040 or 1040NR?

Greeting !!!The Substantial Presence Test and Definition of Exempt IndividualTo meet the substantial presence test, you must be physically present in the U.S. during a period you do not hold an A, F, G, J, M or Q visa on at least:31 days during the current year, and183 days during the 3-year period that includes the current year and the previous two years, counting:all of the days you were present in the current year, and1/3 of the days you were present in the first preceding year, and1/6 of the days you were present in the second preceding year.Exempt IndividualsAn exempt individual is someone whose days in the United States are not counted toward the substantial presence test, not someone who is exempt from tax. If you are an exempt individual, you are a nonresident alien until you are no longer an exempt individual, or until you receive permanent residency status. You are generally in this category if you are:An individual temporarily present in the United States as a foreign government related individual (A or G visa holder).A teacher or trainee temporarily present in the United States under a J or Q visa, who substantially complies with the requirements of the visa.A student temporarily present in the United States under an F, J, M or Q visa, who substantially complies with the requirements of the visa.A professional athlete temporarily in the United States to compete in a charitable sports evenIf above Condition is satisfied then you are Resident and you need to file 1040 other wise 1040NR.non resident files a special tax form (Form 1040NR), pays tax only on U.S. source income, is subject to special rates, and might qualify for treaty exemptions. Conversely, if you are a resident for U.S. tax purposes, you are generally under the same rules and file the same forms as a U.S. citizen. That means you report your worldwide income rather than just U.S. source income.Be Peaceful !!!

-

Which form do I need to file for US returns, 1040 or 1040NR?

Under the substantial presence test you qualify as a resident alien for tax year 2014. You take all of your days of presence in a nonexempt status in 2014, 1/3 of your days of presence in 2013, and 1/6 of your days of presence in 2012. Assuming you were on H1B (a nonexempt status) the entire time, that total is easily more than 183 days.If you have given up your US residence - which it appears that you have - then you can file as a dual-status alien for 2014. Because you are a nonresident alien as of the last day of 2014, you file Form 1040NR with Form 1040 or a similar statement attached showing your income during the portion of the year that you were a US resident. See http://www.irs.gov/Individuals/I... for more information.

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

Do I need to attach the tax form 1099-B to the form 1040 Schedule D?

This sort of question should be resolved by looking at the IRS’ official instructions for the tax form and year in question. You only need to attach such items as the IRS’ official instructions direct you to attach. Recently there has been a trend of requiring fewer attachments.For the sake of answering this specific question for this specific year, there appears to be no such requirement. The Form 1099-B was already reported to the IRS and the Schedule D instructions make no mention of attaching it. You may need to attach a “statement required under Regulations section 1.1(h)-1(e).” Id. lines 10 and 18.For actual advice on filling in your forms, consult a tax attorney or accountant.

-

Which TIN should I use to file my 1040NR form: my ITIN or my LLC's EIN?

The difference is described below between the ITIN and EIN:Every business entity is required to obtain EIN to file business taxes.Every individual must either have a Social Security Number or ITIN to file an income tax return.In your case;You will file both EIN and ITIN. The ITIN will be used on form 1040 and EIN will be used on the schedule C, E or however you are reporting the income.

-

I was on an F1 visa until Sep 30, 2014. From then on, I was on an H1. Which tax form do I use: 1040 or 1040NR?

Days on F1 are not exempt from the Substantial Presence Test if you have already been an exempt individual for any part of 5 previous calendar years. Basically, this means that if this is the first time you've been to the U.S. on F1 or J1, etc., then if you came on F1 in year 2009 or before, then you're a resident alien for all of 2014. If you came on F1 in year 2010 or after, then you're a nonresident alien for all of 2014 (because days on H1b after October 1 are not enough to satisfy the Substantial Presence Test). If you fall into the latter category (nonresident) and you are married, there is a way you can become a resident for all of 2014, if you wish, by using the First-Year Choice.

-

Can I file a claim with TurboTax for filing the wrong form for me? Instead of filling the 1040NR form in 2015 and 2016, TurboTax filled 1040 for me instead. Now I need to file for an amendment, which will cost $1200.

Sure you can. Pretty much any one can sue for anything. You have a snowballs chance in hell of winning though. Go back and read the disclaimer-terms of use that you just accepted without reading on installing it.You’ll notice that they bear NO responsibility for incorrect taxes.Besides it was your failure to pick the correct product. Turbo tax does not and has NEVER produced a 1040NR product.As my old Computer Science professors used to say. GIGO - Garbage In Garbage Out.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

Create this form in 5 minutes!

How to create an eSignature for the attach to form 1040 form 1040nr or form 1040 t

How to make an eSignature for the Attach To Form 1040 Form 1040nr Or Form 1040 T in the online mode

How to make an electronic signature for your Attach To Form 1040 Form 1040nr Or Form 1040 T in Google Chrome

How to create an eSignature for putting it on the Attach To Form 1040 Form 1040nr Or Form 1040 T in Gmail

How to create an electronic signature for the Attach To Form 1040 Form 1040nr Or Form 1040 T straight from your smartphone

How to make an electronic signature for the Attach To Form 1040 Form 1040nr Or Form 1040 T on iOS devices

How to make an eSignature for the Attach To Form 1040 Form 1040nr Or Form 1040 T on Android devices

People also ask

-

What is the 1040nr form and why do I need it?

The 1040nr form is designed for non-resident aliens in the United States to report their income and tax obligations. If you earn income in the U.S. as a non-resident, it's essential to file this form to avoid penalties and ensure compliance with tax regulations.

-

How can airSlate SignNow help with my 1040nr filing?

airSlate SignNow simplifies the process of preparing and submitting your 1040nr by allowing you to securely sign and send important tax documents online. This saves you time and provides a cost-effective solution to manage your tax paperwork efficiently.

-

What features does airSlate SignNow offer for 1040nr documents?

airSlate SignNow offers features like electronic signatures, document tracking, and secure cloud storage, ensuring that your 1040nr documents are handled with the utmost security and ease. With these tools, you can streamline your tax filing process without any hassle.

-

Is there a pricing plan for airSlate SignNow that caters to 1040nr filers?

Yes, airSlate SignNow provides flexible pricing plans suitable for individuals and businesses. You can choose a plan based on your specific needs, making it a cost-effective option for efficiently managing your 1040nr submissions and other document requirements.

-

Are there integrations available for airSlate SignNow when filing 1040nr?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and Microsoft Office, which facilitates easier access and management of documents related to your 1040nr. These integrations enhance your productivity by streamlining your workflow.

-

How secure is airSlate SignNow for handling my 1040nr information?

airSlate SignNow prioritizes the security of your documents, employing encryption and advanced security protocols. When handling your 1040nr information, you can trust that your data is safe from unauthorized access and is protected throughout the signing process.

-

Can I access airSlate SignNow on mobile devices for my 1040nr?

Yes, airSlate SignNow is fully optimized for mobile use, allowing you to access, sign, and send your 1040nr documents from anywhere. Whether you're on the go or working from home, you can manage your tax documents conveniently from your smartphone or tablet.

Get more for Attach To Form 1040, Form 1040NR, Or Form 1040 T

- 3165 application for an on site brewery retail store authorization agco on form

- Attendance referral form

- Under 18 consent form fce cae cpe british council

- Unit5 a quiz name teacher scoring section date listen to alan and debbie talk about shoplifting form

- Tn form rv f1306901

- Ibew 369 benefits form

- Childrens emergency consent form legacy health legacyhealth

- Missouri occupational card sort form

Find out other Attach To Form 1040, Form 1040NR, Or Form 1040 T

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template