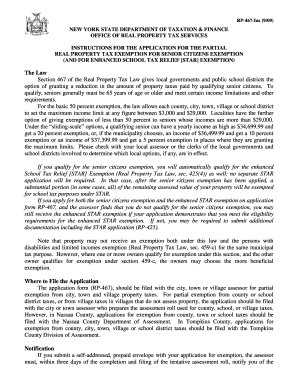

Rp 467 Form

What is the Rp 467

The Rp 467 form is a specific document used primarily in the United States for various administrative and legal purposes. It serves as a formal request or declaration, often required by governmental agencies or organizations for compliance and record-keeping. Understanding the purpose and requirements of the Rp 467 is crucial for individuals and businesses to ensure proper handling of their documentation.

How to use the Rp 467

Using the Rp 467 form involves several steps to ensure that it is filled out correctly and submitted appropriately. First, gather all necessary information and documents that pertain to the form's requirements. Next, carefully complete each section of the form, ensuring that all information is accurate and up to date. After filling out the form, review it for any errors or omissions before submitting it to the relevant authority.

Steps to complete the Rp 467

Completing the Rp 467 form requires attention to detail. Follow these steps for a smooth process:

- Gather required information, including identification and relevant data.

- Fill out the form accurately, ensuring clarity in each section.

- Review the completed form for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Rp 467

The legal use of the Rp 467 form is governed by specific regulations that dictate how it should be completed and submitted. It is essential to adhere to these legal standards to ensure that the form is recognized as valid by governmental entities. This includes understanding the implications of the information provided and the responsibilities associated with signing the form.

Key elements of the Rp 467

Several key elements must be included in the Rp 467 form to ensure its validity and effectiveness. These elements typically include:

- Identification details of the individual or entity submitting the form.

- Specific purpose for which the form is being submitted.

- Accurate and complete responses to all required fields.

- Signature of the individual completing the form, affirming the truthfulness of the information provided.

Examples of using the Rp 467

Examples of using the Rp 467 form can vary widely depending on the context in which it is applied. For instance, it may be used by individuals applying for permits, businesses seeking licenses, or organizations submitting compliance documentation. Each scenario requires careful attention to the form's requirements to ensure successful processing.

Quick guide on how to complete rp 467

Complete Rp 467 effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Rp 467 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to amend and eSign Rp 467 with ease

- Find Rp 467 and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you select. Modify and eSign Rp 467 and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rp 467

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rp 467 and how does it relate to airSlate SignNow?

rp 467 is a key feature within airSlate SignNow that enhances document management efficiency. It allows users to streamline the eSigning process, ensuring that documents are sent, signed, and stored securely. Utilizing rp 467 can greatly improve your organization's workflow.

-

How much does it cost to use rp 467 with airSlate SignNow?

The cost of accessing rp 467 features varies based on the subscription plan you choose. airSlate SignNow offers competitive pricing designed to meet the needs of businesses of all sizes. Investing in rp 467 ensures you receive a cost-effective solution for all your eSigning requirements.

-

What are the main benefits of using rp 467 in airSlate SignNow?

Using rp 467 in airSlate SignNow provides users with several key benefits, including faster document turnaround times and enhanced security. This feature allows for detailed tracking and management of signed documents, which improves accountability within your teams. Overall, rp 467 contributes to increased productivity.

-

Can rp 467 integrate with other software applications?

Yes, rp 467 within airSlate SignNow is designed to seamlessly integrate with various software applications, enhancing functionality. This integration capability allows you to connect with your existing tools, such as CRM and project management systems. By leveraging rp 467, you create a more unified workflow.

-

Is rp 467 suitable for small businesses?

Absolutely! rp 467 is an excellent choice for small businesses seeking an efficient and cost-effective solution for document signing. airSlate SignNow tailors its features, including rp 467, to be user-friendly and accessible, making it suitable for organizations with varying degrees of technological proficiency.

-

How secure is the rp 467 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the rp 467 feature is equipped with advanced security protocols. This includes encryption and secure storage methods to protect your sensitive documents. By using rp 467, you can rest assured that your data remains secure throughout the signing process.

-

What types of documents can I manage with rp 467?

With rp 467, you can manage a wide range of documents, including contracts, agreements, and forms. airSlate SignNow allows you to customize templates to fit your needs, ensuring that all document types can be easily sent and signed. This versatility makes rp 467 a powerful tool for any business.

Get more for Rp 467

- Hotel reservation letter form

- Leave of absence fmla laws ampamp hr compliance analysis form

- Christmas or holiday note to friends or family form

- Lobbyist complaint form for office use only

- Holiday letter to stockholders form

- Short form of agreement to form a partnership in the future

- Credit christmas extension announcement form

- Request to ins for extension of u form

Find out other Rp 467

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online