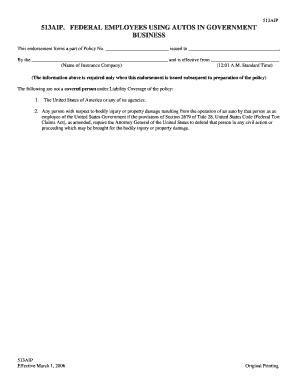

513AIP FEDERAL EMPLOYEES USING AUTOS in GOVERNMENT BUSINESS Taipa Form

What is the 513AIP Federal Employees Using Autos in Government Business Taipa?

The 513AIP Federal Employees Using Autos in Government Business Taipa form is a critical document for federal employees who utilize vehicles for official government duties. This form serves to outline the necessary guidelines and regulations governing the use of government vehicles, ensuring compliance with federal policies. It is essential for maintaining accountability and transparency in the use of government resources.

How to Use the 513AIP Federal Employees Using Autos in Government Business Taipa

To effectively use the 513AIP form, federal employees should first familiarize themselves with the specific requirements outlined in the document. This includes understanding the purpose of the form, which is to document vehicle usage for government business. Employees must accurately fill out the form, providing details such as the purpose of travel, dates, and any relevant expenses incurred during the trip. Once completed, the form should be submitted to the appropriate department for review and approval.

Steps to Complete the 513AIP Federal Employees Using Autos in Government Business Taipa

Completing the 513AIP form involves several key steps:

- Gather necessary information, including travel dates, locations, and purpose of the trip.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your supervisor or designated authority for approval.

Legal Use of the 513AIP Federal Employees Using Autos in Government Business Taipa

The legal use of the 513AIP form is governed by federal regulations that mandate proper documentation of vehicle use by government employees. This form helps ensure that employees adhere to policies regarding the use of government vehicles, including restrictions on personal use and the requirement for accurate reporting of travel details. Compliance with these regulations is crucial for maintaining the integrity of government operations.

Key Elements of the 513AIP Federal Employees Using Autos in Government Business Taipa

Key elements of the 513AIP form include:

- Employee identification details, including name and position.

- Specific details regarding the vehicle used, such as make, model, and license plate number.

- A comprehensive account of the trip, including dates, destinations, and purpose.

- Signature of the employee and, if required, the approving authority.

Eligibility Criteria

Eligibility to use the 513AIP form typically includes federal employees who are authorized to operate government vehicles for official business. Employees must be in good standing with their agency and comply with all relevant regulations regarding vehicle use. It is essential to consult agency-specific guidelines to confirm eligibility and any additional requirements that may apply.

Quick guide on how to complete 513aip federal employees using autos in government business taipa

Accomplish 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa with ease on any device

Digital document management has become favored by companies and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Handle 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to adjust and eSign 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa effortlessly

- Obtain 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools provided specifically by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes requiring new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa to ensure effective communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 513aip federal employees using autos in government business taipa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who counts as a federal employee?

Who are federal employees? Federal employees are individuals who work for the federal government. This includes politicians, judges, and heads of departments such as Labor and State. Federal employees can also be civilians who work government jobs in areas like law enforcement, public health, science and engineering.

-

Can government employees have side businesses?

0:13 1:12 However. There are restrictions on certain types of employment. Such as working for a contractorMoreHowever. There are restrictions on certain types of employment. Such as working for a contractor that does business with the government additionally employees must disclose their outside employment.

-

Are government employees federal employees?

In the United States, government employees includes the U.S. federal civil service, employees of the state governments, and employees of local governments.

-

How do I know if I am a federal employee?

Internal Revenue Code section 3401(c) indicates that an “officer, employee, or elected official” of government is an employee for income tax withholding purposes. However, in some special cases the law or a Section 218 Agreement may specify otherwise.

-

Can federal employees have their own business?

0:00 1:08 Can result in disciplinary action or even criminal charges.MoreCan result in disciplinary action or even criminal charges.

Get more for 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa

Find out other 513AIP FEDERAL EMPLOYEES USING AUTOS IN GOVERNMENT BUSINESS Taipa

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form