Mortgage Connect Reviews Form

What is the Mortgage Connect Reviews

The Mortgage Connect Reviews form is a document that facilitates the collection and evaluation of feedback regarding mortgage services. This form is essential for both lenders and borrowers, as it helps assess the quality of mortgage offerings and customer satisfaction. By gathering insights through this form, organizations can improve their services and address any concerns raised by clients. The form typically includes sections for personal information, service ratings, and open-ended questions to capture detailed feedback.

How to Use the Mortgage Connect Reviews

Using the Mortgage Connect Reviews form is straightforward. Begin by accessing the form through a secure platform that supports electronic signatures. Fill in the required fields, which may include your name, contact information, and details about your mortgage experience. Be sure to provide honest and constructive feedback in the designated sections. Once completed, submit the form electronically to ensure it is received promptly. This process not only streamlines feedback collection but also enhances the overall experience for both parties involved.

Steps to Complete the Mortgage Connect Reviews

Completing the Mortgage Connect Reviews form involves several key steps:

- Access the form through a secure digital platform.

- Provide your personal information, including your name and contact details.

- Rate your experience with the mortgage service on a scale, if applicable.

- Answer any open-ended questions to share specific feedback.

- Review your responses for accuracy and completeness.

- Submit the form electronically to ensure secure delivery.

Legal Use of the Mortgage Connect Reviews

The Mortgage Connect Reviews form must comply with relevant legal standards to be considered valid. This includes adherence to eSignature laws, which ensure that electronic submissions are legally binding. Using a reliable platform that complies with the ESIGN Act and UETA is crucial. These regulations help protect both the submitter's rights and the integrity of the feedback process. Additionally, ensuring that the form is securely stored and accessible only to authorized personnel is essential for maintaining confidentiality.

Key Elements of the Mortgage Connect Reviews

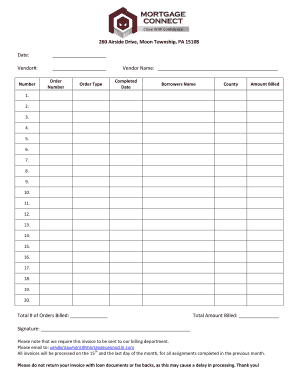

Several key elements are vital for the Mortgage Connect Reviews form to be effective:

- Personal Information: Collecting the respondent's name and contact details for follow-up.

- Service Ratings: Including a rating scale for various aspects of the mortgage service.

- Open-Ended Feedback: Allowing respondents to provide detailed comments and suggestions.

- Submission Confirmation: Providing a receipt or confirmation upon successful submission.

Examples of Using the Mortgage Connect Reviews

Examples of how the Mortgage Connect Reviews form can be utilized include:

- A borrower providing feedback on their mortgage application process to help the lender improve efficiency.

- A lender using aggregated feedback to identify common issues and enhance customer service training.

- Tracking trends in customer satisfaction over time to inform business decisions and marketing strategies.

Quick guide on how to complete mortgage connect reviews

Effortlessly Prepare Mortgage Connect Reviews on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed forms, as you can easily access the appropriate template and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Mortgage Connect Reviews on any platform with airSlate SignNow’s Android or iOS applications and enhance your document-related workflows today.

How to Modify and eSign Mortgage Connect Reviews with Ease

- Find Mortgage Connect Reviews and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Mark relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, cumbersome form searching, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Mortgage Connect Reviews to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage connect reviews

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for mortgage connect reviews?

AirSlate SignNow is known for its user-friendly interface and powerful features, such as document preparation, automated workflows, and secure electronic signatures. Many mortgage connect reviews highlight the platform's ability to streamline the signing process, making it easy for both lenders and borrowers to execute necessary documents quickly and securely.

-

How does airSlate SignNow ensure document security in mortgage connect reviews?

Security is a top priority for airSlate SignNow, as indicated in numerous mortgage connect reviews. The platform employs advanced encryption protocols, secure cloud storage, and compliance with industry standards, providing users with peace of mind that their sensitive documents are protected throughout the signing process.

-

What pricing plans are available for airSlate SignNow as mentioned in mortgage connect reviews?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, as noted in various mortgage connect reviews. Whether you're looking for a free trial or premium options with more advanced features, there is a plan that suits your budget and specific needs.

-

Can airSlate SignNow integrate with other mortgage management systems according to mortgage connect reviews?

Yes, airSlate SignNow provides seamless integrations with popular mortgage management systems, as discussed in many mortgage connect reviews. This capability allows for an efficient workflow, enabling users to connect their signing process directly with their existing tools for better productivity.

-

What benefits do users find most appealing about airSlate SignNow in mortgage connect reviews?

Many users in mortgage connect reviews appreciate the platform's convenience, speed, and affordability. The ability to eSign documents from anywhere at any time signNowly enhances productivity and client satisfaction, making it a preferred choice for mortgage professionals.

-

How does airSlate SignNow simplify the loan signing process based on mortgage connect reviews?

AirSlate SignNow simplifies the loan signing process by enabling electronic signatures and document sharing in real-time, which is frequently noted in mortgage connect reviews. This means less time spent on paperwork and more focus on customer service and closing deals efficiently.

-

What do mortgage professionals say about airSlate SignNow's customer support in mortgage connect reviews?

According to numerous mortgage connect reviews, users rave about airSlate SignNow's responsive customer support. The dedicated support team is available to assist with any technical issues or questions, ensuring that users can maximize the platform's capabilities without signNow downtime.

Get more for Mortgage Connect Reviews

- Affidavit to register a foreign child courtsalaskagov form

- In the superior court for the state of alaska at petitioner form

- Civil rule 5g2 civil rule 77b4 form

- In the superior court for the state of alaska state of form

- Justia affidavit of attempted service of notice and form

- Civ 670 prisoner request for filing fee exemption 12 14 civil forms

- Free alaska district court of alaska formspage 2

- Information for landlords and tenants about forcible entry

Find out other Mortgage Connect Reviews

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple