Form 904

What is the i904 form

The i904 form, also known as Form 904, is a document used primarily in the United States for specific legal and administrative purposes. It is essential for individuals and businesses to understand the function of this form to ensure compliance with applicable regulations. The form is often utilized in various contexts, including tax filings and legal applications, where accurate information is crucial for processing requests or claims.

How to obtain the i904 form

Obtaining the i904 form is a straightforward process. Individuals can download the form directly from the official IRS website or other authorized platforms. It is important to ensure that you are accessing the most current version of the form to avoid any complications during submission. Additionally, some organizations may provide the form as part of their services, so checking with relevant institutions can also be beneficial.

Steps to complete the i904 form

Completing the i904 form involves a series of steps to ensure that all necessary information is accurately provided. Start by gathering all required documents and information, such as identification numbers and relevant financial data. Next, carefully fill out each section of the form, ensuring clarity and accuracy. After completing the form, review it for any errors or omissions before submission. This thorough approach helps to prevent delays or issues with processing.

Legal use of the i904 form

The legal use of the i904 form is governed by specific regulations that dictate how and when it can be utilized. To ensure that the form is legally binding, it must be filled out accurately and submitted according to the established guidelines. Compliance with relevant laws, such as the ESIGN Act and UETA, is essential for the form to be recognized in legal contexts. Understanding these legal frameworks can help users avoid potential pitfalls.

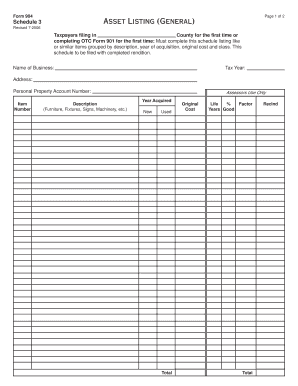

Key elements of the i904 form

Key elements of the i904 form include critical sections that require specific information. This may encompass personal identification details, financial data, and any relevant supporting documentation. Each element plays a vital role in the processing of the form, so it is important to pay attention to detail. Missing or incorrect information can lead to delays or rejections, making it crucial to understand the requirements thoroughly.

Form Submission Methods

The i904 form can be submitted through various methods, including online, by mail, or in person. Each submission method has its own set of guidelines and processing times. Online submissions are often quicker, while mail submissions may take longer due to postal delays. In-person submissions can provide immediate confirmation but may require an appointment or specific location. Understanding these options allows users to choose the most convenient method for their needs.

Filing Deadlines / Important Dates

Filing deadlines for the i904 form are crucial for compliance and can vary based on the specific purpose of the form. It is important to be aware of these deadlines to avoid penalties or complications. Users should check the official IRS calendar or relevant regulatory bodies for the most accurate and up-to-date information regarding important dates associated with the form. Keeping track of these deadlines ensures timely submission and adherence to legal requirements.

Quick guide on how to complete form 904

Effortlessly prepare Form 904 on any device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form 904 on any platform with airSlate SignNow mobile applications for Android or iOS and streamline any document-driven process today.

The easiest way to edit and electronically sign Form 904 without hassle

- Locate Form 904 and click Obtain Form to begin.

- Make use of the tools we offer to fill out your form.

- Select relevant parts of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Complete button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 904 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 904

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is i904 and how does it relate to airSlate SignNow?

i904 is a format used for specific document processing needs, and airSlate SignNow seamlessly supports i904 documents for eSigning. Our platform ensures easy uploading, editing, and signing of i904 forms, enhancing efficiency in your workflows. Whether you're in real estate, finance, or legal sectors, airSlate SignNow's features cater effectively to your i904 document requirements.

-

How much does airSlate SignNow cost for i904 document services?

airSlate SignNow offers competitive pricing for its services, including support for i904 documents. Plans start at an affordable rate, providing essential features for businesses of all sizes. By choosing airSlate SignNow, you can easily manage your i904 documents without breaking the bank.

-

What features does airSlate SignNow provide for managing i904 documents?

With airSlate SignNow, you can easily create, send, and eSign i904 documents using our intuitive interface. Features include customizable templates, real-time tracking, and secure cloud storage. These tools ensure that your i904 documents are managed efficiently and effectively.

-

What benefits does using airSlate SignNow for i904 signing offer my business?

Using airSlate SignNow for i904 signing streamlines your document processes, reducing turnaround time signNowly. The ability to eSign i904 documents from any device increases flexibility and accessibility for your team. Additionally, enhanced security features protect sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for my i904 documents?

Yes, airSlate SignNow allows seamless integration with various platforms, making it easy to manage your i904 documents. You can connect it with CRM systems, cloud storage solutions, and productivity tools. This interoperability enhances your workflow, ensuring that your i904 document processes are smooth and efficient.

-

Is airSlate SignNow user-friendly for handling i904 documentation?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple to handle i904 documentation. Whether you're a tech-savvy user or new to digital tools, our interface allows for quick navigation and efficient eSigning of i904 forms.

-

Are there any security features in airSlate SignNow for i904 documents?

Yes, airSlate SignNow prioritizes the security of your i904 documents with advanced encryption and authentication features. Our platform ensures that all data is securely transmitted and stored, protecting against unauthorized access. You can confidently manage your i904 document workflows, knowing that security is robust.

Get more for Form 904

- Business organizations staying afloat with a hole in the form

- 102 contract operating agreement secgov form

- Ncua ampamp fdic insurance limits how coverage is calculated form

- At all times while operations are conducted under the joint operating agreement to which this form

- The joint operating agreement texasbarcle form

- Gas balancing agreement form

- Gas balancing agreement agreement secgov form

- Gas balancing agreement law and legal definition form

Find out other Form 904

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter