for January 1 December 31, , or Other Tax Year Beginning 2020

Understanding the CT 2017 Form

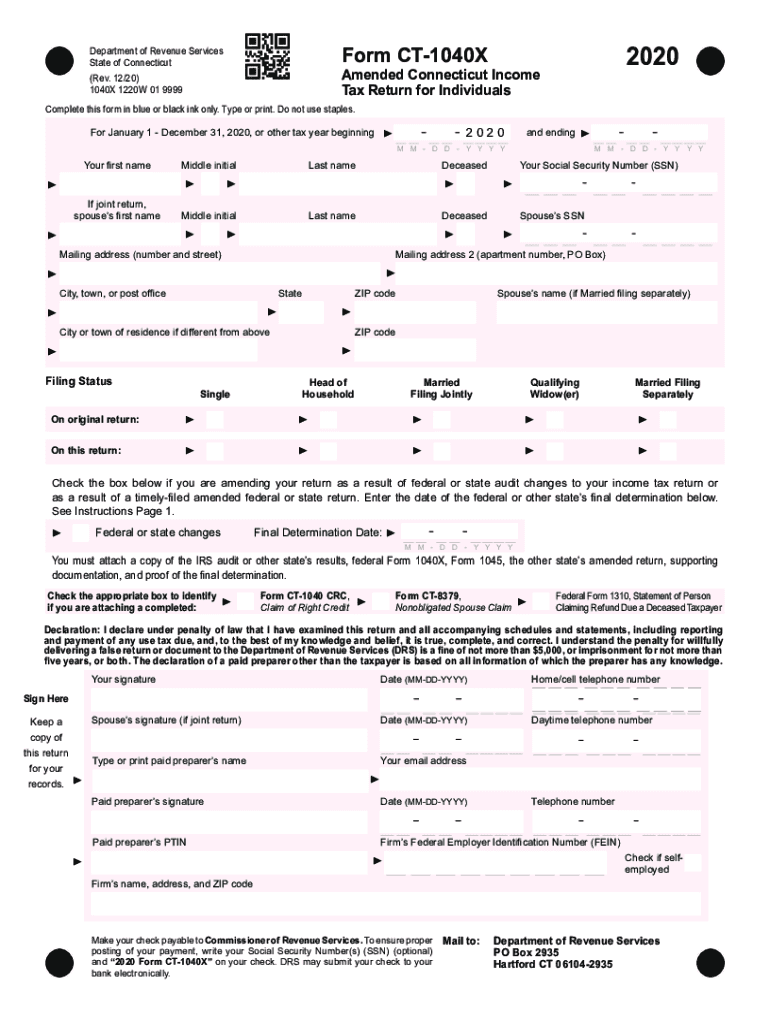

The CT 2017 form is a crucial document for taxpayers in Connecticut, specifically designed for individuals who need to report their income and calculate their state tax obligations. This form is essential for ensuring compliance with state tax laws and is used to assess the amount of tax owed or the refund due. It is important to understand the specific requirements and details associated with this form to avoid any potential issues with the Connecticut Department of Revenue Services.

Steps to Complete the CT 2017 Form

Completing the CT 2017 form involves several key steps that taxpayers should follow to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and dividends.

- Calculate deductions and credits to determine your taxable income.

- Compute your tax liability based on the applicable tax rates.

- Sign and date the form before submission.

Filing Deadlines for the CT 2017 Form

It is essential to be aware of the filing deadlines associated with the CT 2017 form. Typically, the form must be filed by April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions available to ensure timely submission.

Required Documents for the CT 2017 Form

To successfully complete the CT 2017 form, several documents are necessary:

- W-2 forms from employers showing wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods

Taxpayers can submit the CT 2017 form through various methods, including:

- Online submission via the Connecticut Department of Revenue Services website.

- Mailing a paper copy of the completed form to the appropriate state address.

- In-person submission at designated state offices, if necessary.

Legal Use of the CT 2017 Form

The CT 2017 form is legally binding and must be completed accurately to comply with state tax laws. Any discrepancies or inaccuracies can lead to penalties, interest, or audits by the Connecticut Department of Revenue Services. Understanding the legal implications of this form is crucial for taxpayers to avoid potential issues.

Quick guide on how to complete for january 1 december 31 2020 or other tax year beginning

Effortlessly Prepare For January 1 December 31, , Or Other Tax Year Beginning on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage For January 1 December 31, , Or Other Tax Year Beginning on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign For January 1 December 31, , Or Other Tax Year Beginning without hassle

- Find For January 1 December 31, , Or Other Tax Year Beginning and click on Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or wrongly stored documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign For January 1 December 31, , Or Other Tax Year Beginning and ensure exceptional communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for january 1 december 31 2020 or other tax year beginning

Create this form in 5 minutes!

How to create an eSignature for the for january 1 december 31 2020 or other tax year beginning

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to ct 2017?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents efficiently. By implementing features aligned with ct 2017 regulations, it ensures legally binding signatures while maintaining compliance for all your document needs.

-

How does airSlate SignNow pricing work in relation to ct 2017?

The pricing of airSlate SignNow is designed to be cost-effective for businesses of all sizes. With various plans available, you can choose the one that best meets your needs while ensuring compliance with ct 2017 requirements for electronic document submissions.

-

What features does airSlate SignNow offer that are beneficial for ct 2017 compliance?

airSlate SignNow includes features such as advanced authentication, audit trails, and customizable workflows that help businesses comply with ct 2017. These features ensure that your documents are securely signed and stored, meeting the necessary legal standards.

-

Can airSlate SignNow integrate with other software I use in relation to ct 2017?

Yes, airSlate SignNow offers seamless integrations with popular applications to enhance your workflow. These integrations help maintain compliance with ct 2017 while providing a streamlined experience in managing your documents across different platforms.

-

What are the benefits of using airSlate SignNow for businesses focusing on ct 2017?

Using airSlate SignNow allows businesses to accelerate their document signing processes while ensuring compliance with ct 2017. Its easy-to-use interface and robust security features support efficiency and reliability, helping your business thrive in a digital landscape.

-

Is airSlate SignNow suitable for small businesses concerned about ct 2017?

Absolutely! airSlate SignNow is designed to cater to the needs of small businesses while providing robust compliance with ct 2017. Its affordable plans and user-friendly features make it a great choice for smaller organizations looking to streamline their document signing processes.

-

How secure is airSlate SignNow when dealing with ct 2017 documents?

security is a top priority for airSlate SignNow, especially for documents related to ct 2017. The platform utilizes encryption, secure servers, and comprehensive audit trails to ensure that all documents are protected and comply with legal standards.

Get more for For January 1 December 31, , Or Other Tax Year Beginning

- Mutual wills package of last wills and testaments for unmarried persons living together not married with adult children alaska form

- Mutual wills or last will and testaments for unmarried persons living together not married with minor children alaska form

- Living together agreement alaska form

- Paternity law and procedure handbook alaska form

- Bill of sale in connection with sale of business by individual or corporate seller alaska form

- Office lease agreement alaska form

- Commercial sublease alaska form

- Residential lease renewal agreement alaska form

Find out other For January 1 December 31, , Or Other Tax Year Beginning

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now