STATE of CONNECTICUT DEPARTMENT of REVENUE SERVICES Rev 2020

Understanding the Connecticut Form CT-1041

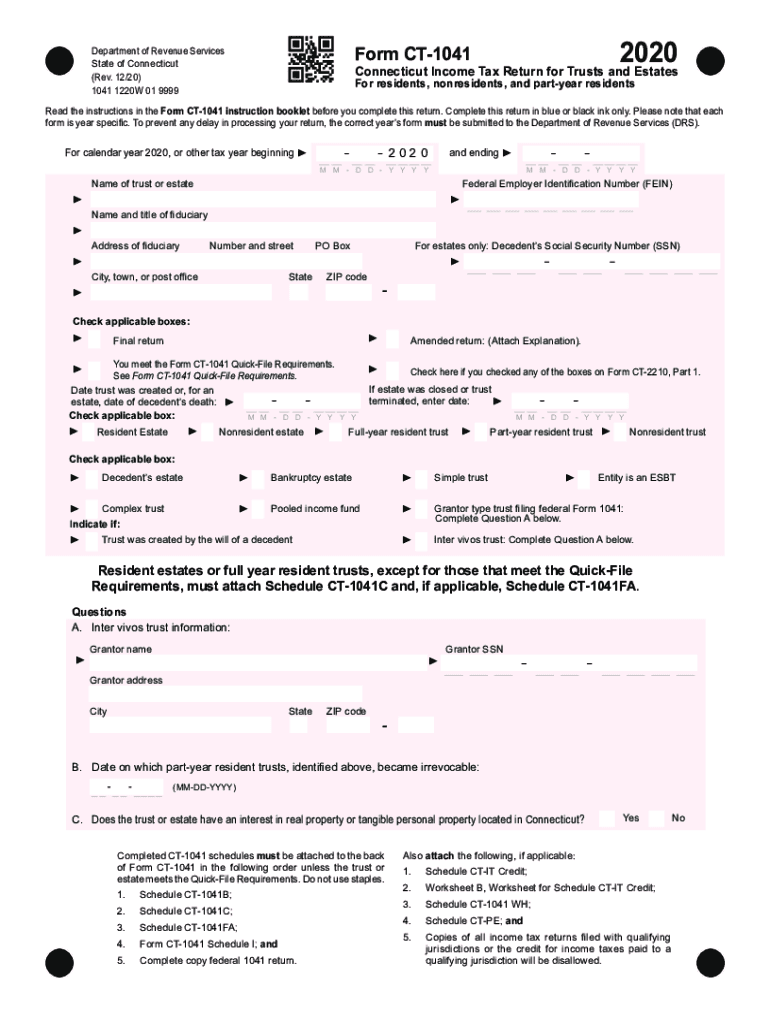

The Connecticut Form CT-1041 is a tax return specifically designed for estates and trusts in the state of Connecticut. This form is essential for reporting income generated by an estate or trust and is required to be filed annually. It helps ensure that the appropriate taxes are calculated and paid, reflecting the income earned during the tax year. The form must be completed accurately to avoid penalties and ensure compliance with state tax laws.

Steps to Complete the Connecticut Form CT-1041

Completing the Connecticut Form CT-1041 involves several key steps:

- Gather Required Information: Collect all necessary documents, including income statements, deduction records, and prior year tax returns.

- Fill Out the Form: Carefully enter the required information in the appropriate sections of the form, ensuring accuracy in reporting income and deductions.

- Review for Errors: Double-check all entries for accuracy, as mistakes can lead to delays or penalties.

- Sign and Date: Ensure that the form is signed and dated by the appropriate parties, as unsigned forms may be rejected.

- Submit the Form: File the completed form by the due date, either electronically or by mail, following the guidelines provided by the Connecticut Department of Revenue Services.

Filing Deadlines for Form CT-1041

The filing deadline for the Connecticut Form CT-1041 typically aligns with the federal tax deadline. Generally, the form must be filed by April fifteenth of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for filers to be aware of these dates to avoid late penalties and interest on unpaid taxes.

Legal Use of the Connecticut Form CT-1041

The Connecticut Form CT-1041 serves a legal purpose as it is used to report income for estates and trusts. Proper completion and timely filing of this form ensure compliance with state tax laws. Additionally, the form may be subject to audits, making accurate reporting essential for legal protection against potential disputes with tax authorities.

Required Documents for Filing Form CT-1041

When filing the Connecticut Form CT-1041, several documents are necessary to support the information reported on the form:

- Income Statements: Documents showing income earned by the estate or trust, such as interest, dividends, and capital gains.

- Deductions: Records of any allowable deductions, including administrative expenses and distributions to beneficiaries.

- Prior Year Returns: Previous tax returns may be helpful for reference and consistency in reporting.

Penalties for Non-Compliance with Form CT-1041

Failure to file the Connecticut Form CT-1041 on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the state. It is essential for estates and trusts to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete state of connecticut department of revenue services rev

Easily Prepare STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides everything you need to create, modify, and electronically sign your documents promptly without delays. Manage STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev Effortlessly

- Locate STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev and ensure excellent communication during every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of connecticut department of revenue services rev

Create this form in 5 minutes!

How to create an eSignature for the state of connecticut department of revenue services rev

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the ct 1041 form, and why is it important?

The ct 1041 form is a tax return form used for Connecticut estate and trust income. It is essential for ensuring compliance with state taxation laws, allowing estates and trusts to accurately report income and pay any necessary taxes. Understanding how to complete the ct 1041 can help manage tax liabilities effectively.

-

How can airSlate SignNow help with filling out the ct 1041?

airSlate SignNow provides an efficient platform for managing and eSigning documents, including the ct 1041. Our user-friendly interface simplifies the process of filling out tax forms, allowing users to quickly complete and send the ct 1041 electronically, streamlining submission to tax authorities.

-

What are the pricing options for using airSlate SignNow for the ct 1041?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes, making it a cost-effective solution for handling documents, including the ct 1041. Users can choose from monthly or annual subscriptions, ensuring flexibility and scalability according to their needs.

-

Are there features specifically designed for managing the ct 1041 process?

Yes, airSlate SignNow includes features tailored for managing the ct 1041 process, such as document templates, automated workflows, and eSignature capabilities. These tools make it easier to prepare, review, and submit the ct 1041 form, enhancing efficiency and accuracy.

-

Is it possible to integrate airSlate SignNow with other accounting software for the ct 1041?

Absolutely! airSlate SignNow seamlessly integrates with several accounting and tax software applications, allowing for a smoother process when handling the ct 1041. This integration ensures that data remains consistent and reduces time spent transferring information between different platforms.

-

What benefits does airSlate SignNow provide for businesses filing the ct 1041?

By using airSlate SignNow for the ct 1041, businesses can save time and reduce errors with our streamlined eSignature process. Additionally, the ability to manage documents in one place enhances collaboration among team members, ensuring that all who need to contribute to the ct 1041 can do so efficiently.

-

Can I access my signed ct 1041 documents anytime?

Yes, airSlate SignNow offers cloud-based storage for all signed documents, including your ct 1041 forms. This means you can access your signed documents anytime, from anywhere, ensuring that you have the necessary paperwork on hand when required.

Get more for STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev

- Apartment lease rental application questionnaire alaska form

- Residential rental lease application alaska form

- Salary verification form for potential lease alaska

- Landlord agreement to allow tenant alterations to premises alaska form

- Notice of default on residential lease alaska form

- Landlord tenant lease co signer agreement alaska form

- Application for sublease alaska form

- Inventory and condition of leased premises for pre lease and post lease alaska form

Find out other STATE OF CONNECTICUT DEPARTMENT OF REVENUE SERVICES Rev

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online