Portal Ct Gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website 2020

Understanding the CT 990T Form

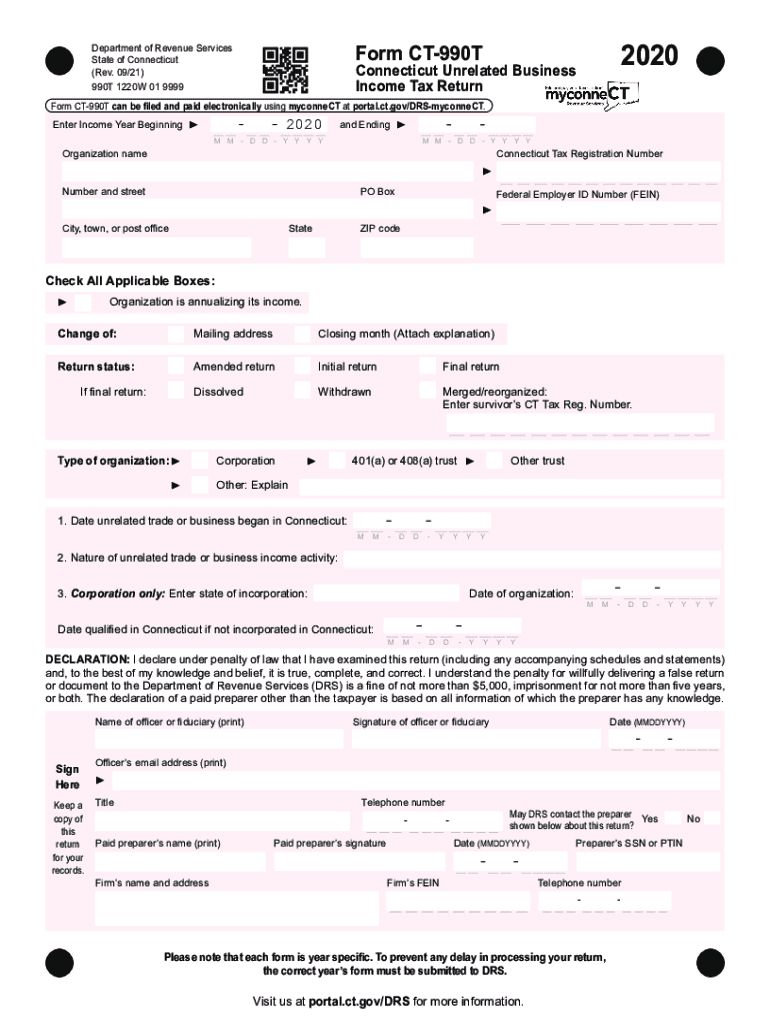

The CT 990T form, officially known as the Connecticut Unrelated Business Income Tax Return, is essential for organizations that generate unrelated business income. This form is primarily used by tax-exempt organizations to report income derived from activities not substantially related to their exempt purpose. Understanding the nuances of the CT 990T is crucial for compliance with state tax regulations.

Steps to Complete the CT 990T Form

Filling out the CT 990T form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather all necessary financial documents, including income statements and expense records related to the unrelated business activities.

- Fill out the identification section with the organization’s name, address, and federal employer identification number (EIN).

- Report all unrelated business income on the form, detailing the sources of income and any applicable deductions.

- Calculate the tax owed based on the reported income and submit the form by the designated deadline.

Filing Deadlines for the CT 990T Form

Timely filing of the CT 990T is critical to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the end of the organization’s tax year. For organizations operating on a calendar year, this means the deadline is April 15. It is advisable to check for any updates or extensions that may affect the filing date.

Required Documents for Filing the CT 990T

To successfully file the CT 990T, organizations must have several documents ready:

- Financial statements that detail income and expenses from unrelated business activities.

- Any supporting documentation for deductions claimed, such as receipts and invoices.

- Previous tax returns, if applicable, to provide context for current filings.

Penalties for Non-Compliance with the CT 990T

Failure to file the CT 990T form on time can result in significant penalties. Organizations may face a late filing penalty, which is typically a percentage of the tax due. Additionally, interest may accrue on any unpaid taxes. It is crucial to adhere to filing requirements to avoid these financial repercussions.

Digital vs. Paper Version of the CT 990T

Organizations have the option to file the CT 990T form either digitally or via paper submission. Digital filing is often faster and allows for immediate confirmation of receipt. Conversely, paper submissions may take longer to process. Choosing the right method depends on the organization’s resources and preferences.

Quick guide on how to complete portalctgov drs drs formsunrelated returns ctgov connecticuts official state website

Accomplish Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website effortlessly on any gadget

Digital document administration has become increasingly favored among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website on any gadget using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The simplest way to alter and eSign Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website effortlessly

- Locate Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website and guarantee exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov drs drs formsunrelated returns ctgov connecticuts official state website

Create this form in 5 minutes!

How to create an eSignature for the portalctgov drs drs formsunrelated returns ctgov connecticuts official state website

The best way to create an e-signature for a PDF file online

The best way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is form ct 990t and why do I need it?

Form CT 990T is used by organizations to report unrelated business income and to calculate the tax owed on that income. If your business engages in activities unrelated to its primary purpose, it may need to file this form to ensure compliance with tax laws. Using airSlate SignNow simplifies the process of gathering necessary signatures and documentation related to form ct 990t.

-

How does airSlate SignNow help with the completion of form ct 990t?

airSlate SignNow provides a user-friendly platform to create, sign, and manage your documents electronically. You can easily upload or create your form ct 990t and share it with your team for quick eSignatures. This streamlines the process, saving you time and ensuring compliance.

-

What features does airSlate SignNow offer for managing document workflows like form ct 990t?

airSlate SignNow offers robust features including customizable templates, real-time tracking, and automated reminders for document signing. These features enhance collaboration and ensure that your form ct 990t is completed accurately and on time, allowing you to focus on your core business activities.

-

Is there a cost associated with using airSlate SignNow for form ct 990t?

Yes, airSlate SignNow operates on a subscription-based model with various pricing tiers tailored to different business needs. This cost-effective solution allows you to send and eSign your form ct 990t without incurring excessive expenses. A free trial is often available for you to explore its capabilities first.

-

Can I integrate airSlate SignNow with other software for my form ct 990t?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Salesforce, and others. This means you can easily pull in documents related to form ct 990t from your existing tools, enhancing your workflow and document management efficiency.

-

What are the key benefits of using airSlate SignNow for form ct 990t?

Using airSlate SignNow for your form ct 990t offers numerous benefits, including increased efficiency, reduced turnaround time for document signing, and improved accuracy. The electronic signature process minimizes errors and ensures that all required signatures are collected swiftly. Additionally, it helps maintain a secure archiving system for all your important documents.

-

How secure is my data when I use airSlate SignNow for form ct 990t?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and security protocols to protect your sensitive data, such as your form ct 990t. You can trust that your documents are safe and compliant with privacy regulations throughout the signing process.

Get more for Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website

- Alaska standby temporary guardian legal documents package alaska form

- Alaska 13 form

- Bill of sale with warranty by individual seller alaska form

- Bill of sale with warranty for corporate seller alaska form

- Bill of sale without warranty by individual seller alaska form

- Bill of sale without warranty by corporate seller alaska form

- Alaska 13 497294043 form

- Verification of creditors matrix alaska form

Find out other Portal ct gov DRS DRS FormsUnrelated Returns CT GOV Connecticut's Official State Website

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile