Ctw4p 2021-2026

What is the CTW4P?

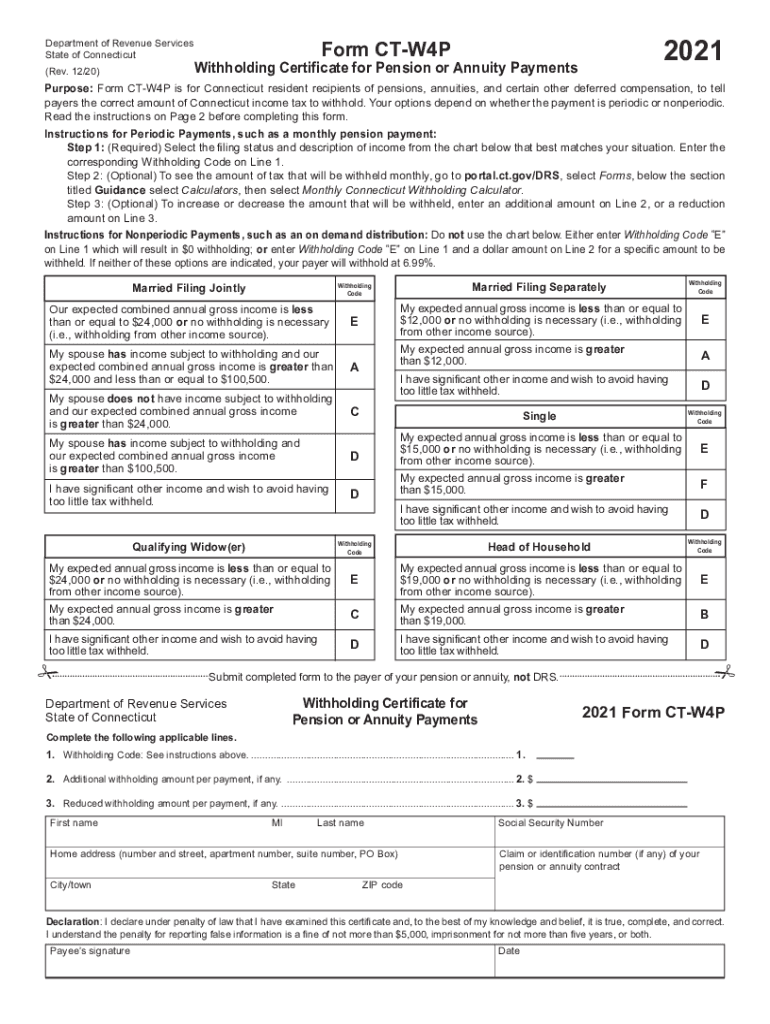

The CTW4P, or Connecticut Withholding Pension form, is a crucial document for individuals receiving pension or annuity payments in Connecticut. This form allows recipients to specify the amount of state income tax to be withheld from their payments. Proper completion of the CTW4P ensures that individuals meet their tax obligations and helps avoid under-withholding, which can lead to penalties during tax season.

How to Use the CTW4P

Using the CTW4P is straightforward. Recipients must fill out the form with accurate personal information, including their name, address, and Social Security number. Additionally, they should indicate the amount to be withheld from their pension or annuity payments. Once completed, the form must be submitted to the payer of the pension or annuity. This ensures that the correct amount of state tax is withheld from future payments.

Steps to Complete the CTW4P

Completing the CTW4P involves several key steps:

- Download the Form: Obtain the CTW4P form from a reliable source.

- Fill Out Personal Information: Provide your name, address, and Social Security number accurately.

- Specify Withholding Amount: Indicate the desired amount to be withheld from your payments.

- Review for Accuracy: Double-check all entries to ensure correctness.

- Submit the Form: Send the completed CTW4P to your pension or annuity payer.

Legal Use of the CTW4P

The CTW4P is legally recognized under Connecticut state law. It is essential for ensuring that pension and annuity recipients comply with state income tax requirements. When properly filled out and submitted, the CTW4P serves as a legal directive to the payer regarding the amount of tax to withhold, thereby safeguarding the recipient against potential tax liabilities.

Key Elements of the CTW4P

Understanding the key elements of the CTW4P is important for effective completion. The form typically includes:

- Personal Information: Essential details about the recipient.

- Withholding Amount: The specific dollar amount or percentage to be withheld.

- Signature: The recipient's signature confirming the accuracy of the information provided.

- Date: The date of completion, which is crucial for record-keeping.

Filing Deadlines / Important Dates

It is important to be aware of filing deadlines associated with the CTW4P to ensure compliance. Generally, the form should be submitted before the first payment date to ensure that the correct withholding takes effect. Recipients should also keep track of any changes in their financial situation that may require updates to the form, as this can affect withholding amounts.

Quick guide on how to complete ctw4p 2021

Effortlessly Prepare Ctw4p on Any Device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without any hindrances. Handle Ctw4p on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Ctw4p with Ease

- Locate Ctw4p and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using specific tools offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Ctw4p to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ctw4p 2021

Create this form in 5 minutes!

How to create an eSignature for the ctw4p 2021

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is ctw4p and how does it benefit my business?

CTW4P is a powerful feature of airSlate SignNow that streamlines your document workflow process. By utilizing ctw4p, businesses can efficiently send, manage, and eSign documents, resulting in faster turnaround times and improved productivity. This solution helps eliminate paperwork burdens while ensuring compliance and security.

-

How much does using the ctw4p feature cost?

The pricing for airSlate SignNow with ctw4p is flexible and designed to accommodate businesses of all sizes. You can choose from various subscription plans that offer the best value based on your needs. Each plan includes access to the ctw4p functionality along with other essential features.

-

What features can I access with ctw4p?

CTW4P offers a robust set of features including customizable templates, automated workflows, real-time tracking, and secure cloud storage. These features simplify the document signing process and enhance collaboration among team members. With ctw4p, you can also integrate with other applications seamlessly.

-

Is ctw4p suitable for small businesses?

Absolutely! CTW4P is designed to cater to small businesses by providing a cost-effective solution for all document signing needs. It empowers small business owners to maintain professionalism while managing contracts and agreements without the overhead of paper-based processes.

-

Can I integrate ctw4p with other software?

Yes, ctw4p easily integrates with a variety of popular applications such as CRM tools, cloud storage services, and project management software. This integration capability allows for a seamless workflow and improves overall efficiency. Users benefit from the flexibility and convenience of having all tools connected.

-

What security measures are in place with ctw4p?

CTW4P includes advanced security protocols to protect sensitive information, including encryption and secure access controls. Your documents are stored safely in the cloud with robust authentication processes, ensuring that only authorized personnel can access them. This makes ctw4p a reliable choice for businesses concerned about data security.

-

How does ctw4p improve the eSigning process?

CTW4P enhances the eSigning experience by providing an intuitive interface that makes it easy for users to sign documents anytime, anywhere. The streamlined process signNowly reduces the time required to finalize agreements, allowing businesses to close deals faster. Additionally, ctw4p's automated reminders ensure that no signature is missed.

Get more for Ctw4p

- Alaska prenuptial premarital agreement with financial statements alaska form

- Alaska prenuptial premarital agreement without financial statements alaska form

- Amendment to prenuptial or premarital agreement alaska form

- Financial statements only in connection with prenuptial premarital agreement alaska form

- Revocation of premarital or prenuptial agreement alaska form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children alaska form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property form

- Alaska business form

Find out other Ctw4p

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple