AR1050 Dfa Arkansas Form

What is the AR1050 Dfa Arkansas

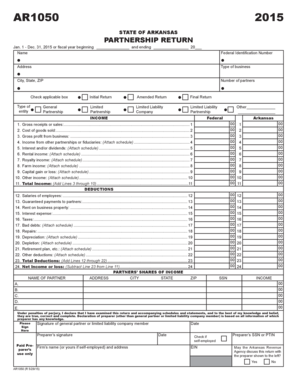

The AR1050 Dfa Arkansas form is a state-specific document used primarily for tax purposes in Arkansas. This form is essential for individuals and businesses to report various financial activities and fulfill their tax obligations. Understanding the purpose and requirements of the AR1050 is crucial for compliance with state tax laws, ensuring that all necessary information is accurately reported to the Arkansas Department of Finance and Administration.

How to use the AR1050 Dfa Arkansas

Using the AR1050 Dfa Arkansas form involves several key steps. First, gather all necessary financial documents and information relevant to your tax situation. This may include income statements, deductions, and any applicable credits. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is important to review the form for errors before submission, as inaccuracies can lead to delays or penalties. Finally, submit the completed form according to the instructions provided, either electronically or by mail.

Steps to complete the AR1050 Dfa Arkansas

Completing the AR1050 Dfa Arkansas form requires a systematic approach:

- Collect all relevant financial documents, including W-2s, 1099s, and receipts for deductions.

- Download the AR1050 form from the official Arkansas Department of Finance and Administration website or access it through approved software.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions accurately in the designated sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, either electronically or by hand, depending on your submission method.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the AR1050 Dfa Arkansas

The AR1050 Dfa Arkansas form is legally binding when completed and submitted in accordance with state tax laws. To ensure its legal validity, it must be signed by the taxpayer or an authorized representative. Additionally, compliance with eSignature laws is essential if the form is submitted electronically. By using a secure and compliant platform for electronic signatures, taxpayers can enhance the legal standing of their submissions, ensuring they meet all necessary legal requirements.

State-specific rules for the AR1050 Dfa Arkansas

Each state has unique regulations governing the use of tax forms, and Arkansas is no exception. The AR1050 Dfa Arkansas form must adhere to state-specific rules regarding filing deadlines, acceptable deductions, and reporting requirements. It is important for taxpayers to familiarize themselves with these rules to avoid potential issues. Additionally, staying updated on any changes in state tax legislation can help ensure compliance and prevent penalties.

Form Submission Methods (Online / Mail / In-Person)

The AR1050 Dfa Arkansas form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through approved platforms, which often provide additional benefits like instant confirmation.

- Mail Submission: For those who prefer traditional methods, the form can be printed, completed, and mailed to the Arkansas Department of Finance and Administration.

- In-Person Submission: Taxpayers may also choose to submit the form in person at designated state offices, allowing for direct interaction with tax officials.

Quick guide on how to complete ar1050 dfa arkansas

Effortlessly Prepare AR1050 Dfa Arkansas on Any Device

The management of online documents has gained considerable traction among corporations and individuals alike. It serves as a superb environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the necessary form and securely archive it on the web. airSlate SignNow equips you with all the resources required to generate, alter, and electronically sign your documents quickly and without holdups. Oversee AR1050 Dfa Arkansas on any device with airSlate SignNow applications for Android or iOS and enhance any documentation process today.

The optimal method to alter and electronically sign AR1050 Dfa Arkansas effortlessly

- Locate AR1050 Dfa Arkansas and press Get Form to begin.

- Utilize the features we provide to submit your document.

- Emphasize pertinent portions of the documents or obscure sensitive information with the tools available from airSlate SignNow specifically for this function.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Verify the details and click the Done button to secure your modifications.

- Choose your preferred delivery method for your form, whether it be through email, text (SMS), or invitation link, or download it directly to your computer.

Put aside concerns about lost or misfiled documents, tedious searches for forms, or errors requiring the reprinting of additional document versions. airSlate SignNow addresses all your document management needs in just a few clicks from whichever device you prefer. Modify and electronically sign AR1050 Dfa Arkansas to guarantee effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1050 dfa arkansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AR1050 Dfa Arkansas and how does it work?

The AR1050 Dfa Arkansas is a digital form designed for efficient document management. It allows users to complete, sign, and submit various forms electronically, streamlining the process for both individuals and businesses. With its user-friendly interface, this tool minimizes paperwork and accelerates signature collection.

-

What are the pricing options for using AR1050 Dfa Arkansas?

Pricing for the AR1050 Dfa Arkansas is competitive and designed to meet the needs of various users. Plans typically include different features, allowing you to choose one based on your volume and complexity of document signing needs. For exact pricing, visit our website or contact our sales team for personalized options.

-

What features does AR1050 Dfa Arkansas offer?

The AR1050 Dfa Arkansas offers robust features such as customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, users can easily integrate this solution with other applications, making it a versatile choice for businesses seeking efficiency. Its emphasis on security ensures that your documents remain confidential and protected.

-

How can AR1050 Dfa Arkansas benefit my business?

Implementing the AR1050 Dfa Arkansas can signNowly reduce the time spent on document management and enhance productivity. By automating the signing process, your team can focus on core tasks rather than administrative paperwork. This not only speeds up workflows but also improves customer satisfaction through timely responses.

-

Is AR1050 Dfa Arkansas easy to integrate with existing systems?

Yes, the AR1050 Dfa Arkansas has been designed with integrations in mind. It supports various popular platforms and software, ensuring a seamless connection to your current digital ecosystem. This flexibility helps businesses maintain their existing processes while adopting new efficiencies.

-

What security measures are in place for AR1050 Dfa Arkansas?

The AR1050 Dfa Arkansas employs advanced encryption and authentication measures to protect sensitive data. These security protocols ensure that all document transactions are secure and compliant with industry standards. Users can confidently manage their documentation without worrying about unauthorized access.

-

Can I customize documents with AR1050 Dfa Arkansas?

Absolutely! The AR1050 Dfa Arkansas allows users to create and customize documents according to their specific needs. This feature helps tailor the signing experience for different situations, ensuring that your legal and business requirements are met with flexibility.

Get more for AR1050 Dfa Arkansas

Find out other AR1050 Dfa Arkansas

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment