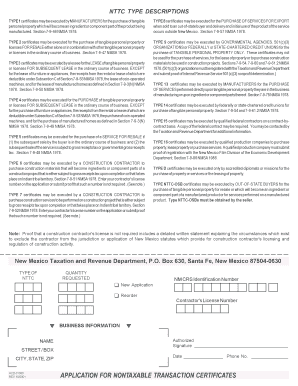

Nontaxable Transaction Certificate Form

What is the Nontaxable Transaction Certificate

The Nontaxable Transaction Certificate (NTTC) is a crucial document used in New Mexico to facilitate tax-exempt purchases. This certificate allows buyers to make purchases without incurring sales tax on certain transactions, typically involving goods that will be resold or used in manufacturing. The NTTC serves as proof that the buyer intends to use the purchased items in a manner that qualifies for tax exemption under state law.

How to use the Nontaxable Transaction Certificate

To use the NTTC effectively, buyers must present the certificate to sellers at the time of purchase. The seller retains a copy of the NTTC for their records, ensuring compliance with tax regulations. It is essential for buyers to complete the certificate accurately, providing all required information, including the purchaser's details, the seller's information, and a description of the items being purchased. This process helps prevent any misunderstandings regarding tax liabilities.

How to obtain the Nontaxable Transaction Certificate

Obtaining the NTTC in New Mexico is a straightforward process. Buyers can request the certificate from the New Mexico Taxation and Revenue Department or download it from their official website. It is important to ensure that the form is filled out correctly and includes all necessary information to avoid delays or issues during transactions. Additionally, businesses may need to provide proof of their tax-exempt status to qualify for the NTTC.

Steps to complete the Nontaxable Transaction Certificate

Completing the NTTC involves several key steps:

- Download the NTTC form from the New Mexico Taxation and Revenue Department's website.

- Fill in the purchaser's name, address, and tax identification number.

- Provide the seller's name and address.

- Describe the items being purchased and indicate their intended use.

- Sign and date the certificate to validate it.

Once completed, the NTTC should be presented to the seller during the transaction.

Key elements of the Nontaxable Transaction Certificate

The NTTC includes several key elements that are vital for its validity:

- Purchaser Information: The name and address of the buyer, along with their tax identification number.

- Seller Information: The name and address of the seller.

- Description of Goods: A detailed description of the items being purchased.

- Intended Use: A statement indicating how the items will be used, confirming they qualify for tax exemption.

- Signature: The purchaser’s signature and date, which authenticate the certificate.

Legal use of the Nontaxable Transaction Certificate

The legal use of the NTTC is governed by New Mexico tax laws. It is essential that the certificate is used only for eligible transactions, such as purchases for resale or items used in manufacturing. Misuse of the NTTC, such as using it for personal purchases, can lead to penalties and tax liabilities. Sellers are also responsible for verifying the validity of the NTTC presented to them to ensure compliance with state regulations.

Quick guide on how to complete nontaxable transaction certificate

Complete Nontaxable Transaction Certificate effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Nontaxable Transaction Certificate on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Nontaxable Transaction Certificate without hassle

- Find Nontaxable Transaction Certificate and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put aside worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Modify and eSign Nontaxable Transaction Certificate and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nontaxable transaction certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nttc new mexico?

nttc new mexico refers to the New Mexico arm of the National Training and Technical Center, focusing on training and resources for businesses. This center provides valuable educational support related to electronic signatures and document management, enhancing your experience with tools like airSlate SignNow.

-

How does airSlate SignNow integrate with nttc new mexico resources?

AirSlate SignNow seamlessly integrates with various tools and systems used by nttc new mexico. This ensures that businesses leveraging nttc new mexico's training can easily implement electronic signatures and document workflows to enhance efficiency.

-

What pricing options are available for airSlate SignNow users interested in nttc new mexico?

AirSlate SignNow offers flexible pricing plans tailored for businesses engaging with nttc new mexico. These plans cater to varying needs and budgets, ensuring you can find a cost-effective solution that aligns with the educational resources provided by nttc new mexico.

-

What features does airSlate SignNow provide for nttc new mexico participants?

Participants at nttc new mexico benefit from a suite of powerful features in airSlate SignNow, including customizable templates, secure eSigning, and easy document sharing. These features are designed to streamline workflow and improve efficiency in document handling.

-

What are the benefits of using airSlate SignNow in conjunction with nttc new mexico?

Utilizing airSlate SignNow alongside nttc new mexico enhances the learning experience by enabling seamless electronic transactions. This integration helps businesses to adopt innovative document management practices while benefiting from the educational initiatives of nttc new mexico.

-

Can airSlate SignNow help my business meet compliance requirements with resources from nttc new mexico?

Yes, airSlate SignNow helps businesses meet compliance requirements crucial for operations associated with nttc new mexico. With secure eSigning and audit trails, your business can confidently adhere to legal and regulatory standards.

-

Are there any special offers for nttc new mexico members using airSlate SignNow?

AirSlate SignNow frequently updates its offerings and may provide special discounts or benefits for nttc new mexico members. It's advisable to check directly with airSlate SignNow for the latest promotions that can enhance your experience.

Get more for Nontaxable Transaction Certificate

Find out other Nontaxable Transaction Certificate

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile