Kentucky Form 51a154

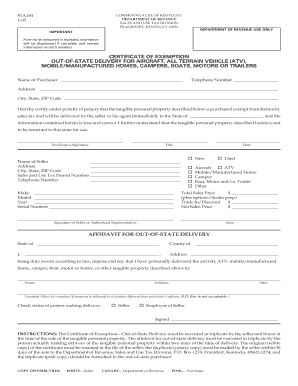

What is the Kentucky Form 51a154

The Kentucky Form 51a154 is a tax form used by individuals and businesses in Kentucky to report specific financial information to the Kentucky Revenue Department. This form is essential for ensuring compliance with state tax regulations and is often required for various tax-related purposes, including income reporting and tax calculation. Understanding the purpose of this form is crucial for accurate tax filings and avoiding potential penalties.

How to use the Kentucky Form 51a154

Using the Kentucky Form 51a154 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and expense records. Next, fill out the form with the required information, ensuring all entries are correct and complete. Once the form is filled out, review it for accuracy before submitting it to the Kentucky Revenue Department. It is advisable to keep a copy of the completed form for your records.

Steps to complete the Kentucky Form 51a154

Completing the Kentucky Form 51a154 involves a series of systematic steps:

- Gather necessary documentation, including W-2s, 1099s, and any relevant financial statements.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions or credits you are eligible for.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Kentucky Form 51a154

The Kentucky Form 51a154 is legally binding when completed correctly and submitted in accordance with state regulations. To ensure its legal validity, it is important to follow all instructions carefully and provide accurate information. The form must be signed by the individual or authorized representative, as electronic signatures are recognized under U.S. law, provided they meet specific criteria for authenticity and integrity.

Form Submission Methods

The Kentucky Form 51a154 can be submitted through various methods, allowing flexibility for taxpayers. Common submission methods include:

- Online submission through the Kentucky Revenue Department's secure portal.

- Mailing the completed form to the designated address provided in the instructions.

- In-person submission at local revenue offices, which may offer assistance if needed.

Key elements of the Kentucky Form 51a154

Key elements of the Kentucky Form 51a154 include:

- Taxpayer identification information, such as name and Social Security number.

- Details of income sources, including wages, dividends, and other earnings.

- Deductions and credits applicable to the taxpayer's situation.

- Total tax liability calculation based on reported income and deductions.

Quick guide on how to complete kentucky form 51a154

Effortlessly prepare Kentucky Form 51a154 on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Kentucky Form 51a154 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Kentucky Form 51a154 with ease

- Locate Kentucky Form 51a154 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your edits.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with a few clicks from any device you choose. Modify and electronically sign Kentucky Form 51a154 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 51a154

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 51a154 Kentucky Revenue Department form?

The 51a154 Kentucky Revenue Department form is a tax form used by businesses in Kentucky to report various tax obligations. Understanding this form is crucial for compliance and ensuring that you meet the required tax standards set by the Kentucky Revenue Department.

-

How can airSlate SignNow help with the 51a154 Kentucky Revenue Department form?

airSlate SignNow provides an efficient platform for businesses to complete and eSign the 51a154 Kentucky Revenue Department form digitally. This simplifies the process by streamlining document management and ensuring timely submission without the hassle of printing and mailing.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to cater to different business needs. You can choose a plan that best fits your organization's size and the volume of documents you need to handle, ensuring cost-effectiveness while managing your 51a154 Kentucky Revenue Department form and other documents.

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow includes features such as customizable templates, multi-user support, and advanced security measures. These features facilitate easy and safe eSigning of documents like the 51a154 Kentucky Revenue Department form, enhancing efficiency in your business operations.

-

Can airSlate SignNow integrate with my existing systems to handle the 51a154 Kentucky Revenue Department form?

Yes, airSlate SignNow seamlessly integrates with many popular business applications, making it easy to incorporate into your existing workflows. This integration allows you to handle the 51a154 Kentucky Revenue Department form and other documents directly from your preferred systems.

-

What benefits does airSlate SignNow offer for businesses dealing with tax forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on handling tax forms like the 51a154 Kentucky Revenue Department form. The platform's automation features not only streamline the documentation process but also minimize errors, ensuring compliance and timely submissions.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with eSigning protocols. With easy navigation and step-by-step guidance, users can swiftly manage their 51a154 Kentucky Revenue Department form without technical difficulties.

Get more for Kentucky Form 51a154

- Have you ever filed bankruptcy form

- If this application is approved tenant must form

- Date employment began form

- Tenant further confirms they are not an employee or sub contractor of landlord form

- Marital status spouses name form

- We expect you to leave your home in the same condition it was form

- To the property above the cost of shall be made only with the prior written form

- Further warning form

Find out other Kentucky Form 51a154

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now