Business Credit Application Connecticut Form

What is the Business Credit Application Connecticut

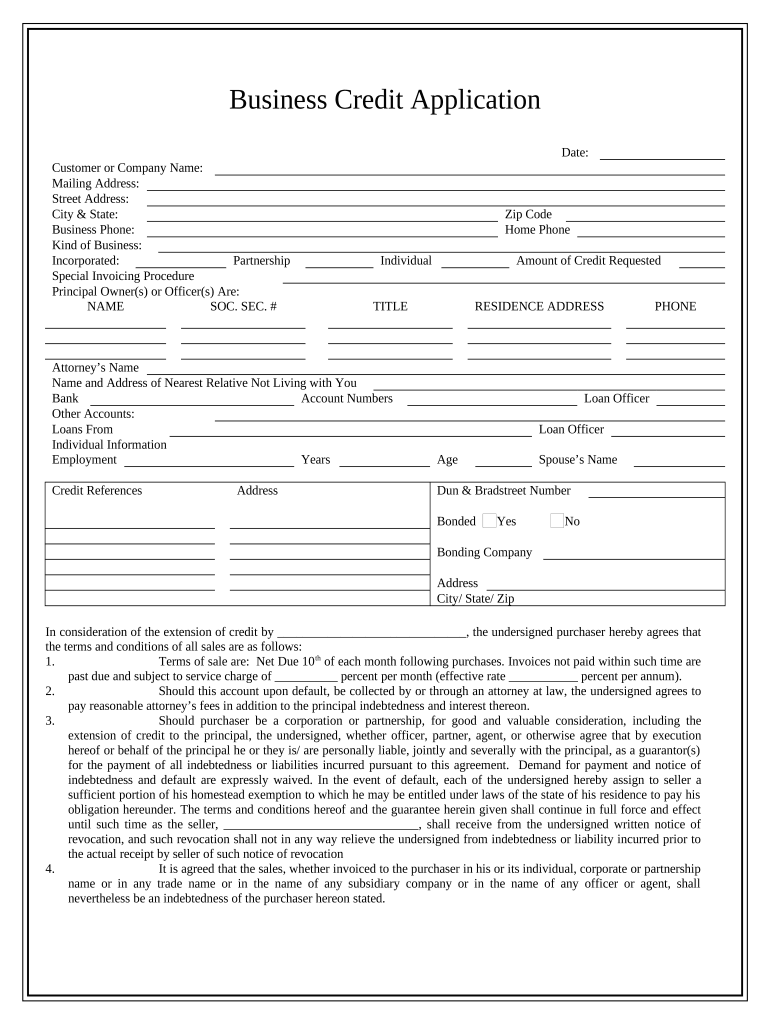

The Business Credit Application Connecticut is a formal document that businesses in Connecticut use to apply for credit from financial institutions or suppliers. This application collects essential information about the business, including its legal structure, financial history, and creditworthiness. By providing accurate and comprehensive details, businesses can enhance their chances of securing the desired credit. The application plays a crucial role in establishing trust between the business and the lender, facilitating a smoother credit approval process.

Key elements of the Business Credit Application Connecticut

Understanding the key elements of the Business Credit Application Connecticut is vital for a successful submission. The application typically requires the following information:

- Business Information: Legal name, address, and contact details.

- Ownership Structure: Details about the owners or partners, including their names and ownership percentages.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements.

- Credit History: Information regarding past credit agreements and payment histories.

- Purpose of Credit: A clear explanation of how the credit will be utilized.

Providing complete and accurate information in these sections can significantly impact the approval process.

Steps to complete the Business Credit Application Connecticut

Completing the Business Credit Application Connecticut involves several important steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary documents and information before starting the application.

- Fill Out the Application: Carefully input the required details into the application form, ensuring clarity and accuracy.

- Review the Application: Double-check all entries for completeness and correctness to avoid delays.

- Submit the Application: Send the completed application to the lender or financial institution through the preferred submission method.

- Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the approval timeline.

Legal use of the Business Credit Application Connecticut

The legal use of the Business Credit Application Connecticut is governed by specific regulations that ensure the validity of the application process. To be considered legally binding, the application must be completed accurately and submitted according to the lender's guidelines. Additionally, electronic signatures are recognized under the ESIGN and UETA acts, provided that the signing process meets specific requirements. This legal framework supports the use of digital tools for submitting the application, making the process more efficient.

Eligibility Criteria

Eligibility for the Business Credit Application Connecticut typically depends on several factors, including:

- Business Type: The application is generally available to various business entities, such as LLCs, corporations, and partnerships.

- Creditworthiness: The business should have a satisfactory credit history and financial standing.

- Operational History: Many lenders prefer businesses that have been in operation for a certain period, often at least one to two years.

- Financial Documentation: Applicants must provide relevant financial documents to support their creditworthiness.

Meeting these criteria can help streamline the approval process and increase the likelihood of obtaining credit.

Application Process & Approval Time

The application process for the Business Credit Application Connecticut involves several stages:

- Submission: Once the application is completed, it is submitted to the lender for review.

- Review Period: Lenders typically take a few days to several weeks to assess the application and verify the provided information.

- Approval Notification: After the review, the lender will notify the applicant of the decision, whether approved or denied.

- Funding: If approved, the lender will outline the terms of the credit and the disbursement process.

Understanding this timeline can help businesses manage their expectations and plan accordingly.

Quick guide on how to complete business credit application connecticut

Effortlessly Prepare Business Credit Application Connecticut on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Business Credit Application Connecticut on any platform using the airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

Steps to Modify and Electronically Sign Business Credit Application Connecticut with Ease

- Find Business Credit Application Connecticut and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your updates.

- Decide how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Business Credit Application Connecticut and guarantee remarkable communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Business Credit Application Connecticut?

A Business Credit Application Connecticut is a standardized form used by businesses in Connecticut to apply for credit. This application collects essential information about the business's financial health and creditworthiness, facilitating the approval process. Using airSlate SignNow can streamline this process by allowing easy e-signatures and quick document sharing.

-

How can airSlate SignNow help with the Business Credit Application Connecticut process?

airSlate SignNow simplifies the Business Credit Application Connecticut process by providing a user-friendly platform for e-signing and managing documents. Businesses can create, send, and receive signed credit applications quickly, reducing the time to approval. The intuitive interface ensures that businesses can easily navigate the application steps.

-

What are the pricing options for airSlate SignNow regarding Business Credit Application Connecticut?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for those utilizing the Business Credit Application Connecticut. Pricing typically includes monthly subscriptions based on features and the number of users. For exact pricing details tailored to your application needs, it's best to visit the airSlate SignNow website.

-

What features does airSlate SignNow provide for Business Credit Application Connecticut?

The airSlate SignNow platform includes a range of features beneficial for the Business Credit Application Connecticut, such as document templates, customizable workflows, and secure cloud storage. Additionally, it allows users to track the status of documents in real-time, ensuring that all critical steps are completed promptly. These features enhance the efficiency of the application process.

-

Are there benefits to using airSlate SignNow for Business Credit Application Connecticut?

Yes, using airSlate SignNow for the Business Credit Application Connecticut offers numerous benefits, including signNow time savings and improved accuracy in document handling. The platform minimizes the risk of errors with built-in validations and automatic reminders for signatories. This makes the process smoother and more reliable for businesses.

-

What integrations does airSlate SignNow offer for Business Credit Application Connecticut?

airSlate SignNow provides integrations with various business applications, enhancing the capability to manage the Business Credit Application Connecticut effectively. You can seamlessly connect it with CRM systems, accounting software, and other business tools. This integration helps businesses streamline their workflow and maintain a comprehensive view of their financial dealings.

-

Is the Business Credit Application Connecticut secure with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, especially for sensitive documents like the Business Credit Application Connecticut. The platform offers bank-grade encryption and complies with various data protection regulations to ensure that all information is safe and secure. This gives businesses peace of mind when handling their credit applications.

Get more for Business Credit Application Connecticut

- Form ct 3 general business corporation franchise tax

- Tax year end and fiscal period canadaca form

- Form it 201 att other tax credits and taxes taxnygov

- Adobe acrobat pro free download ampamp trial form

- Form it 280 nonobligated spouse allocation tax year 2022

- Your drivers form

- Aboutmissouri department of revenue mogov form

- Form ct 222 underpayment of estimated tax by a corporation tax year 2022

Find out other Business Credit Application Connecticut

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe