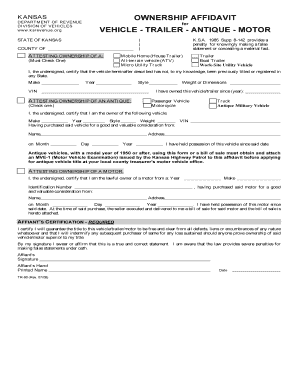

Ksrevenue Org Form

What is the Ksrevenue Org

The ksrevenue org is a vital form used within the United States for various tax-related purposes. It serves as a means for individuals and businesses to report income, claim deductions, and fulfill their tax obligations. Understanding the specifics of this form is crucial for accurate tax filing and compliance with federal and state regulations.

How to use the Ksrevenue Org

Using the ksrevenue org involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information is current and complete. After completing the form, review it for any errors before submission. Depending on your preference, you can submit the form electronically or via mail.

Steps to complete the Ksrevenue Org

Completing the ksrevenue org requires attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and other earnings.

- Claim any eligible deductions or credits.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, depending on your choice.

Legal use of the Ksrevenue Org

The ksrevenue org is legally binding when filled out correctly and submitted in accordance with IRS regulations. To ensure its legal validity, it is essential to comply with all federal and state laws governing tax reporting. Utilizing a reliable eSignature tool can enhance the legitimacy of the form by providing a secure method for signing and submitting electronically.

Filing Deadlines / Important Dates

Timely filing of the ksrevenue org is crucial to avoid penalties. Key deadlines typically include:

- April 15: Standard deadline for individual tax returns.

- October 15: Extended deadline for those who filed for an extension.

It is important to stay informed about any changes to these dates, as they can vary yearly or due to specific circumstances.

Required Documents

To complete the ksrevenue org, certain documents are necessary. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process and help ensure accuracy.

Quick guide on how to complete ksrevenue org

Complete Ksrevenue Org effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Ksrevenue Org on any device with airSlate SignNow Android or iOS applications and simplify your document-related processes today.

The easiest way to edit and eSign Ksrevenue Org with ease

- Obtain Ksrevenue Org and click on Get Form to commence.

- Utilize the tools we offer to fill in your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about missing or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign Ksrevenue Org and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ksrevenue org

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ksrevenue org and how is it related to airSlate SignNow?

ksrevenue org is a service that offers online tools for managing and filing tax-related documents. With airSlate SignNow, businesses can easily eSign documents and streamline their interactions with ksrevenue org, enhancing efficiency.

-

How does airSlate SignNow pricing compare for users of ksrevenue org?

airSlate SignNow offers cost-effective solutions that can signNowly benefit users engaging with ksrevenue org. We provide various pricing tiers that cater to businesses of all sizes, ensuring you find a plan that meets your needs and budget.

-

What features does airSlate SignNow offer for ksrevenue org users?

airSlate SignNow provides a range of features including document templates, secure cloud storage, and automated workflows. These tools are designed to facilitate easier document management for users interacting with ksrevenue org, helping to optimize your tax filing process.

-

How can airSlate SignNow improve my experience with ksrevenue org?

Using airSlate SignNow can simplify your experience with ksrevenue org by allowing you to eSign important tax documents quickly and securely. This integration boosts productivity and ensures that your documents are handled with the utmost care.

-

Are there any integrations available between airSlate SignNow and ksrevenue org?

Yes, airSlate SignNow supports integrations that allow for seamless connectivity with ksrevenue org. This means you can transmit tax documents and necessary forms effortlessly, reducing the time spent on manual workflows.

-

What benefits do I get when using airSlate SignNow with ksrevenue org?

When you use airSlate SignNow with ksrevenue org, you gain enhanced document security, faster processing times, and easier accessibility. This combination empowers businesses to manage their document workflows efficiently while staying compliant with tax regulations.

-

Can I customize templates for my ksrevenue org documents using airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize document templates that align with the requirements of ksrevenue org. This flexibility helps streamline your document preparation process, saving you valuable time.

Get more for Ksrevenue Org

- Fillable online sc articles of incorporation department of south form

- Free articles of organization 33 44 203 state of sou form

- South carolinas supreme court clarifies the requirements form

- Wife as joint tenants with rights of survivorship hereinafter grantees the following lands and form

- Grantor does grant bargain sell and release and by these presents do grant bargain sell and release form

- Release and by these presents do grant bargain sell and release unto and form

- Release and by these presents do grant bargain sell and release unto an form

- Improvements located thereon lying in the county of state of south form

Find out other Ksrevenue Org

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online