Fillable Online HBP Request to Withdraw Funds from an 2024-2026

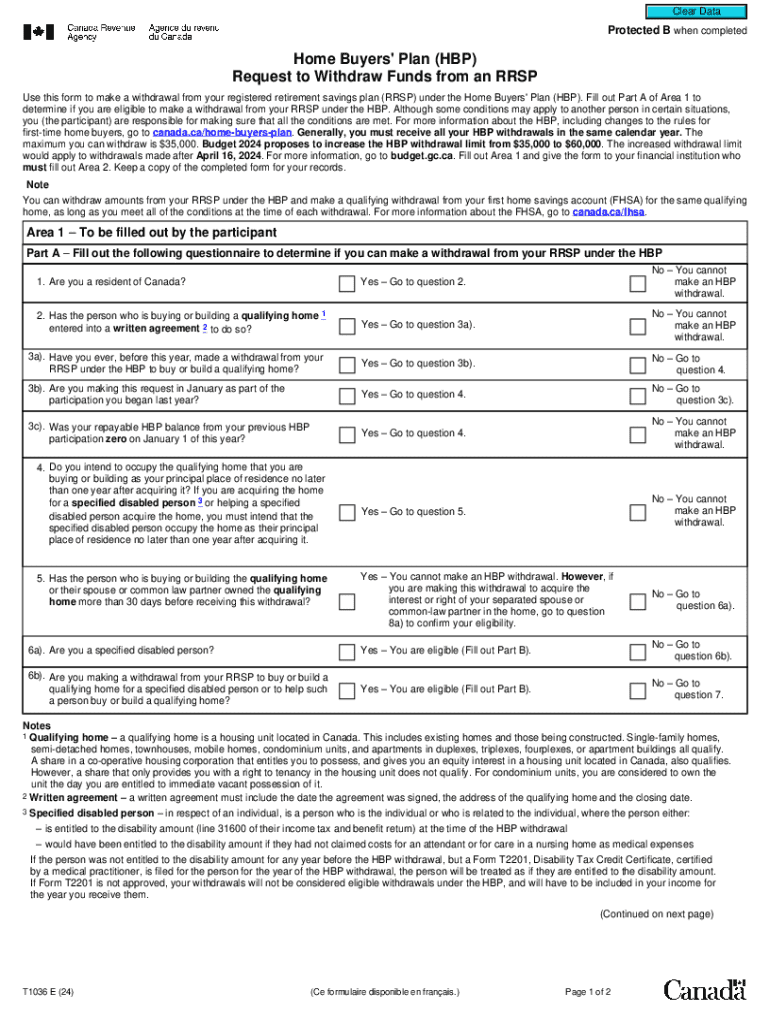

What is the Fillable Online HBP Request To Withdraw Funds From An RRSP?

The Fillable Online HBP Request To Withdraw Funds From An RRSP is a specific form used by individuals in the United States to access funds from their Registered Retirement Savings Plan (RRSP) under the Home Buyers' Plan (HBP). This program allows first-time home buyers to withdraw up to a certain amount from their RRSPs to help with the purchase of a home. The form is designed to facilitate this process, ensuring that applicants can easily submit their requests while complying with the necessary regulations.

Eligibility Criteria for the HBP Request Form

To qualify for the Home Buyers' Plan, applicants must meet specific eligibility criteria. These include being a first-time home buyer, having a written agreement to buy or build a qualifying home, and planning to live in the home as their principal residence within one year of withdrawal. Additionally, the funds must be repaid to the RRSP within a designated period, typically within 15 years. Understanding these criteria is essential to ensure that applicants can successfully utilize the withdrawal options available through the HBP.

Steps to Complete the Fillable Online HBP Request Form

Completing the Fillable Online HBP Request To Withdraw Funds From An RRSP involves several key steps. First, gather all necessary personal information, including your RRSP account details and identification. Next, accurately fill out the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form electronically, or print it for mailing, depending on your preference. Following these steps carefully helps streamline the withdrawal process and ensures compliance with regulations.

Required Documents for the HBP Request Form

When submitting the Fillable Online HBP Request To Withdraw Funds From An RRSP, certain documents are required to support your application. These typically include proof of your first-time home buyer status, a copy of the purchase agreement for the home, and identification documents. It is important to have these documents ready to avoid delays in processing your request. Ensuring that all required documentation is complete and accurate can significantly enhance the likelihood of a smooth withdrawal process.

Form Submission Methods

The Fillable Online HBP Request To Withdraw Funds From An RRSP can be submitted through various methods. Applicants can choose to submit the form electronically via a secure online portal, which is often the fastest option. Alternatively, the form can be printed and mailed to the appropriate financial institution or regulatory body. In some cases, in-person submission may also be an option, depending on the institution's policies. Understanding these submission methods can help applicants select the most convenient option for their needs.

IRS Guidelines for RRSP Withdrawals

When withdrawing funds from an RRSP under the Home Buyers' Plan, it is crucial to adhere to IRS guidelines. These guidelines outline the tax implications of the withdrawal, including potential penalties for non-compliance. It is advisable to consult with a tax professional to understand how these withdrawals may affect your tax situation. Staying informed about IRS regulations helps ensure that individuals can make the most of their RRSP funds without incurring unexpected tax liabilities.

Quick guide on how to complete fillable online hbp request to withdraw funds from an

Complete Fillable Online HBP Request To Withdraw Funds From An seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to find the suitable form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents quickly without interruptions. Manage Fillable Online HBP Request To Withdraw Funds From An on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign Fillable Online HBP Request To Withdraw Funds From An effortlessly

- Find Fillable Online HBP Request To Withdraw Funds From An and click Get Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online HBP Request To Withdraw Funds From An and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online hbp request to withdraw funds from an

Create this form in 5 minutes!

How to create an eSignature for the fillable online hbp request to withdraw funds from an

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a withdrawal RRSP qualifying?

A withdrawal RRSP qualifying refers to the conditions under which you can withdraw funds from your Registered Retirement Savings Plan (RRSP) without facing penalties. Understanding these qualifications is crucial for effective financial planning and ensuring you maximize your retirement savings.

-

How can airSlate SignNow help with withdrawal RRSP qualifying documents?

airSlate SignNow provides an efficient platform for businesses to send and eSign documents related to withdrawal RRSP qualifying. Our easy-to-use solution ensures that all necessary paperwork is completed accurately and securely, streamlining the process for both individuals and financial institutions.

-

Are there any fees associated with using airSlate SignNow for withdrawal RRSP qualifying?

Yes, airSlate SignNow offers a cost-effective pricing model that includes various plans to suit different business needs. While there may be fees associated with specific features, the overall value provided by our platform for managing withdrawal RRSP qualifying documents is signNow.

-

What features does airSlate SignNow offer for managing withdrawal RRSP qualifying?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing withdrawal RRSP qualifying documents. These tools help ensure compliance and efficiency in handling sensitive financial information.

-

Can I integrate airSlate SignNow with other financial software for withdrawal RRSP qualifying?

Absolutely! airSlate SignNow offers seamless integrations with various financial software solutions, making it easier to manage withdrawal RRSP qualifying processes. This interoperability enhances your workflow and ensures that all your financial documents are in sync.

-

What are the benefits of using airSlate SignNow for withdrawal RRSP qualifying?

Using airSlate SignNow for withdrawal RRSP qualifying provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your financial goals without the hassle of traditional document handling.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with withdrawal RRSP qualifying?

Yes, airSlate SignNow is designed to cater to both individuals and businesses managing withdrawal RRSP qualifying. Whether you're a financial advisor or an individual looking to withdraw funds, our platform offers the tools necessary to streamline the process.

Get more for Fillable Online HBP Request To Withdraw Funds From An

- Sfaa agreement to rent parking space cloudfront net form

- Montana form ina ct 11120143

- Psc01 form pdf

- Power of attorney for visa application form

- Wic prescriptions and clinical data form for infants wisconsin dhs wisconsin

- Renunciation of executor hudson county surrogate form

- Basketball coach contract template form

- Employee promotion contract template form

Find out other Fillable Online HBP Request To Withdraw Funds From An

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online