California Form 100x Instructions

What is the California Form 100x Instructions

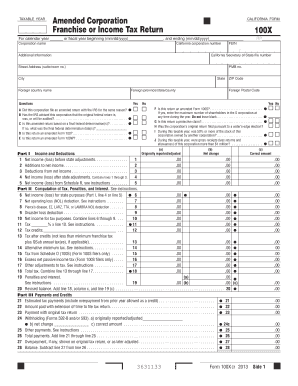

The California Form 100x instructions provide detailed guidance for businesses and individuals on how to properly complete the Form 100x, which is used for corporate tax purposes in California. This form is specifically designed for corporations that are seeking to amend their previously filed California corporate tax returns. Understanding the instructions is crucial for ensuring compliance with state tax regulations and for accurately reporting any changes in income, deductions, or credits.

Steps to complete the California Form 100x Instructions

To complete the California Form 100x instructions effectively, follow these essential steps:

- Gather all relevant financial documents, including previous tax returns and any supporting documentation for changes being reported.

- Carefully read through the Form 100x instructions to understand the requirements for amendments.

- Fill out the form accurately, ensuring that all necessary fields are completed, including details about the original return and the specific changes being made.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the specified methods outlined in the instructions, whether online, by mail, or in person.

Legal use of the California Form 100x Instructions

The legal use of the California Form 100x instructions is essential for ensuring that all amendments to corporate tax returns are valid and recognized by the California Franchise Tax Board. Compliance with the instructions ensures that the amended return meets all legal requirements, which can prevent potential penalties or issues during audits. It is important to follow the guidelines closely, as any discrepancies may lead to legal challenges or delays in processing the amended return.

Key elements of the California Form 100x Instructions

Key elements of the California Form 100x instructions include:

- Identification Information: This section requires the corporation's name, address, and tax identification number.

- Details of the Original Return: Information about the original tax return being amended must be provided.

- Changes Being Made: Clear explanations of the specific changes to income, deductions, or credits must be included.

- Signature Requirements: The form must be signed by an authorized representative of the corporation to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 100x are critical to ensure timely processing and compliance with state tax laws. Generally, the amended return must be filed within a specific period following the original return's due date. It is advisable to check the California Franchise Tax Board's official guidelines for the most current deadlines and any potential extensions that may apply.

Form Submission Methods (Online / Mail / In-Person)

The California Form 100x can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many corporations choose to file electronically for faster processing.

- Mail: The form can be printed and mailed to the appropriate address specified in the instructions.

- In-Person: Some businesses may opt to deliver the form in person to local tax offices for immediate confirmation of receipt.

Quick guide on how to complete california form 100x instructions

Complete California Form 100x Instructions effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage California Form 100x Instructions on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The most effective way to modify and eSign California Form 100x Instructions with ease

- Obtain California Form 100x Instructions and click on Get Form to start.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign California Form 100x Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 100x instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are CA Form 100X instructions?

CA Form 100X instructions refer to the guidelines provided for completing the California Corporation Annual Tax Return. These instructions help businesses file their taxes accurately and ensure compliance with California tax laws.

-

How can airSlate SignNow help with CA Form 100X instructions?

airSlate SignNow allows users to eSign and send CA Form 100X documents seamlessly. With our intuitive platform, businesses can easily fill out and submit their CA Form 100X by following the detailed instructions provided.

-

Is there a cost associated with using airSlate SignNow for CA Form 100X instructions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan provides access to features that simplify the process of filling out and submitting CA Form 100X instructions, enhancing both efficiency and affordability.

-

What features does airSlate SignNow offer for managing CA Form 100X?

Our platform offers essential features such as document templates, secure eSigning, and real-time collaboration. These tools make managing CA Form 100X paperwork straightforward and efficient, helping users adhere to the instructions with ease.

-

Can I integrate airSlate SignNow with my accounting software for CA Form 100X instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software options. This integration simplifies the process of applying CA Form 100X instructions by automatically transferring necessary data, reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for CA Form 100X filing?

Using airSlate SignNow for CA Form 100X filing enhances accuracy and speed. Our platform minimizes paperwork hassles, allowing businesses to focus on their operations while ensuring compliance with the CA Form 100X instructions.

-

Is there customer support available for CA Form 100X instructions with airSlate SignNow?

Yes, airSlate SignNow provides extensive customer support for users. Our team can assist you with questions regarding CA Form 100X instructions, ensuring that your filing process is smooth and efficient.

Get more for California Form 100x Instructions

- Take an annual financial check up townebank form

- Control number ut p077 pkg form

- Control number ut p080 pkg form

- Control number ut p081 pkg form

- Identity theftutah state tax commission form

- Control number ut p085 pkg form

- Control number ut p087 pkg form

- How to file a utah mechanics lien step by step guide form

Find out other California Form 100x Instructions

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile