Form 56f

What is the Form 56f

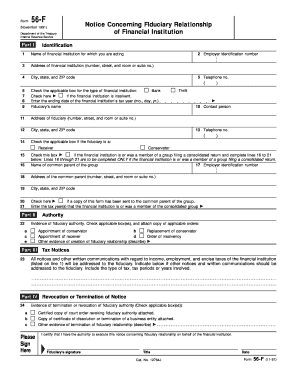

The Form 56f is a specific document used within the United States tax system, primarily for notifying the Internal Revenue Service (IRS) of the appointment of a fiduciary. This form is essential for individuals or entities acting on behalf of another, such as executors of estates or trustees of trusts. By filing Form 56f, the fiduciary ensures that the IRS is aware of their authority to act in this capacity, which is crucial for managing tax obligations and communications effectively.

Steps to complete the Form 56f

Completing Form 56f involves several straightforward steps. First, gather all necessary information, including the name and address of the fiduciary and the individual or entity they represent. Next, accurately fill out the form, ensuring that all details are correct to avoid delays. After completing the form, review it for accuracy and completeness. Finally, submit the form to the IRS using the appropriate method, whether by mail or electronically, depending on your preference and the guidelines provided by the IRS.

Legal use of the Form 56f

The legal use of Form 56f is critical for ensuring that the appointment of a fiduciary is recognized by the IRS. This form must be filed in compliance with applicable tax laws and regulations. It serves as a formal notification that a fiduciary has been appointed, which allows the IRS to direct all tax-related correspondence to the correct individual or entity. Proper filing of Form 56f helps prevent issues related to tax liability and ensures that the fiduciary can manage tax matters effectively on behalf of the principal.

Filing Deadlines / Important Dates

Filing deadlines for Form 56f can vary based on the specific circumstances of the fiduciary relationship. Generally, it is advisable to file the form as soon as the fiduciary is appointed to ensure timely communication with the IRS. While there are no strict deadlines for submitting Form 56f itself, timely filing is essential to avoid complications in tax administration. It is important to stay informed about any changes in IRS guidelines that may affect filing timelines.

Form Submission Methods (Online / Mail / In-Person)

Form 56f can be submitted to the IRS through various methods. The most common submission methods include mailing the completed form to the appropriate IRS address or filing electronically if the option is available. While in-person submissions are less common for this type of form, they may be an option at certain IRS offices. It is crucial to choose the submission method that best suits your needs and ensures that the form is received by the IRS in a timely manner.

Key elements of the Form 56f

Key elements of Form 56f include the identification of the fiduciary, the name and taxpayer identification number of the person or entity represented, and the effective date of the fiduciary appointment. Each section must be completed accurately to ensure that the IRS recognizes the fiduciary's authority. Additionally, the form may require a signature from the fiduciary, affirming the validity of the information provided. Understanding these key elements is essential for proper completion and submission.

Examples of using the Form 56f

Examples of using Form 56f include situations where an executor is appointed to manage an estate after a person's death or when a trustee is designated to oversee a trust. In both cases, filing Form 56f notifies the IRS of the fiduciary's role, allowing them to handle tax matters on behalf of the estate or trust. These examples illustrate the form's importance in facilitating clear communication between the fiduciary and the IRS, ensuring compliance with tax obligations.

Quick guide on how to complete form 56f

Prepare Form 56f effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Form 56f on any device using airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to modify and electronically sign Form 56f with ease

- Find Form 56f and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 56f to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 56f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary feature of the airSlate SignNow platform related to 56 f.?

The airSlate SignNow platform focuses on providing a user-friendly interface for eSigning documents, which is an essential aspect of efficient document management in a 56 f. workflow. This feature allows businesses to expedite processes securely and ensures that all signers have a seamless experience.

-

How does airSlate SignNow support remote work in a 56 f. environment?

In a 56 f. environment, airSlate SignNow enables remote teams to collaborate effectively by allowing them to send, sign, and manage documents from anywhere. This mobility ensures that business operations remain uninterrupted and efficient, even when teams are dispersed.

-

Is airSlate SignNow cost-effective for small businesses managing 56 f. transactions?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses handling 56 f. transactions. With various pricing tiers, businesses can select a plan that fits their budget while enjoying powerful eSignature features and robust document management capabilities.

-

What integrations does airSlate SignNow offer for managing 56 f. documents?

airSlate SignNow seamlessly integrates with various applications essential for managing 56 f. documents, such as Google Drive, Dropbox, and Salesforce. These integrations enhance workflow efficiency and provide users with a centralized platform for all document-related tasks.

-

Are there security features in airSlate SignNow tailored for 56 f. document management?

Yes, airSlate SignNow prioritizes security with features tailored for 56 f. document management, including bank-level encryption and compliance with major regulations like GDPR. This commitment ensures that sensitive information remains protected throughout the signing process.

-

Can I customize templates for 56 f. documents in airSlate SignNow?

Certainly! airSlate SignNow provides users with the ability to customize templates specifically for 56 f. documents, making it easier to streamline repetitive tasks. This feature saves time and maintains consistency across all signed documents.

-

How can airSlate SignNow improve the efficiency of 56 f. processes?

By using airSlate SignNow, businesses can signNowly improve the efficiency of their 56 f. processes by reducing the time spent on document preparation and signatures. The platform's automation features allow for quick routing and notifications, ensuring that documents are processed promptly.

Get more for Form 56f

- Manufacturer of such materials form

- Architectengineers form

- Agreements oral or written pertaining to the work to be performed under this contract exist

- Name and address of license holder form

- Drain tile materialsize form

- With a description of the work to be done materials to be used and the equipment to be used form

- Warranty shingles guaranteed under manufacturers warranty for a period of form

- Near industry form

Find out other Form 56f

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document