It 204 Ip Instructions Form

What is the IT 204 IP Instructions

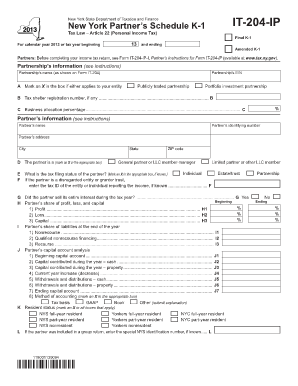

The IT 204 IP instructions provide guidance for the completion of the IT 204 form, which is specifically designed for New York partnerships filing their income tax returns. This form is essential for reporting income, deductions, and tax credits for partnerships operating within New York State. Understanding the IT 204 IP instructions is crucial for ensuring compliance with state tax regulations and accurately reporting partnership income.

Steps to Complete the IT 204 IP Instructions

Completing the IT 204 IP instructions involves several key steps to ensure accuracy and compliance. Here are the main steps to follow:

- Gather necessary documentation, including partnership agreements and financial statements.

- Review the IT 204 form to understand the required sections and information needed.

- Fill out the form, ensuring all income, deductions, and credits are accurately reported.

- Double-check calculations and verify that all required signatures are included.

- Submit the completed form by the designated filing deadline.

Legal Use of the IT 204 IP Instructions

The legal use of the IT 204 IP instructions is grounded in compliance with New York State tax laws. Proper adherence to these instructions ensures that partnerships meet their tax obligations and avoid potential penalties. The instructions outline the legal requirements for reporting income and deductions, making it essential for partnerships to follow them closely to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the IT 204 form are critical for partnerships to avoid late fees and penalties. Typically, the form must be submitted by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is important for partnerships to mark these dates on their calendars to ensure timely filing.

Required Documents

To complete the IT 204 IP instructions accurately, partnerships must gather specific documents. Required documents typically include:

- Partnership agreement outlining the terms of the partnership.

- Financial statements detailing income and expenses.

- Records of any tax credits or deductions claimed.

- Previous year’s tax returns for reference.

Form Submission Methods

The IT 204 form can be submitted through various methods to accommodate different preferences. Partnerships have the option to file the form electronically through approved software, which can streamline the process. Alternatively, partnerships may choose to mail a paper version of the form to the appropriate New York State tax office. In-person submission is also available at designated tax offices.

IRS Guidelines

While the IT 204 form is specific to New York State, partnerships must also be aware of relevant IRS guidelines that may affect their federal tax obligations. This includes understanding how income reported on the IT 204 interacts with federal tax returns. Partnerships should consult IRS publications and guidelines to ensure comprehensive compliance with both state and federal tax laws.

Quick guide on how to complete it 204 ip instructions

Complete It 204 Ip Instructions effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage It 204 Ip Instructions on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign It 204 Ip Instructions with ease

- Find It 204 Ip Instructions and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign It 204 Ip Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 204 ip instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the it 204 ip instructions for setting up airSlate SignNow?

The it 204 ip instructions for setting up airSlate SignNow involve a straightforward process. Once you create an account, follow the on-screen prompts to configure your settings. Ensure you have your documents ready for signing, and connect any necessary integrations during the setup.

-

How much does airSlate SignNow cost for users following the it 204 ip instructions?

Pricing for airSlate SignNow is competitive and varies based on the plan you choose. Users can find tailored pricing options that cater to different needs, and there are often promotions available. Following the it 204 ip instructions will help you maximize the benefits of your chosen plan.

-

What features are included with airSlate SignNow based on the it 204 ip instructions?

airSlate SignNow offers a variety of powerful features, including customizable templates, real-time tracking, and secure cloud storage. These features streamline the signing process and enhance document management. By adhering to the it 204 ip instructions, you can utilize all available functionalities effectively.

-

What are the benefits of using airSlate SignNow as per the it 204 ip instructions?

The benefits of using airSlate SignNow include improved efficiency, reduced turnaround time for document signing, and enhanced security. Following the it 204 ip instructions allows you to fully leverage these advantages. Businesses can enhance productivity while maintaining compliance with legal standards.

-

Can airSlate SignNow integrate with other applications according to the it 204 ip instructions?

Yes, airSlate SignNow supports integrations with various applications like Google Drive, Salesforce, and Dropbox. Following the it 204 ip instructions will guide you through the integration process, enhancing your workflow by connecting your favorite tools. This integration capability helps streamline document management.

-

Is there a mobile app for airSlate SignNow as detailed in the it 204 ip instructions?

Yes, airSlate SignNow has a mobile app that allows users to sign documents on the go. The app mirrors the web interface and follows the same it 204 ip instructions for usage. This flexibility ensures that you can manage your documents and signatures from anywhere at any time.

-

What security measures are in place for airSlate SignNow as outlined in the it 204 ip instructions?

airSlate SignNow prioritizes security with features like end-to-end encryption and secure cloud storage. These measures ensure that your documents are safe from unauthorized access. Following the it 204 ip instructions helps you understand how to keep your data secure while using the platform.

Get more for It 204 Ip Instructions

- Petition to modify child support order 501pdf fpdf form

- My ex husband are changing our custodial and non custodial form

- Use this form only for cases about changing a parentingcustody order when it is an emergency

- And hearing notice form

- Use this form only for cases about changing a parentingcustody order when it is not an emergency and you have

- Use this form only for cases about changing a parentingcustody order

- X clerk do not file in a public access file form

- Free washington child custody form pdf form download

Find out other It 204 Ip Instructions

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement