Uniform Sales and Use Tax Certificate

What is the Uniform Sales And Use Tax Certificate

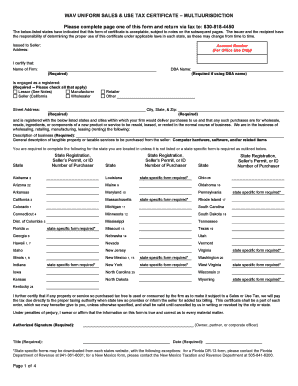

The uniform sales and use tax certificate is a document that allows businesses to make tax-exempt purchases of goods and services. This certificate is crucial for entities that resell products or use items in a manner that qualifies for tax exemption under state laws. It serves as proof that the buyer is not liable for sales tax on the transaction, provided that the items purchased are intended for resale or other exempt purposes.

How to use the Uniform Sales And Use Tax Certificate

To effectively use the uniform sales and use tax certificate, businesses must present it to suppliers at the time of purchase. It is essential to fill out the certificate accurately, including details such as the buyer's name, address, and the nature of the exempt purchase. Suppliers will typically keep a copy for their records, ensuring that they comply with tax regulations. This process helps maintain transparency and accountability in tax-exempt transactions.

Steps to complete the Uniform Sales And Use Tax Certificate

Completing the uniform sales and use tax certificate involves several key steps:

- Obtain the correct form from your state’s revenue department or authorized agency.

- Fill in your business name, address, and the type of business entity.

- Specify the reason for the exemption, such as resale or manufacturing.

- Include the seller's information and the date of the transaction.

- Sign and date the certificate to validate it.

Ensure that all information is accurate to avoid issues with tax compliance.

Legal use of the Uniform Sales And Use Tax Certificate

The legal use of the uniform sales and use tax certificate is governed by state laws. Businesses must ensure that the certificate is used solely for qualifying purchases. Misuse of the certificate, such as using it for personal items or non-exempt purchases, can lead to penalties, including fines or back taxes owed. It is important to understand the specific regulations in your state to maintain compliance.

State-specific rules for the Uniform Sales And Use Tax Certificate

Each state in the U.S. has its own rules regarding the uniform sales and use tax certificate. While the basic structure of the certificate is consistent, the requirements for filling it out and the types of exemptions allowed can vary. Businesses should familiarize themselves with their state’s regulations to ensure proper use. This includes understanding which types of purchases qualify for exemption and any additional documentation that may be required.

Examples of using the Uniform Sales And Use Tax Certificate

Examples of using the uniform sales and use tax certificate include:

- A retailer purchasing inventory for resale.

- A contractor buying materials for a construction project that will not be taxed.

- A manufacturer acquiring machinery that will be used in production.

In each case, the certificate must be presented to the seller to validate the tax-exempt status of the purchase.

Quick guide on how to complete uniform sales and use tax certificate 6051356

Prepare Uniform Sales And Use Tax Certificate easily on any device

Managing documents online has gained popularity among both businesses and individuals. It offers a perfect eco-friendly substitute for conventional physical paperwork since you can locate the required form and securely store it online. airSlate SignNow supplies you with all the tools necessary to generate, modify, and eSign your documents quickly without delays. Handle Uniform Sales And Use Tax Certificate on any platform using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to alter and eSign Uniform Sales And Use Tax Certificate effortlessly

- Obtain Uniform Sales And Use Tax Certificate and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your preference. Alter and eSign Uniform Sales And Use Tax Certificate and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uniform sales and use tax certificate 6051356

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a uniform sales and use tax certificate?

A uniform sales and use tax certificate is a standardized document that allows businesses to purchase goods and services without paying sales tax, provided they intend to resell these items. This certificate is crucial for ensuring compliance with state tax regulations while also facilitating smooth transactions between vendors and buyers. By utilizing a uniform sales and use tax certificate, businesses streamline their purchasing processes.

-

How can airSlate SignNow help me manage uniform sales and use tax certificates?

AirSlate SignNow offers features that allow businesses to easily send, sign, and store their uniform sales and use tax certificates electronically. Our platform simplifies the documentation process, ensuring that you can quickly access and share your certificates as needed. This not only saves time but also helps maintain compliance with tax regulations.

-

Are there any costs associated with obtaining a uniform sales and use tax certificate?

Obtaining a uniform sales and use tax certificate typically involves some state-specific application and renewal fees. However, using airSlate SignNow can help minimize overall costs by providing an affordable eSignature solution to manage your documentation needs efficiently. We believe in offering a cost-effective platform that enhances your business operations.

-

What features does airSlate SignNow offer for handling uniform sales and use tax certificates?

AirSlate SignNow provides a robust set of features, including customizable templates for your uniform sales and use tax certificates, secure electronic signatures, and automated workflows. With these tools, you can easily create, send, and track your certificates, ensuring a smooth and efficient process. Our platform is designed to simplify document management for your business.

-

Can I integrate airSlate SignNow with other tools for managing tax documents?

Yes, airSlate SignNow offers seamless integration with various business applications, enhancing your workflow management for uniform sales and use tax certificates. Whether you're using CRM systems or accounting software, our platform can work alongside your existing tools to ensure your documents are easily accessible and properly managed. This integration is key to maintaining efficiency.

-

What benefits does airSlate SignNow provide for managing uniform sales and use tax certificates?

By using airSlate SignNow for your uniform sales and use tax certificates, you not only gain efficiency in document handling but also enhance team collaboration and compliance tracking. Our user-friendly interface allows your team members to manage certificates effortlessly, reducing the chances of errors. Overall, this leads to streamlined operations and better resource allocation.

-

Is airSlate SignNow suitable for small businesses needing uniform sales and use tax certificates?

Absolutely! AirSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses requiring uniform sales and use tax certificates. Our cost-effective solution allows you to manage your documentation without overwhelming expenses or complex setups. Small businesses can benefit signNowly from our platform's efficiency and ease of use.

Get more for Uniform Sales And Use Tax Certificate

- Trespass timber form

- Mississippi motion dismiss 497314771 form

- Mississippi trespass 497314772 form

- Motion in limine to prohibit evidence on the issue of performance productivity and or efficiency mississippi

- Complaint mississippi 497314774 form

- Mississippi conversion 497314775 form

- Order of dismissal mississippi 497314776 form

- Complaint to vacate and or alter a recorded plat and for other relief mississippi 497314778 form

Find out other Uniform Sales And Use Tax Certificate

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile