Missouri Trust Form

What is the Missouri Trust

The Missouri Trust is a legal arrangement that allows individuals to transfer assets into a trust for the benefit of designated beneficiaries. This type of trust can be used for various purposes, including estate planning, asset protection, and tax benefits. By establishing a Missouri Trust, the grantor can maintain control over the assets while ensuring they are managed according to their wishes. This trust is governed by Missouri state laws, which outline the rights and responsibilities of all parties involved.

How to use the Missouri Trust

Using a Missouri Trust involves several key steps. First, the grantor must decide on the type of trust that best suits their needs, whether revocable or irrevocable. Next, they will need to draft the trust document, specifying the terms, beneficiaries, and trustee. After the trust is created, the grantor must fund it by transferring assets into the trust. It is important to keep records of all transactions and ensure that the trust complies with state regulations. Regular reviews and updates may be necessary to adapt to changes in the law or personal circumstances.

Steps to complete the Missouri Trust

Completing a Missouri Trust involves a systematic approach:

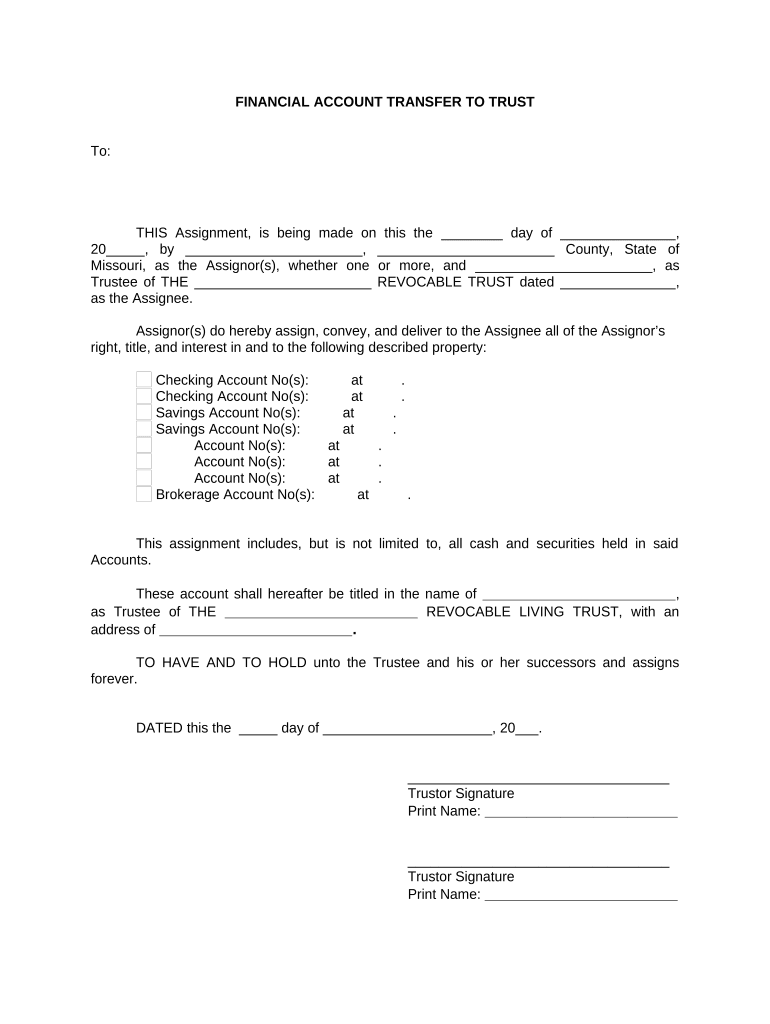

- Determine the type of trust: Choose between a revocable or irrevocable trust based on your goals.

- Draft the trust document: Include essential details such as the grantor, trustee, beneficiaries, and distribution terms.

- Sign the document: Ensure that the trust document is signed in accordance with Missouri law, which may require witnesses or notarization.

- Fund the trust: Transfer assets into the trust, which may include real estate, bank accounts, or investments.

- Review and update: Regularly review the trust to ensure it meets your current needs and complies with any changes in the law.

Legal use of the Missouri Trust

The legal use of a Missouri Trust is defined by state laws that govern trusts and estates. It is essential to ensure that the trust is established and maintained in compliance with these laws to be considered valid. The trust must have a clear purpose, identifiable beneficiaries, and a trustee responsible for managing the assets. Additionally, the trust document should outline the distribution of assets upon the grantor's death or incapacitation, ensuring that the grantor's wishes are honored.

Key elements of the Missouri Trust

Several key elements define the structure and function of a Missouri Trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and carrying out the terms of the trust.

- Beneficiaries: Individuals or entities designated to receive the benefits from the trust.

- Trust document: A legal document that outlines the terms and conditions of the trust, including asset distribution and management.

- Funding: The process of transferring assets into the trust to ensure it operates as intended.

State-specific rules for the Missouri Trust

Missouri has specific rules governing the creation and management of trusts. These rules include requirements for the trust document, such as the necessity for signatures and potential witness or notarization requirements. Additionally, Missouri law outlines the responsibilities of trustees, including fiduciary duties to act in the best interest of the beneficiaries. It is crucial for individuals establishing a trust in Missouri to be aware of these regulations to ensure compliance and validity.

Quick guide on how to complete missouri trust 497313348

Complete Missouri Trust smoothly on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional hardcopy paperwork by allowing you to locate the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any holdups. Manage Missouri Trust across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to edit and eSign Missouri Trust with ease

- Locate Missouri Trust and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or redact sensitive information with the features that airSlate SignNow has specifically designed for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or sharing link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Missouri Trust to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Missouri trust?

A Missouri trust is a legal arrangement that allows an individual to manage assets for the benefit of beneficiaries. Trusts in Missouri can help avoid probate, reduce estate taxes, and provide clear instructions for asset distribution. Understanding the rules and regulations regarding Missouri trusts is crucial for effective estate planning.

-

How can airSlate SignNow facilitate the creation of a Missouri trust?

airSlate SignNow simplifies the process of drafting and signing documents needed to establish a Missouri trust. With its user-friendly interface, you can easily create trust agreements and ensure secure electronic signatures. The platform streamlines document management, making it ideal for setting up trusts efficiently.

-

What are the key benefits of using airSlate SignNow for Missouri trust management?

Using airSlate SignNow for Missouri trust management offers several benefits, including enhanced security and accessibility of documents. It allows you to manage trust-related documents from anywhere, ensuring that you can oversee your trust efficiently. Additionally, the platform helps reduce paperwork and is cost-effective, making trust management hassle-free.

-

What features does airSlate SignNow offer for managing a Missouri trust?

airSlate SignNow provides features such as document sending, eSigning, and customizable templates tailored for Missouri trust documents. It also includes audit trails to track document activity and secure cloud storage for easy access. These functionalities ensure comprehensive management of trust-related documentation.

-

Are there any costs associated with using airSlate SignNow for my Missouri trust documentation?

Yes, airSlate SignNow offers several pricing plans to suit various needs, including options for individuals and businesses managing a Missouri trust. Each plan comes with essential features for document management and eSigning at a competitive price. Check the website for the most up-to-date pricing and plan details.

-

How does airSlate SignNow ensure the security of my Missouri trust documents?

airSlate SignNow takes document security seriously, employing advanced encryption methods to protect your Missouri trust files. Additionally, the platform complies with industry standards and regulations to ensure that all data remains confidential and secure. You can trust that your sensitive information is safe when using our services.

-

Can I integrate airSlate SignNow with other tools for my Missouri trust management?

Absolutely! airSlate SignNow offers integration options with various third-party applications, making it easy to connect with tools you may already use for managing your Missouri trust. This interoperability helps streamline your workflows and enhances overall efficiency, allowing for better management of trust documents.

Get more for Missouri Trust

Find out other Missouri Trust

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online