Irs Complaint Form 13909 2016

What is the IRS Complaint Form 13909

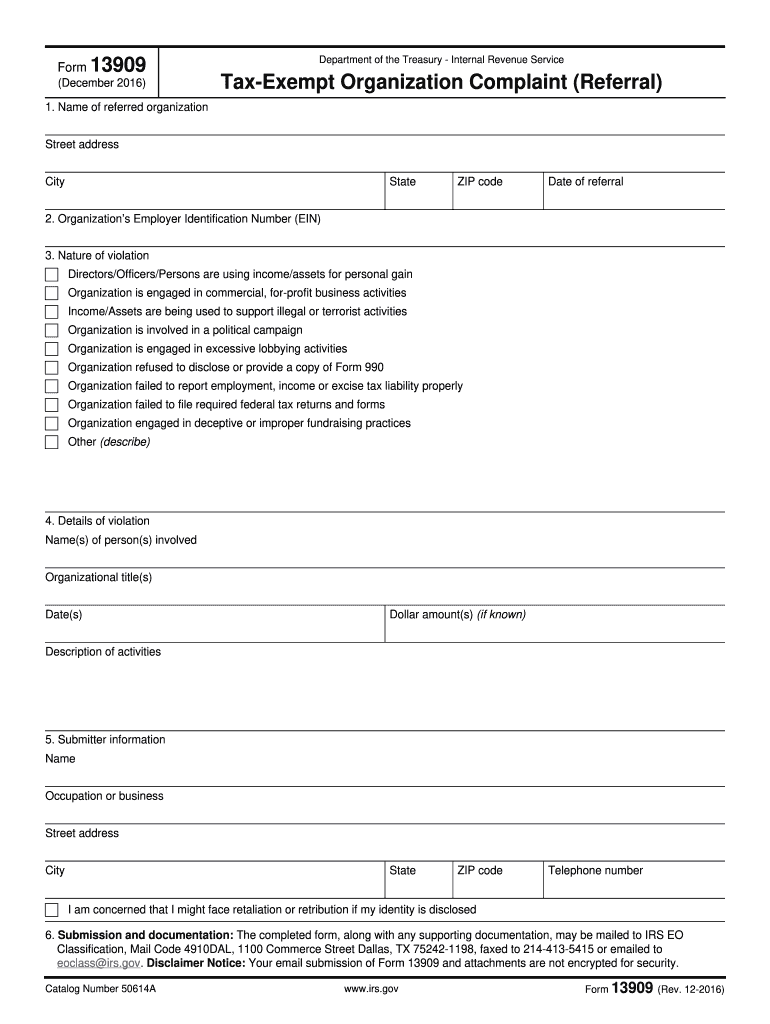

The IRS Complaint Form 13909 is a crucial document used to report violations related to tax-exempt organizations, specifically those classified under section 501(c)(3) of the Internal Revenue Code. This form allows individuals and entities to submit complaints regarding potential misconduct by these organizations, such as improper activities, lack of compliance with operational standards, or failure to adhere to the rules governing tax-exempt status.

How to Use the IRS Complaint Form 13909

Using the IRS Complaint Form 13909 involves several key steps. First, gather all relevant information regarding the organization you wish to report. This includes the organization's name, address, and any specific details related to the complaint. Next, complete the form by providing accurate and detailed information in the required fields. It is essential to be clear and concise, as this will aid the IRS in understanding the nature of the complaint. Once completed, submit the form according to the provided instructions.

Steps to Complete the IRS Complaint Form 13909

Completing the IRS Complaint Form 13909 requires careful attention to detail. Follow these steps:

- Begin by downloading the IRS Form 13909 PDF from an official source.

- Fill in your personal information, including your name, address, and contact details.

- Provide the name and address of the organization you are reporting.

- Clearly describe the nature of the complaint, including specific incidents or behaviors that prompted your report.

- Attach any supporting documentation that may help substantiate your claims.

- Review the completed form for accuracy before submission.

Legal Use of the IRS Complaint Form 13909

The IRS Complaint Form 13909 is legally recognized as a formal means of reporting issues concerning tax-exempt organizations. It is important to understand that submitting this form is a serious matter and should only be used for legitimate concerns regarding compliance with IRS regulations. Misuse of the form, such as filing false complaints, can lead to legal repercussions.

Form Submission Methods

The IRS Complaint Form 13909 can be submitted in various ways to ensure convenience for users. You may choose to file the form electronically, utilizing secure online platforms that comply with IRS standards. Alternatively, you can print the completed form and mail it directly to the appropriate IRS office. Ensure that you follow the submission guidelines provided with the form to avoid delays in processing your complaint.

Key Elements of the IRS Complaint Form 13909

Understanding the key elements of the IRS Complaint Form 13909 is essential for effective reporting. The form typically includes sections for personal information, details about the organization being reported, and a narrative section where you can explain the nature of your complaint. Additionally, there may be a checklist for required attachments and a declaration confirming the accuracy of the information provided. Ensuring that all elements are thoroughly completed will enhance the clarity and impact of your submission.

Quick guide on how to complete irs 13909 complaint 2016 2019 form

Explore the easiest approach to complete and sign your Irs Complaint Form 13909

Are you still spending time preparing your official paperwork on printed forms instead of utilizing online methods? airSlate SignNow offers a superior way to complete and sign your Irs Complaint Form 13909 and analogous forms for public services. Our intelligent eSignature solution equips you with all the tools necessary to manage documentation swiftly and according to official standards - comprehensive PDF editing, organizing, safeguarding, signing, and sharing features are all available within a user-friendly interface.

There are just a few steps required to complete and sign your Irs Complaint Form 13909:

- Insert the editable template into the editor using the Get Form button.

- Identify what details you need to input in your Irs Complaint Form 13909.

- Navigate through the fields with the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross features to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize the essential parts or Redact sections that are no longer relevant.

- Hit Sign to create a legally enforceable eSignature using your preferred method.

- Add the Date beside your signature and finalize your task with the Done button.

Store your completed Irs Complaint Form 13909 in the Documents folder within your account, download it, or upload it to your chosen cloud service. Our solution also provides adaptable form-sharing options. There’s no need to print out your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it now!

Create this form in 5 minutes or less

Find and fill out the correct irs 13909 complaint 2016 2019 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

Create this form in 5 minutes!

How to create an eSignature for the irs 13909 complaint 2016 2019 form

How to make an electronic signature for your Irs 13909 Complaint 2016 2019 Form in the online mode

How to create an electronic signature for your Irs 13909 Complaint 2016 2019 Form in Chrome

How to make an eSignature for putting it on the Irs 13909 Complaint 2016 2019 Form in Gmail

How to generate an electronic signature for the Irs 13909 Complaint 2016 2019 Form straight from your smart phone

How to create an electronic signature for the Irs 13909 Complaint 2016 2019 Form on iOS

How to create an eSignature for the Irs 13909 Complaint 2016 2019 Form on Android

People also ask

-

What is the IRS Complaint Form 13909 and how do I use it?

The IRS Complaint Form 13909 is a tool for taxpayers to report suspected tax fraud or misconduct by tax professionals. By filling out this form, you can provide the IRS with essential details about the issue. Using airSlate SignNow, you can easily eSign and submit the form securely, ensuring your complaint signNowes the IRS promptly.

-

How can airSlate SignNow help me with the IRS Complaint Form 13909?

AirSlate SignNow simplifies the process of filling out the IRS Complaint Form 13909 by providing a user-friendly interface for document creation and eSigning. You can quickly upload your completed form, add signatures, and send it directly to the IRS without hassle. This streamlines your ability to report issues effectively.

-

Is there a cost associated with using airSlate SignNow for the IRS Complaint Form 13909?

AirSlate SignNow offers a variety of pricing plans to suit different needs, including cost-effective options for individuals and businesses. While the service is affordable, it provides excellent value by enabling you to efficiently manage documents like the IRS Complaint Form 13909. Check our pricing page for specific details.

-

Can I integrate airSlate SignNow with other applications for IRS Complaint Form 13909?

Yes, airSlate SignNow supports integrations with various applications, enhancing your workflow when dealing with documents like the IRS Complaint Form 13909. You can connect it with tools such as Google Drive, Dropbox, and more to streamline document management and storage.

-

What features does airSlate SignNow offer for managing the IRS Complaint Form 13909?

AirSlate SignNow offers features such as eSigning, document templates, and real-time collaboration, which can be particularly beneficial when handling the IRS Complaint Form 13909. These features allow you to prepare and send your complaint quickly, ensuring that all necessary parties can review and sign as needed.

-

How secure is airSlate SignNow for submitting the IRS Complaint Form 13909?

Security is a top priority at airSlate SignNow. When submitting the IRS Complaint Form 13909, your information is protected by advanced encryption protocols, ensuring that your sensitive data remains confidential. We comply with industry standards to safeguard your submissions.

-

Can I track the status of my IRS Complaint Form 13909 submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your IRS Complaint Form 13909 submission. You will receive notifications when your document is viewed and signed, giving you peace of mind during the process.

Get more for Irs Complaint Form 13909

- Internship time log form has vcu

- Personal trainer job application form pdf

- Notarial acknowledgement state of bnotary2prob form

- Olcc permits po box 22297 milwaukie or 97269 2297 oregon form

- How to save pay stub as pdf form

- Transcript request form hazelwoodschoolsorg

- Notice of intended sale form

- Arc membership columbia mo form

Find out other Irs Complaint Form 13909

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement