171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud 2007

What is the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

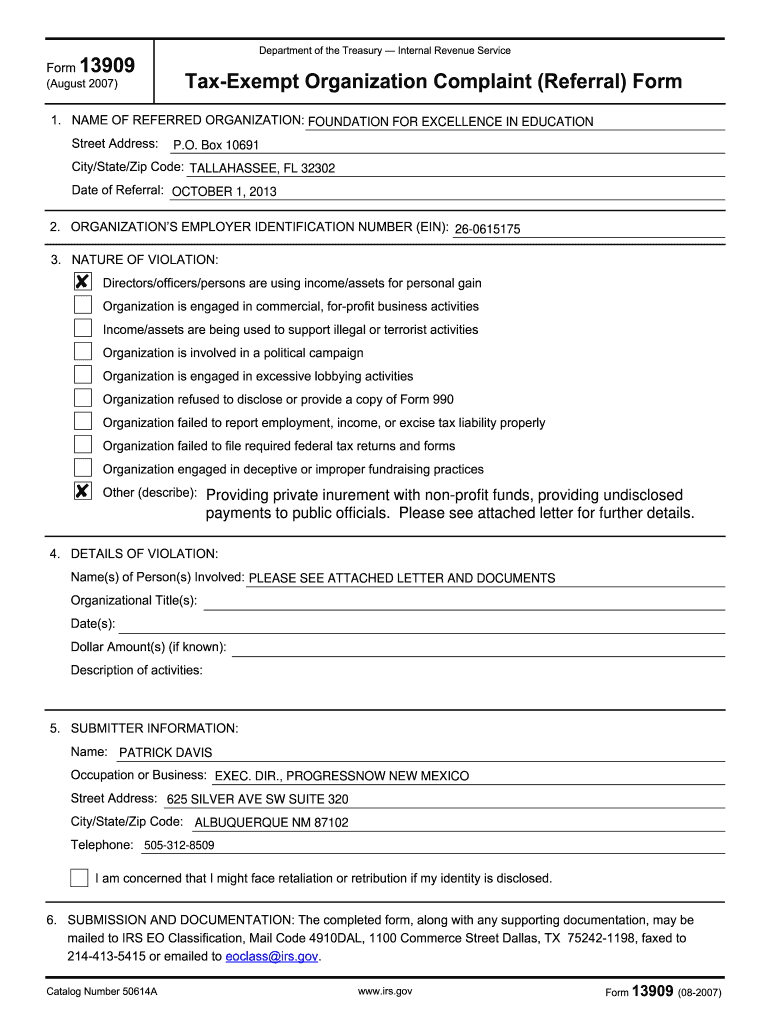

The 171199541 IRS Form 13909 is a critical document used by taxpayers in the United States to report concerns regarding the tax-exempt status of an organization. This form is particularly relevant for individuals or entities that believe a tax-exempt organization is not complying with the requirements of its tax-exempt status. The form allows individuals to provide detailed information about the organization in question, enabling the IRS to investigate and take appropriate action if necessary.

How to use the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

Using the 171199541 IRS Form 13909 involves several straightforward steps. First, download the PDF version of the form from a reliable source. Once you have the form, fill it out with accurate information, including your contact details and a description of your concerns regarding the organization's tax-exempt status. After completing the form, you can submit it to the IRS either electronically or via mail, depending on your preference. Ensure that you keep a copy of the submitted form for your records.

Steps to complete the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

Completing the 171199541 IRS Form 13909 requires careful attention to detail. Here are the essential steps:

- Download the form in PDF format from a trusted source.

- Provide your personal information, including name, address, and phone number.

- Enter the name and address of the organization you are reporting.

- Clearly describe your concerns and the reasons for your report.

- Sign and date the form to confirm the accuracy of the information provided.

Legal use of the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

The legal use of the 171199541 IRS Form 13909 is essential for maintaining transparency and accountability among tax-exempt organizations. This form serves as a formal mechanism for individuals to report suspected non-compliance with tax-exempt regulations. When submitted correctly, the form initiates a review process by the IRS, which may lead to further investigation. It is important to ensure that all information provided is truthful and accurate to avoid potential legal repercussions.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 13909. Taxpayers should familiarize themselves with these guidelines to ensure proper completion and submission. The IRS emphasizes the importance of detailed and factual reporting, as this information is crucial for their review process. Additionally, individuals should be aware of the confidentiality of their submissions, as the IRS aims to protect the identities of those who report concerns regarding tax-exempt organizations.

Filing Deadlines / Important Dates

Filing deadlines for the 171199541 IRS Form 13909 can vary depending on the circumstances surrounding the report. It is advisable to submit the form as soon as concerns arise to ensure timely review by the IRS. While there may not be a strict deadline for submitting this form, acting promptly can facilitate a quicker response and resolution to the issues reported. Keeping track of any relevant dates related to the organization in question can also be beneficial.

Quick guide on how to complete 171199541 irs form 13909 pdf documentcloud s3 documentcloud

Effortlessly Complete 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the right form and securely store it digitally. airSlate SignNow gives you all the essential tools to craft, modify, and eSign your documents quickly and without hassles. Manage 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud with Ease

- Locate 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow effectively meets your document management needs with just a few clicks from any device you prefer. Modify and eSign 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud to ensure smooth communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 171199541 irs form 13909 pdf documentcloud s3 documentcloud

Create this form in 5 minutes!

How to create an eSignature for the 171199541 irs form 13909 pdf documentcloud s3 documentcloud

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

The 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud is a specific IRS form used for reporting tax-exempt organizations. This form can be easily accessed and managed using airSlate SignNow's eSignature solution, making it simpler for businesses to handle their tax-related documentation effectively.

-

How does airSlate SignNow help with the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

airSlate SignNow allows users to upload, send, and eSign the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud directly from the platform. This streamlines the process of completing and submitting this important tax-related form efficiently, saving time and reducing errors.

-

What features does airSlate SignNow offer for managing the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

Some features that enhance the management of the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud include customizable templates, automated workflows, and a user-friendly interface. These features ensure that users can easily prepare, sign, and track their documents without any hassle.

-

Is airSlate SignNow a cost-effective solution for eSigning the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

Absolutely! airSlate SignNow offers competitive pricing plans that provide great value for businesses looking to eSign the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud. With various pricing tiers, users can choose a plan that best fits their needs without overspending.

-

Can I integrate airSlate SignNow with other applications for the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

Yes, airSlate SignNow offers robust integration options with various applications such as Google Drive, Salesforce, and many more. This means you can seamlessly manage and eSign the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud alongside your existing tools for increased efficiency.

-

What are the benefits of using airSlate SignNow for the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

Using airSlate SignNow for the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud offers numerous benefits, including enhanced security, compliance with legal standards, and reduced turnaround times. With electronic signatures, users can complete the form quickly and reliably, ensuring they meet their filing deadlines.

-

How secure is airSlate SignNow when handling the 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption technologies to protect your data and ensure the confidentiality of your 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud during the eSigning process, making it a trusted choice for sensitive documents.

Get more for 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

- Quitclaim deed husband and wife to three individuals colorado form

- Quitclaim deed three individuals to a limited liability company colorado form

- Colorado limited company 497300768 form

- Quitclaim deed husband and wife to a trust colorado form

- Co deed to form

- General warranty deed two individuals to two individuals colorado form

- Quitclaim deed from an individual to a corporation colorado form

- Quitclaim deed from corporation to individual colorado form

Find out other 171199541 IRS FORM 13909 PDF DocumentCloud S3 Documentcloud

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple