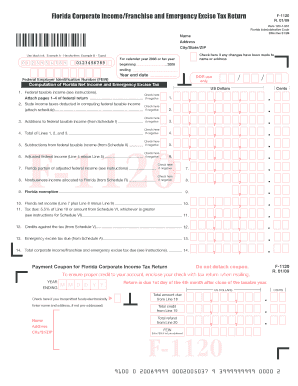

Florida Corporate Income Franchise and Emergency Excise Tax Form

What is the Florida Corporate Income Franchise And Emergency Excise Tax Form

The Florida Corporate Income Franchise and Emergency Excise Tax Form is a crucial document for corporations operating in Florida. It is used to report and pay taxes on corporate income, franchise fees, and emergency excise taxes. This form ensures compliance with state tax laws and is essential for maintaining good standing with the Florida Department of Revenue. Corporations must accurately complete this form to avoid penalties and ensure their tax obligations are met.

Steps to complete the Florida Corporate Income Franchise And Emergency Excise Tax Form

Completing the Florida Corporate Income Franchise and Emergency Excise Tax Form involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Determine the applicable tax rates based on your corporation's income level.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid late fees.

Each step is vital to ensure compliance and accuracy in your tax reporting.

How to obtain the Florida Corporate Income Franchise And Emergency Excise Tax Form

The Florida Corporate Income Franchise and Emergency Excise Tax Form can be obtained through the Florida Department of Revenue's official website. It is available for download in a printable format. Additionally, businesses may request a physical copy by contacting the Department of Revenue directly. It is important to ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the Florida Corporate Income Franchise And Emergency Excise Tax Form

The legal use of the Florida Corporate Income Franchise and Emergency Excise Tax Form is governed by state tax laws. To be considered valid, the form must be filled out completely and accurately, and submitted by the required deadlines. Electronic signatures are permissible under the ESIGN Act, provided that the eSignature solution used meets compliance standards. This ensures that the form is legally binding and can be upheld in a court of law if necessary.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Florida Corporate Income Franchise and Emergency Excise Tax Form. Typically, the form is due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 1. It is essential for businesses to mark these dates on their calendars to avoid penalties for late submission.

Penalties for Non-Compliance

Failure to file the Florida Corporate Income Franchise and Emergency Excise Tax Form on time can result in significant penalties. These may include late fees and interest charges on unpaid taxes. In severe cases, the Florida Department of Revenue may impose additional penalties for continued non-compliance, which can affect the corporation's standing and ability to conduct business in the state. Timely submission of the form is crucial to avoid these repercussions.

Quick guide on how to complete florida corporate income franchise and emergency excise tax form

Effortlessly prepare Florida Corporate Income Franchise And Emergency Excise Tax Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Florida Corporate Income Franchise And Emergency Excise Tax Form on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to modify and eSign Florida Corporate Income Franchise And Emergency Excise Tax Form effortlessly

- Acquire Florida Corporate Income Franchise And Emergency Excise Tax Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misdirected files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Corporate Income Franchise And Emergency Excise Tax Form while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida corporate income franchise and emergency excise tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Florida Corporate Income Franchise And Emergency Excise Tax Form?

The Florida Corporate Income Franchise And Emergency Excise Tax Form is a document that businesses in Florida must complete to report income and pay applicable taxes. This form ensures compliance with state tax laws and helps businesses avoid penalties. Using airSlate SignNow, you can easily fill and eSign this form from anywhere, streamlining the process.

-

How can airSlate SignNow assist with the Florida Corporate Income Franchise And Emergency Excise Tax Form?

With airSlate SignNow, you can efficiently create, send, and sign your Florida Corporate Income Franchise And Emergency Excise Tax Form electronically. The platform provides templates and guided assistance, making the form-filling process straightforward. This saves you time and increases accuracy in your submissions.

-

Is airSlate SignNow affordable for small businesses needing to file the Florida Corporate Income Franchise And Emergency Excise Tax Form?

Yes, airSlate SignNow offers competitive pricing tailored to small businesses that need to file the Florida Corporate Income Franchise And Emergency Excise Tax Form. Our cost-effective plans provide essential features without hidden fees, allowing you to manage your tax forms efficiently. You can start with a free trial to see if it fits your budget.

-

Can I integrate airSlate SignNow with other accounting software for the Florida Corporate Income Franchise And Emergency Excise Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your Florida Corporate Income Franchise And Emergency Excise Tax Form and related documents. These integrations ensure that your data stays organized and accessible, streamlining your overall tax filing process.

-

What features does airSlate SignNow offer for filling out the Florida Corporate Income Franchise And Emergency Excise Tax Form?

airSlate SignNow offers a range of features specifically for filling out the Florida Corporate Income Franchise And Emergency Excise Tax Form. This includes customizable templates, intuitive editing tools, and the ability to collect electronic signatures securely. These features make the form-filling process efficient and user-friendly.

-

How secure is the information I input in the Florida Corporate Income Franchise And Emergency Excise Tax Form with airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that all information entered into the Florida Corporate Income Franchise And Emergency Excise Tax Form is protected. We comply with the highest industry standards for data encryption and privacy, giving you peace of mind when submitting sensitive information. Your documents are safe, compliant, and accessible only to authorized users.

-

Can I access the Florida Corporate Income Franchise And Emergency Excise Tax Form from multiple devices using airSlate SignNow?

Yes, airSlate SignNow allows you to access the Florida Corporate Income Franchise And Emergency Excise Tax Form from multiple devices. Whether you are using a computer, tablet, or smartphone, you can easily manage your tax forms on the go. This flexibility ensures that you can complete your filings whenever and wherever you need.

Get more for Florida Corporate Income Franchise And Emergency Excise Tax Form

Find out other Florida Corporate Income Franchise And Emergency Excise Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors