Ftb Heavy Use Tax Form Dmv

What is the Ftb Heavy Use Tax Form Dmv

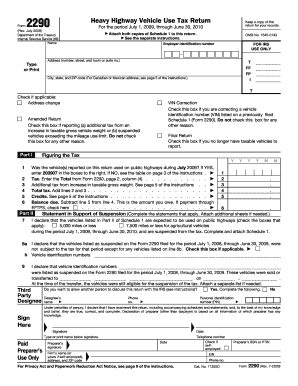

The Ftb Heavy Use Tax Form Dmv is a specific document required for individuals and businesses that operate heavy vehicles in the United States. This form is essential for reporting and paying the heavy vehicle use tax, which applies to vehicles that exceed a certain weight threshold. The tax helps fund highway maintenance and improvements, ensuring that road infrastructure remains safe and efficient for all users. Completing this form accurately is crucial for compliance with federal regulations and to avoid potential penalties.

Steps to complete the Ftb Heavy Use Tax Form Dmv

Completing the Ftb Heavy Use Tax Form Dmv involves several key steps:

- Gather necessary information, including vehicle identification numbers, weight, and usage details.

- Obtain the form from the appropriate state department or online resources.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form either online, by mail, or in-person, depending on state guidelines.

How to obtain the Ftb Heavy Use Tax Form Dmv

The Ftb Heavy Use Tax Form Dmv can be obtained through various channels. Most commonly, it is available on the official website of the Department of Motor Vehicles (DMV) for your state. Additionally, you can visit local DMV offices to request a physical copy of the form. Some states may also provide the form through tax offices or online tax preparation services. Ensure that you are using the most current version of the form to avoid any compliance issues.

Legal use of the Ftb Heavy Use Tax Form Dmv

The legal use of the Ftb Heavy Use Tax Form Dmv hinges on its proper completion and submission. To ensure that the form is legally binding, it must be filled out in accordance with federal and state regulations. This includes providing accurate information about the vehicle and its usage. Utilizing a reliable eSignature platform can enhance the legal standing of your submission, as it ensures compliance with eSignature laws such as ESIGN and UETA.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Ftb Heavy Use Tax Form Dmv can be done through multiple methods, depending on state regulations:

- Online: Many states allow electronic submission through their official DMV websites.

- Mail: Completed forms can often be mailed to the designated address provided on the form.

- In-Person: You may also submit the form directly at a local DMV office, where staff can assist with the process.

Penalties for Non-Compliance

Failing to comply with the requirements of the Ftb Heavy Use Tax Form Dmv can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to submit the form accurately and on time to avoid these consequences. Regularly reviewing your compliance status can help mitigate risks associated with non-compliance.

Quick guide on how to complete ftb heavy use tax form dmv

Effortlessly prepare Ftb Heavy Use Tax Form Dmv on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Ftb Heavy Use Tax Form Dmv on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Ftb Heavy Use Tax Form Dmv with ease

- Obtain Ftb Heavy Use Tax Form Dmv and click Get Form to commence.

- Make use of the tools we offer to submit your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to preserve your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the risk of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Ftb Heavy Use Tax Form Dmv and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb heavy use tax form dmv

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ftb Heavy Use Tax Form DMV?

The Ftb Heavy Use Tax Form DMV is a form used by businesses to report and pay the California heavy vehicle use tax. This tax applies to vehicles that are operated on public highways and have a gross weight of 55,000 pounds or more. Completing this form correctly ensures compliance with California tax regulations.

-

How can I obtain the Ftb Heavy Use Tax Form DMV?

You can obtain the Ftb Heavy Use Tax Form DMV directly from the California Department of Tax and Fee Administration (CDTFA) website or the DMV. Additionally, electronic filing options may be available for convenience, especially if you use airSlate SignNow to eSign and submit your document efficiently.

-

What are the benefits of using airSlate SignNow for the Ftb Heavy Use Tax Form DMV?

Using airSlate SignNow to complete the Ftb Heavy Use Tax Form DMV offers numerous benefits including an easy-to-use interface, secure document storage, and the ability to track your submissions. The platform enables seamless collaboration with team members, making the process of filling out and signing the form much simpler.

-

Is there a cost associated with filing the Ftb Heavy Use Tax Form DMV?

Yes, there are fees associated with the Ftb Heavy Use Tax Form DMV as it is linked to the heavy vehicle use tax. The tax amount varies depending on the weight of the vehicle and the time of operation. Ensure you check the current fee schedule on the DMV or CDTFA website.

-

Can I edit the Ftb Heavy Use Tax Form DMV after it’s been signed?

Once the Ftb Heavy Use Tax Form DMV has been signed using airSlate SignNow, it is essential to note that the form becomes a legally binding document. It is advisable to carefully review all entries before signing, as editing after signing may not be permitted without creating a new version of the form.

-

What features does airSlate SignNow offer for managing the Ftb Heavy Use Tax Form DMV?

airSlate SignNow provides features such as document templates, automated reminders for filing deadlines, and real-time collaboration tools. These features streamline the filing of the Ftb Heavy Use Tax Form DMV, ensuring that you remain compliant and on schedule.

-

How secure is the airSlate SignNow platform for handling the Ftb Heavy Use Tax Form DMV?

The airSlate SignNow platform employs industry-standard security measures such as encryption to protect your personal and financial information related to the Ftb Heavy Use Tax Form DMV. This focus on security helps to ensure that your sensitive data remains confidential throughout the filing process.

Get more for Ftb Heavy Use Tax Form Dmv

Find out other Ftb Heavy Use Tax Form Dmv

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile