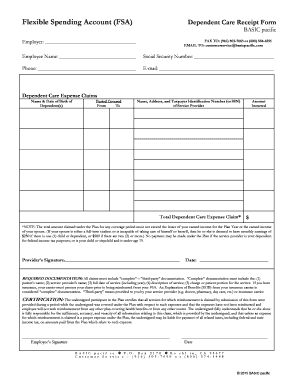

Flexible Spending Account FSA Dependent Care Receipt Form

What is the Flexible Spending Account FSA Dependent Care Receipt

The Flexible Spending Account (FSA) Dependent Care Receipt is a crucial document that enables employees to claim reimbursement for eligible dependent care expenses. This receipt serves as proof of payment for services related to the care of children or dependents, allowing individuals to utilize pre-tax dollars for these expenses. The FSA Dependent Care Receipt must include specific details such as the provider's name, the dates of service, and the amount paid to ensure compliance with IRS regulations.

How to use the Flexible Spending Account FSA Dependent Care Receipt

Using the FSA Dependent Care Receipt involves several steps. First, gather all necessary documentation, including the receipt itself and any additional forms required by your employer. Next, complete the reimbursement request form provided by your employer or FSA administrator. Attach the FSA Dependent Care Receipt to this form, ensuring that all required information is clearly visible. Submit the completed form and receipt according to your employer's specified method, whether online, by mail, or in person.

Steps to complete the Flexible Spending Account FSA Dependent Care Receipt

Completing the FSA Dependent Care Receipt requires careful attention to detail. Begin by ensuring that the receipt includes the following key elements:

- Provider’s Name: The name of the individual or organization providing the dependent care services.

- Service Dates: The specific dates during which the services were rendered.

- Amount Paid: The total cost incurred for the dependent care services.

- Signature: A signature from the provider may be required to validate the receipt.

Once all information is accurately filled out, review the document for completeness before submitting it for reimbursement.

Legal use of the Flexible Spending Account FSA Dependent Care Receipt

The FSA Dependent Care Receipt must adhere to specific legal guidelines to be considered valid. It is essential that the receipt accurately reflects the services provided and meets IRS requirements for dependent care expenses. This includes ensuring that the care is provided for a qualifying dependent, such as a child under the age of thirteen or a spouse or dependent who is physically or mentally incapable of self-care. Non-compliance with these regulations can lead to penalties or denial of reimbursement claims.

Eligibility Criteria

To utilize the FSA Dependent Care Receipt, individuals must meet certain eligibility criteria. Generally, employees must be enrolled in a Flexible Spending Account through their employer. Additionally, the dependent receiving care must qualify under IRS guidelines, which typically include children under thirteen or dependents who cannot care for themselves due to physical or mental disabilities. It is important for employees to verify these criteria before submitting their receipts for reimbursement.

Filing Deadlines / Important Dates

Filing deadlines for submitting the FSA Dependent Care Receipt can vary by employer and plan. Typically, employees must submit their receipts within a specific time frame after the end of the plan year, often within 90 days. It is crucial to be aware of these deadlines to ensure that reimbursements are processed in a timely manner. Missing the deadline may result in forfeiting the funds allocated for dependent care expenses.

Quick guide on how to complete flexible spending account fsa dependent care receipt

Effortlessly Prepare Flexible Spending Account FSA Dependent Care Receipt on Any Device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Flexible Spending Account FSA Dependent Care Receipt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and eSign Flexible Spending Account FSA Dependent Care Receipt Effortlessly

- Find Flexible Spending Account FSA Dependent Care Receipt and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the specialized tools provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a traditional handwritten signature.

- Review all information and then click the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new prints. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Flexible Spending Account FSA Dependent Care Receipt to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the flexible spending account fsa dependent care receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Flexible Spending Account FSA Dependent Care Receipt?

A Flexible Spending Account FSA Dependent Care Receipt is a document that confirms your expenses for dependent care services. This receipt is necessary for substantiating claims to your FSA, allowing you to use pre-tax dollars to pay for eligible care costs. Proper documentation helps ensure you maximize your FSA benefits.

-

How do I obtain a Flexible Spending Account FSA Dependent Care Receipt?

You can obtain a Flexible Spending Account FSA Dependent Care Receipt by requesting one from your care provider when you make payments for dependent care services. Ensure that the receipt includes essential details such as the provider's name, dates of service, and the amount paid. This documentation is crucial for FSA reimbursement.

-

What expenses are eligible for reimbursement with a Flexible Spending Account FSA Dependent Care Receipt?

Eligible expenses for reimbursement typically include daycare, preschool, and summer camp costs for children under 13, as well as care for disabled dependents. It's important to keep comprehensive receipts and documentation, such as the Flexible Spending Account FSA Dependent Care Receipt, to submit claims effectively. Always review IRS guidelines to ensure compliance.

-

Can I use the Flexible Spending Account FSA Dependent Care Receipt for out-of-pocket expenses?

Yes, you can use the Flexible Spending Account FSA Dependent Care Receipt to request reimbursement for out-of-pocket dependent care expenses. By providing the necessary receipts and information from your provider, you can ensure smooth and quick reimbursements from your FSA. Keeping thorough records of these receipts is essential for maximizing benefits.

-

What is the benefit of using airSlate SignNow for managing my Flexible Spending Account FSA Dependent Care Receipts?

Using airSlate SignNow allows you to easily eSign and manage your Flexible Spending Account FSA Dependent Care Receipts digitally. This streamlines the process of submitting and storing important documents, enhancing efficiency. With airSlate SignNow, you can ensure your receipts are organized and accessible whenever you need them.

-

Is there a cost associated with using airSlate SignNow for my FSA receipts?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, which includes features for managing your Flexible Spending Account FSA Dependent Care Receipts. Pricing typically varies based on the number of users and features needed. It remains a cost-effective solution for document management and eSignature needs.

-

How can I integrate airSlate SignNow with my FSA management system?

airSlate SignNow can integrate with various FSA management systems and tools through API and other integration solutions. This allows for seamless document transfers and enhanced operational efficiency when managing your Flexible Spending Account FSA Dependent Care Receipts. Check with your FSA provider to see how integration can benefit you.

Get more for Flexible Spending Account FSA Dependent Care Receipt

- Maryland month to month lease form

- 30 day notice 497310281 form

- 7 day notice to terminate week to week lease residential from landlord to tenant maryland form

- Maryland lease residential form

- Maryland lease residential 497310284 form

- 90 day notice lease form

- Assignment of deed of trust by individual mortgage holder maryland form

- Maryland deed 497310287 form

Find out other Flexible Spending Account FSA Dependent Care Receipt

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy