Notice of Default Form

What is the notice of default?

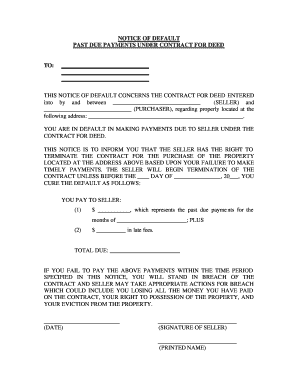

The notice of default is a formal document used primarily in real estate and mortgage contexts. It serves as a notification to a borrower that they have failed to meet their mortgage obligations, such as missing payments. This document is typically issued by the lender and indicates the beginning of the foreclosure process if the default is not remedied. Understanding the specifics of a notice of default is crucial for borrowers, as it outlines their rights and responsibilities and the potential consequences of continued non-compliance.

Steps to complete the notice of default

Completing a notice of default involves several important steps to ensure it is legally valid and effectively communicates the necessary information. The following steps outline the process:

- Gather relevant information, including the borrower’s name, property address, and loan details.

- Clearly state the reasons for the default, including specific missed payments and the total amount owed.

- Include a deadline for the borrower to rectify the default, typically ranging from thirty to ninety days.

- Sign and date the document, ensuring it is executed by an authorized representative of the lending institution.

- Send the notice via certified mail to ensure delivery and obtain a receipt as proof.

Legal use of the notice of default

The legal use of a notice of default is governed by state-specific laws and regulations. This document must comply with local requirements to be enforceable in court. It is essential for lenders to follow proper procedures when issuing a notice of default to avoid potential legal challenges. The notice must accurately reflect the borrower's default status and provide clear information regarding the next steps, including the potential for foreclosure if the default is not cured.

Key elements of the notice of default

A well-structured notice of default contains several key elements that ensure its effectiveness and legal standing. These elements include:

- The name and contact information of the lender.

- The name and address of the borrower.

- A description of the property involved.

- The specific reasons for the default, including payment history.

- The total amount due and any applicable fees.

- A clear statement of the actions the borrower must take to remedy the default.

- The consequences of failing to address the default, including the possibility of foreclosure.

How to obtain the notice of default

Obtaining a notice of default typically involves contacting the lender or mortgage servicer directly. Borrowers can request a copy of the notice if they believe they are in default or if they have received communication about their mortgage status. Additionally, some states may require lenders to file the notice with a local government office, making it accessible to the public. It is important for borrowers to stay informed about their mortgage status and to seek legal advice if they receive a notice of default.

State-specific rules for the notice of default

Each state in the U.S. has its own regulations governing the issuance and handling of a notice of default. These rules can affect the timeline for foreclosure, the required content of the notice, and the rights of the borrower. Borrowers should familiarize themselves with their state's laws to understand their rights and obligations. Consulting with a legal professional can provide additional clarity on how state-specific rules may impact their situation.

Quick guide on how to complete notice of default

Complete Notice Of Default effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Notice Of Default on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

How to alter and eSign Notice Of Default with ease

- Locate Notice Of Default and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Don’t worry about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Notice Of Default and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice of default

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a notice of default and why is it important?

A notice of default is a formal document indicating that a borrower has failed to meet the repayment terms of a loan. This document is crucial as it represents the first step towards foreclosure, informing the borrower of the overdue status and allowing them to take corrective action. Understanding a notice of default can help businesses prevent potential legal issues.

-

How can airSlate SignNow help with the notice of default process?

airSlate SignNow streamlines the notice of default process by allowing businesses to create, send, and eSign these critical documents quickly and securely. Our platform ensures compliance with legal standards and provides a convenient way to manage the documentation workflow. By using airSlate SignNow, businesses can reduce processing time and enhance their operational efficiency.

-

What features does airSlate SignNow offer for managing a notice of default?

With airSlate SignNow, users can create customizable templates for notices of default, track document status in real-time, and automate reminders for signers. Additionally, the platform provides robust security features, ensuring that all confidential information remains protected. These features help businesses maintain accuracy and efficiency in their document management process.

-

Is airSlate SignNow cost-effective for handling notices of default?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing notices of default. Our pricing includes all essential features, allowing you to send an unlimited number of documents without hidden fees. This value-driven approach ensures that you get the best return on your investment.

-

Can I integrate airSlate SignNow with my existing systems to manage notices of default?

Absolutely! airSlate SignNow offers seamless integrations with popular CRM and enterprise software, enabling businesses to efficiently manage the notice of default process within their existing workflows. This compatibility allows for quick data transfer and keeps all documentation organized in one place, saving time and reducing manual errors.

-

What benefits do I gain by using airSlate SignNow for a notice of default?

Using airSlate SignNow for a notice of default streamlines your document workflows, enhances collaboration, and reduces the risk of errors. The platform's eSigning feature accelerates the signing process, allowing for faster resolution of default issues. Additionally, its legal compliance ensures that your notices are recognized and enforceable.

-

Is it easy to learn how to use airSlate SignNow for notices of default?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to create and manage notices of default. With intuitive navigation and step-by-step guidance, users can quickly familiarize themselves with the platform. Our support resources, including tutorials and customer service, ensure that you have all the assistance you need.

Get more for Notice Of Default

- Ohio return work workers form

- Ohio mortgage form 497322658

- Ohio release form 497322659

- Partial release of property from mortgage for corporation ohio form

- Partial release of property from mortgage by individual holder ohio form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy ohio form

- Warranty deed for parents to child with reservation of life estate ohio form

- Warranty deed for separate or joint property to joint tenancy ohio form

Find out other Notice Of Default

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself