F8960 PDF Form 8960 Department of the Treasury Internal Revenue 2022

Understanding the 2023 IRS 8960 Form

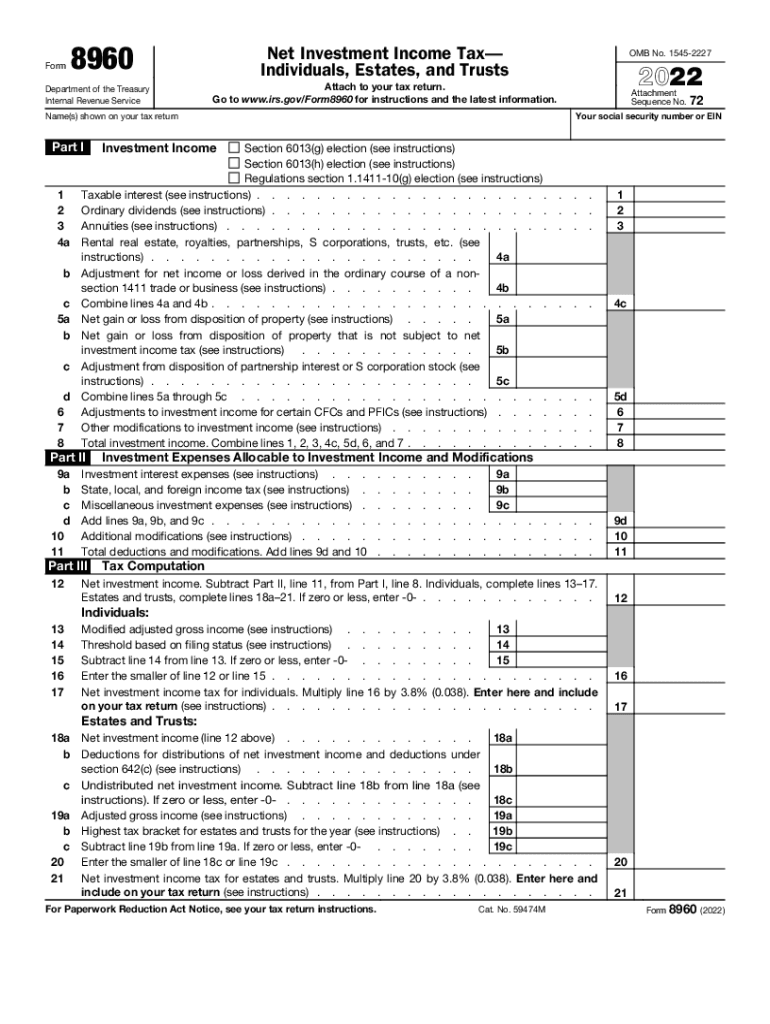

The 2023 IRS 8960 form, officially known as the "Net Investment Income Tax - Form 8960," is a tax document used by individuals to report their net investment income and calculate the additional tax owed under the Affordable Care Act. This form is essential for taxpayers whose modified adjusted gross income exceeds certain thresholds, specifically for higher-income earners. The form requires detailed information about various sources of investment income, such as dividends, interest, and capital gains, as well as deductions related to investment expenses.

Steps to Complete the 2023 IRS 8960 Form

Completing the 2023 IRS 8960 form involves several key steps:

- Gather Required Information: Collect all relevant financial documents, including statements for dividends, interest, and capital gains.

- Calculate Net Investment Income: Determine your total net investment income by summing up all applicable income sources and subtracting any allowable deductions.

- Determine Modified Adjusted Gross Income: Calculate your modified adjusted gross income to see if it exceeds the threshold for additional tax.

- Fill Out the Form: Carefully enter your calculated figures into the appropriate sections of the form.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Filing Deadlines for the 2023 IRS 8960 Form

The deadline for filing the 2023 IRS 8960 form typically aligns with the standard federal tax return deadline. For most taxpayers, this means the form is due on April 15 of the following year. If you file for an extension, you may have until October 15 to submit your form. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Legal Use of the 2023 IRS 8960 Form

The 2023 IRS 8960 form is legally binding when filled out correctly and submitted to the IRS. It is essential to ensure that all information provided is accurate and complete, as discrepancies can lead to audits or penalties. Utilizing a reliable digital platform for completion and submission can enhance the security and legality of the form, ensuring compliance with IRS regulations.

Required Documents for the 2023 IRS 8960 Form

To complete the 2023 IRS 8960 form, you will need several documents, including:

- Investment income statements, such as 1099-DIV and 1099-INT forms.

- Records of capital gains and losses from the sale of assets.

- Documentation of any investment-related expenses that can be deducted.

- Your most recent tax return to reference your modified adjusted gross income.

Form Submission Methods for the 2023 IRS 8960 Form

The 2023 IRS 8960 form can be submitted in various ways:

- Online: Many taxpayers choose to file electronically using tax preparation software, which often includes e-filing options.

- By Mail: You can print the completed form and mail it to the appropriate IRS address based on your location.

- In-Person: Some taxpayers may opt to deliver their forms directly to an IRS office, although this is less common.

Quick guide on how to complete f8960pdf form 8960 department of the treasury internal revenue

Accomplish F8960 pdf Form 8960 Department Of The Treasury Internal Revenue effortlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle F8960 pdf Form 8960 Department Of The Treasury Internal Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-oriented workflow today.

The easiest method to edit and electronically sign F8960 pdf Form 8960 Department Of The Treasury Internal Revenue without hassle

- Acquire F8960 pdf Form 8960 Department Of The Treasury Internal Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form hunting, or mistakes necessitating the reprinting of new document copies. airSlate SignNow meets your needs in document administration with just a few clicks from a device of your choice. Edit and electronically sign F8960 pdf Form 8960 Department Of The Treasury Internal Revenue and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8960pdf form 8960 department of the treasury internal revenue

Create this form in 5 minutes!

People also ask

-

What is the 2023 IRS 8960 form and why is it important?

The 2023 IRS 8960 form is used to calculate and report the net investment income tax (NIIT) for individuals. Understanding this form is crucial for taxpayers as it helps ensure compliance with tax obligations, especially for high earners. Properly completing the 2023 IRS 8960 form can prevent costly errors and taxes.

-

How can airSlate SignNow help with the 2023 IRS 8960 form?

airSlate SignNow simplifies the process of preparing and signing the 2023 IRS 8960 form. With easy-to-use templates and eSignature capabilities, you can quickly fill out forms and get them signed electronically. This streamlines your workflow and ensures all necessary documentation is properly executed.

-

Is there a cost associated with using airSlate SignNow for the 2023 IRS 8960 form?

Yes, airSlate SignNow offers various pricing tiers depending on your business needs. Our plans are designed to be cost-effective, providing you with comprehensive features to assist in managing your documents, including the 2023 IRS 8960 form. Visit our pricing page for detailed information on subscriptions.

-

What features does airSlate SignNow offer to assist with the 2023 IRS 8960 form?

airSlate SignNow provides a range of features that are beneficial for managing the 2023 IRS 8960 form, such as document templates, automated workflows, and secure eSigning. These features allow you to customize your documents, reduce turnaround time, and maintain compliance with IRS regulations efficiently.

-

Can I integrate airSlate SignNow with other software for managing the 2023 IRS 8960 form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications. This makes it easier to manage your financial documents, including the 2023 IRS 8960 form, within your existing workflows, enhancing efficiency and organization.

-

What benefits does airSlate SignNow provide for eSigning the 2023 IRS 8960 form?

Using airSlate SignNow for eSigning the 2023 IRS 8960 form offers several advantages. It saves time with instant document transfer and signing, enhances security with encryption, and provides a legally-binding signature process that meets compliance standards. This ensures your submissions are handled safely and promptly.

-

Is airSlate SignNow compatible with mobile devices for managing the 2023 IRS 8960 form?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage the 2023 IRS 8960 form on the go. You can view, edit, and eSign documents directly from your smartphone or tablet, ensuring you have access to your important forms anytime, anywhere.

Get more for F8960 pdf Form 8960 Department Of The Treasury Internal Revenue

- Fencing contract for contractor new mexico form

- Hvac contract for contractor new mexico form

- Landscape contract for contractor new mexico form

- Nm commercial form

- New mexico contract form

- Renovation contract for contractor new mexico form

- Concrete mason contract for contractor new mexico form

- Demolition contract for contractor new mexico form

Find out other F8960 pdf Form 8960 Department Of The Treasury Internal Revenue

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself