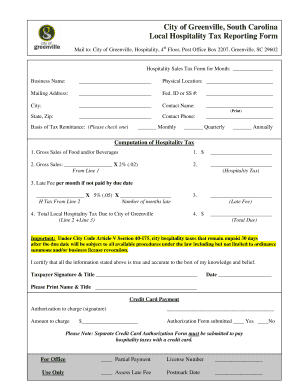

City of Greenville Hospitality Tax Form

What is the City of Greenville Hospitality Tax

The City of Greenville Hospitality Tax is a specific tax imposed on businesses that provide accommodations, food, and beverages within the city. This tax is aimed at generating revenue to support local tourism and hospitality initiatives. It is typically applied to hotel stays, restaurant bills, and other related services. Understanding this tax is essential for both business owners and consumers, as it impacts pricing and revenue allocation for city projects.

How to use the City of Greenville Hospitality Tax

Using the City of Greenville Hospitality Tax involves understanding its application in transactions. Businesses that offer taxable services must collect this tax from customers and remit it to the city. Proper accounting practices should be in place to ensure accurate collection and reporting. Business owners should familiarize themselves with the tax rate and any exemptions that may apply to specific transactions.

Steps to complete the City of Greenville Hospitality Tax

Completing the City of Greenville Hospitality Tax involves several key steps:

- Determine the applicable tax rate based on the type of service provided.

- Collect the tax from customers at the point of sale.

- Maintain accurate records of all transactions subject to the hospitality tax.

- Prepare the tax return, detailing the amount collected and owed.

- Submit the tax return and payment to the appropriate city department by the designated deadline.

Legal use of the City of Greenville Hospitality Tax

The legal use of the City of Greenville Hospitality Tax is governed by local ordinances and state laws. Businesses must comply with these regulations to ensure they are collecting and remitting the tax correctly. Failure to adhere to these laws can result in penalties or legal repercussions. It is advisable for businesses to consult with legal or tax professionals to navigate the complexities of hospitality tax compliance.

Required Documents

When dealing with the City of Greenville Hospitality Tax, certain documents are essential for compliance and reporting. These may include:

- Tax registration certificate for the business.

- Invoices or receipts showing the hospitality tax collected.

- Completed tax return forms.

- Proof of payment to the city for the tax owed.

Filing Deadlines / Important Dates

Filing deadlines for the City of Greenville Hospitality Tax are crucial for businesses to avoid penalties. Typically, tax returns must be filed quarterly or annually, depending on the business's revenue level. It is important to stay informed about specific due dates to ensure timely submissions. Businesses should mark their calendars for these deadlines to maintain compliance.

Quick guide on how to complete city of greenville hospitality tax

Prepare City Of Greenville Hospitality Tax easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage City Of Greenville Hospitality Tax on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign City Of Greenville Hospitality Tax effortlessly

- Find City Of Greenville Hospitality Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Edit and electronically sign City Of Greenville Hospitality Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of greenville hospitality tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Greenville hospitality tax?

The city of Greenville hospitality tax is a specific levy imposed on certain businesses in the hospitality sector, including hotels and restaurants. This tax is designed to support local services and infrastructure, bolstering the city's economy. Understanding this tax can help business owners navigate their responsibilities effectively.

-

How can airSlate SignNow assist with managing the city of Greenville hospitality tax?

airSlate SignNow provides a streamlined solution for businesses to manage their various document needs, including forms related to the city of Greenville hospitality tax. With its eSigning capabilities, companies can easily send and sign necessary tax documentation. This can simplify compliance and ensure timely submissions.

-

Are there any specific features in airSlate SignNow for handling tax documents?

Yes, airSlate SignNow offers features tailored for managing tax documents, including templates for the city of Greenville hospitality tax. Users can create, send, and securely sign these documents, reducing the time spent on paperwork. Automated workflows ensure that all steps are captured efficiently.

-

What are the pricing options for airSlate SignNow for businesses in Greenville?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including those in the hospitality sector affected by the city of Greenville hospitality tax. The plans include essential features that help with compliance and efficiency. Visit our pricing page to choose a plan that meets your needs.

-

Can I integrate airSlate SignNow with my existing software to manage hospitality tax documents?

Absolutely! airSlate SignNow provides various integrations with popular business software, allowing you to manage your city of Greenville hospitality tax documents seamlessly. Whether you use document management systems or accounting software, airSlate SignNow can enhance your workflow through integrations.

-

What benefits does airSlate SignNow offer for small businesses handling hospitality taxes?

For small businesses facing the city of Greenville hospitality tax, airSlate SignNow offers an affordable and user-friendly platform. It helps streamline the signing process and ensures that you remain compliant with tax requirements. This can lead to time savings and reduced operational stress.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow employs high-level security measures to protect sensitive information, including details related to the city of Greenville hospitality tax. With encryption and secure cloud storage, your documents are safe from unauthorized access. Trust airSlate SignNow to keep your data protected.

Get more for City Of Greenville Hospitality Tax

- Dg paystub form

- Adac second hand car sales contract form

- Affidavit of parental consent for marriage philippines pdf form

- Revocable living trust amendment printable form

- Weight lifting chart pdf form

- Rifts character sheet form

- General denial answer sample texas form

- Ethekwini municipality student relief fund form

Find out other City Of Greenville Hospitality Tax

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free