South Dakota Verification of Tax Assessment by Out of FormuPack

What is the South Dakota Verification Of Tax Assessment By Out of FormuPack

The South Dakota Verification of Tax Assessment by Out of FormuPack is a crucial document used to confirm the assessment of property taxes in South Dakota. This form serves as an official record that verifies the assessed value of a property, which is essential for both property owners and local authorities. It ensures transparency in the property tax assessment process and provides a basis for any appeals or adjustments that may be necessary. Understanding this form is vital for anyone involved in property ownership or taxation in South Dakota.

How to use the South Dakota Verification Of Tax Assessment By Out of FormuPack

Using the South Dakota Verification of Tax Assessment by Out of FormuPack involves several straightforward steps. First, you must obtain the form, which can typically be found on the official state or local government websites. Once you have the form, fill it out with accurate information regarding the property in question, including the property address and the assessed value. After completing the form, it can be submitted electronically or via traditional mail, depending on the specific requirements set by the local tax authority.

Steps to complete the South Dakota Verification Of Tax Assessment By Out of FormuPack

Completing the South Dakota Verification of Tax Assessment by Out of FormuPack requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary information about the property, including its location and assessed value.

- Access the form from the appropriate government website.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through a secure platform or mail it to the designated office.

Legal use of the South Dakota Verification Of Tax Assessment By Out of FormuPack

The legal use of the South Dakota Verification of Tax Assessment by Out of FormuPack is grounded in its compliance with state regulations regarding property tax assessments. This form must be filled out accurately and submitted within the designated timeframes to be considered valid. Its legal standing is reinforced by adherence to electronic signature laws, ensuring that any digital submissions are recognized as legally binding. This form is essential for property owners who wish to contest their tax assessments or provide proof of their property’s assessed value.

Key elements of the South Dakota Verification Of Tax Assessment By Out of FormuPack

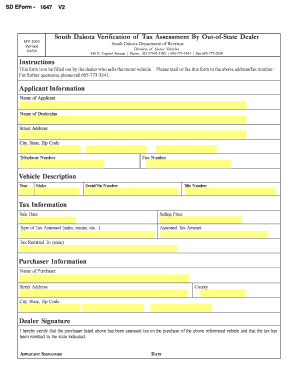

Several key elements must be included in the South Dakota Verification of Tax Assessment by Out of FormuPack to ensure its validity:

- Property Identification: Accurate details about the property, including its address and parcel number.

- Assessed Value: The current assessed value as determined by the local tax authority.

- Signature: The signature of the property owner or authorized representative, which may be electronic.

- Date of Submission: The date on which the form is submitted, which is crucial for compliance with deadlines.

State-specific rules for the South Dakota Verification Of Tax Assessment By Out of FormuPack

Each state has specific rules governing the use and submission of tax assessment verification forms. In South Dakota, it is essential to be aware of the deadlines for submission, which may vary by county. Additionally, the form must comply with local regulations regarding property assessments and any required documentation that supports the assessed value. Familiarity with these state-specific rules ensures that property owners can effectively navigate the tax assessment process and avoid potential penalties.

Quick guide on how to complete south dakota verification of tax assessment by out of formupack

Complete South Dakota Verification Of Tax Assessment By Out of FormuPack effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage South Dakota Verification Of Tax Assessment By Out of FormuPack on any device using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to alter and eSign South Dakota Verification Of Tax Assessment By Out of FormuPack without hassle

- Obtain South Dakota Verification Of Tax Assessment By Out of FormuPack and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign South Dakota Verification Of Tax Assessment By Out of FormuPack and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south dakota verification of tax assessment by out of formupack

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the South Dakota Verification Of Tax Assessment By Out of FormuPack?

The South Dakota Verification Of Tax Assessment By Out of FormuPack is a streamlined solution for ensuring that tax assessments in South Dakota are correctly verified. This service is particularly beneficial for businesses looking to maintain compliance with state taxation laws. By using this tool, you can easily navigate the verification process and ensure your documentation is accurate.

-

How does airSlate SignNow facilitate the South Dakota Verification Of Tax Assessment By Out of FormuPack?

AirSlate SignNow provides an easy-to-use platform that enables businesses to send and eSign documents required for the South Dakota Verification Of Tax Assessment By Out of FormuPack. The intuitive interface makes the process quick and efficient, allowing users to complete their verification without hassle. Our tool ensures all documents are securely signed and stored for future reference.

-

What are the pricing options for the South Dakota Verification Of Tax Assessment By Out of FormuPack?

AirSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Depending on your needs, you can choose from various subscription tiers that grant access to the South Dakota Verification Of Tax Assessment By Out of FormuPack feature. Contact our sales team for a detailed breakdown of pricing and to find the best plan for your business.

-

What features are included in the South Dakota Verification Of Tax Assessment By Out of FormuPack?

The South Dakota Verification Of Tax Assessment By Out of FormuPack includes several key features such as customizable document templates, seamless eSignature capabilities, and robust tracking functionalities. Additionally, it offers secure document storage and easy sharing options, ensuring that all necessary verification documentation is handled efficiently and safely.

-

What benefits does the South Dakota Verification Of Tax Assessment By Out of FormuPack provide to businesses?

Using the South Dakota Verification Of Tax Assessment By Out of FormuPack helps businesses save time and reduce errors associated with tax assessments. The automated processes streamline workflows, allowing teams to focus on core business activities instead of administrative tasks. Ultimately, this can lead to better compliance with state regulations and improved financial planning.

-

Can the South Dakota Verification Of Tax Assessment By Out of FormuPack integrate with existing software solutions?

Yes, airSlate SignNow's South Dakota Verification Of Tax Assessment By Out of FormuPack is designed to integrate seamlessly with various business applications. This includes CRM systems, accounting software, and project management tools, allowing for a unified workflow. By integrating our solution, businesses can enhance their operational efficiency and document management.

-

Is customer support available for the South Dakota Verification Of Tax Assessment By Out of FormuPack?

Absolutely, airSlate SignNow offers dedicated customer support for users of the South Dakota Verification Of Tax Assessment By Out of FormuPack. Our support team is available to assist with any questions or issues you may encounter, ensuring you can maximize the benefits of our services. We provide multiple channels for signNowing out, including live chat, email, and phone support.

Get more for South Dakota Verification Of Tax Assessment By Out of FormuPack

Find out other South Dakota Verification Of Tax Assessment By Out of FormuPack

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation