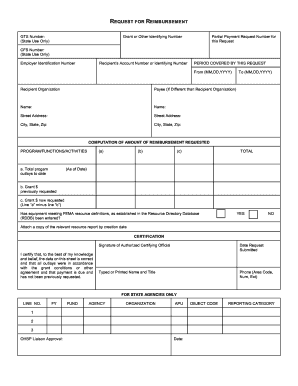

GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number or Identifyin Form

Understanding the GTS Number and Related Identifying Numbers

The GTS Number, along with the CFS Number, Employer Identification Number, and Recipient's Account Number, serves as vital identifiers in various administrative and financial processes. Each of these numbers plays a specific role in tracking and managing accounts, ensuring compliance with regulations, and facilitating communication between entities. Understanding these identifiers is crucial for accurate reporting and record-keeping.

How to Use the GTS Number and Other Identifying Numbers

When filling out forms that require the GTS Number, CFS Number, or other identifying numbers, it is essential to enter the information accurately. This ensures that the document is processed correctly and reduces the risk of delays. Each number should be placed in its designated field, and care should be taken to verify that all entries are correct before submission.

Steps to Complete the Required Form Accurately

Completing the form that includes the GTS Number and other identifying numbers involves several steps:

- Gather all necessary information, including the GTS Number, CFS Number, and Employer Identification Number.

- Fill in the period covered by the request, specifying the start and end dates clearly.

- Double-check all entries for accuracy to prevent errors that could lead to complications.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the GTS Number and Other Identifying Numbers

The GTS Number and related identifiers must be used in compliance with applicable laws and regulations. This includes ensuring that the information provided is accurate and up-to-date. Misuse or falsification of these numbers can lead to legal penalties and complications in financial transactions.

Key Elements to Include When Filling Out the Form

When completing the form, it is important to include the following key elements:

- GTS Number: A unique identifier for tracking purposes.

- CFS Number: Another identifier that may be required by specific entities.

- Employer Identification Number: Essential for tax and employment-related documentation.

- Recipient's Account Number: Necessary for identifying the account associated with the request.

- Period Covered: Clearly state the timeframe relevant to the request.

Examples of Situations Requiring the GTS Number

Common scenarios where the GTS Number and related identifiers are required include:

- Submitting tax documents to the IRS, where accurate identification is crucial.

- Filing for grants or funding, where specific identifiers help in processing applications.

- Completing financial reports that require detailed tracking of transactions.

Quick guide on how to complete gts number state use only cfs number state use only employer identification number recipients account number or identifying

Complete GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to modify and eSign GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin effortlessly

- Locate GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gts number state use only cfs number state use only employer identification number recipients account number or identifying

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of the GTS Number, CFS Number, or Employer Identification Number in the airSlate SignNow process?

The GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifying Number are essential for identifying the entities involved in document signing. By including these numbers, users can ensure compliance and facilitate streamlined processing of documents. This makes the electronic signature process both secure and efficient.

-

How does airSlate SignNow ensure the security of my documents with regards to the recipient's account number?

airSlate SignNow employs robust encryption protocols to safeguard documents that utilize the Recipient's Account Number Or Identifying Number. This ensures that sensitive information related to the GTS Number State Use Only CFS Number State Use Only Employer Identification Number is protected during transmission. Our thorough security measures ensure peace of mind for businesses handling critical data.

-

Can I integrate other software systems with airSlate SignNow to manage documents using identifiers like the Grant Or Other Identifying Number?

Yes, airSlate SignNow supports integration with a variety of software systems, making it easy to manage documents that require identifiers such as Grant Or Other Identifying Number. Integrating with your existing tools allows for better workflow efficiency and enhances document management strategies. Our API documentation provides all the necessary details to facilitate seamless integration.

-

What are the benefits of using airSlate SignNow for submitting forms that include timestamps like PERIOD COVERED BY THIS REQUEST?

Using airSlate SignNow allows for precise electronic record-keeping when submitting forms with timestamps like PERIOD COVERED BY THIS REQUEST From MM,DD,YYYY To MM,DD,YYYY. This ensures that all parties have a clear understanding of timelines and adherence to deadlines. Additionally, our platform provides automated reminders and tracking features to optimize your document processes.

-

Is the airSlate SignNow platform cost-effective for small businesses dealing with documents that require CFS Numbers?

Yes, airSlate SignNow is designed to be cost-effective, making it suitable for small businesses managing documents with CFS Numbers. Our pricing plans are competitive and cater to various business sizes, ensuring that you only pay for the features you need. Moreover, the savings from reduced printing and mailing expenses can signNowly benefit your budget.

-

How does airSlate SignNow help in tracking the status of documents including those marked with GTS or CFS numbers?

airSlate SignNow provides real-time tracking features that allow users to monitor the status of documents marked with GTS Number or CFS Number. This transparency ensures you are always informed about who has viewed or signed a document. Such tracking capabilities enhance accountability and facilitate timely follow-ups.

-

What features does airSlate SignNow offer for verifying the authenticity of documents requiring an Employer Identification Number?

airSlate SignNow offers several verification features for documents that require an Employer Identification Number. These include advanced identity verification options, audit trails, and tamper-evident seals, ensuring the authenticity of the completed documents. This level of security and verification helps maintain trust in your electronic workflows.

Get more for GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin

Find out other GTS Number State Use Only CFS Number State Use Only Employer Identification Number Recipient's Account Number Or Identifyin

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile